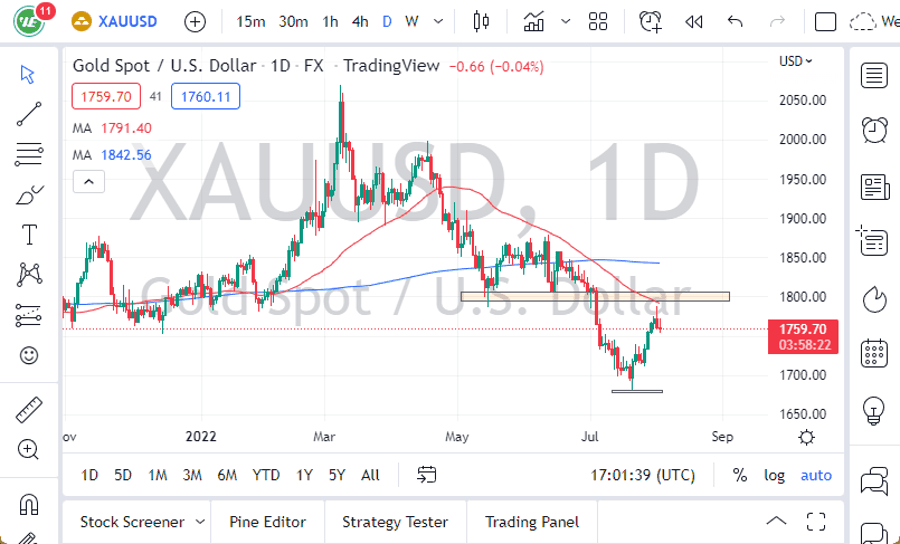

Gold markets have rallied a bit during the trading session on Tuesday, reaching towards the $1290 level. The reason that is significant is that we had seen a neckline form for the previous head and shoulders at that level. Beyond that, the 50 day EMA, pictured in red on the chart, causes a bit of resistance and then of course we have to deal with the $1300 level. In other words, rallying from here is going to be difficult, but not necessarily impossible.

Looking at the chart, we also see the 200 day EMA just below pictured in blue, hanging just above the $1275 level. Because of this and the previously mentioned resistance, it’s a bit like we are caught between two major barriers. Anytime you have that, if you have a lot of volatility. It’s going to be very difficult to trade this market for any significant amount of time until we break out of this range. However, on the other side of that argument is the fact that once we do break out of that area, we should get enough clarity that we can start to put more money to work in trade for a bigger move.

Looking at the chart, if we break down below, we could fulfill the target from the head and shoulders pattern. That means that we could go as low as $1225 underneath. That’s an area that is rather well supported, so at all lines up quite nicely. However, if we break above the $1300 level, it’s very likely that we will then go to the $1325 level, and possibly even the $1350 level, although it will certainly take quite a bit of momentum to finally make that happen.