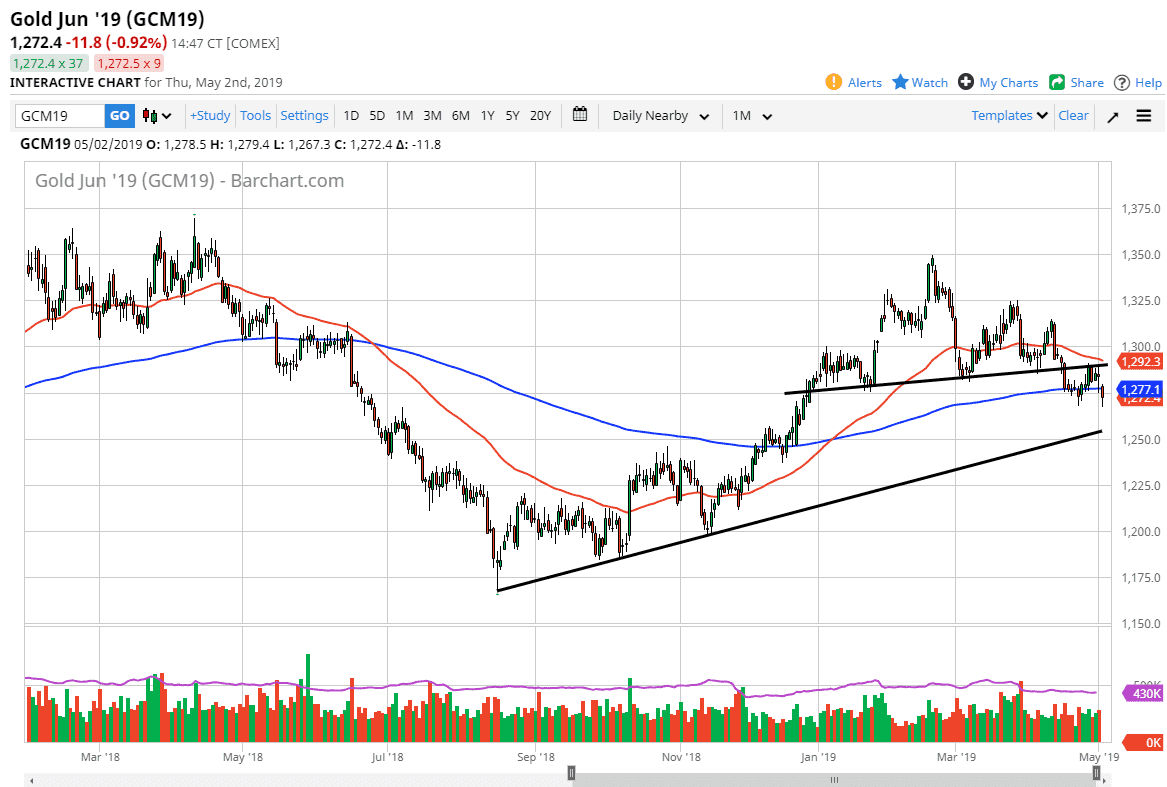

Gold markets broke down significantly during the day on Thursday, gapping lower to kick off the session. We sliced through the 200 day EMA rather quickly, and then even broke down below the $1270 level. This was a very ugly move, but in the end we did find buyers near the $1267 level and recovered a bit. At this point in time, even though this is a somewhat supportive looking candle, I think this sets up for a great trade down the road.

If we can get some type of bounce, I suspect that we are going to struggle near the $1290 level. I am more than willing to sell on signs of exhaustion in that area. The uptrend line above is the neckline from the head and shoulders pattern, and that of course should offer significant resistance. If we were to break above there and by extension the 50 day EMA pictured in red, then we could have a bullish move to the upside.

On the downside, if we break down below the lows of the session on Thursday, then we will probably go looking towards the uptrend line underneath that I have drawn. Beyond that, if you look at the head and shoulders pattern and measure the potential move, we could be looking at a move to roughly $1225 level, destroying the trend line. In the end, I believe this all comes down to the US dollar.

The US dollar strengthened after the Federal Reserve gave no hints whatsoever as to whether or not it was thinking about cutting interest rates going forward. Because of this, the market had to reprice that interest rate risk, and therefore it makes sense that Gold got hit due to the stronger greenback. What’s going to be even more interesting is that Friday is the jobs number, so that will most certainly cause volatility in the greenback, and by extension the gold market.