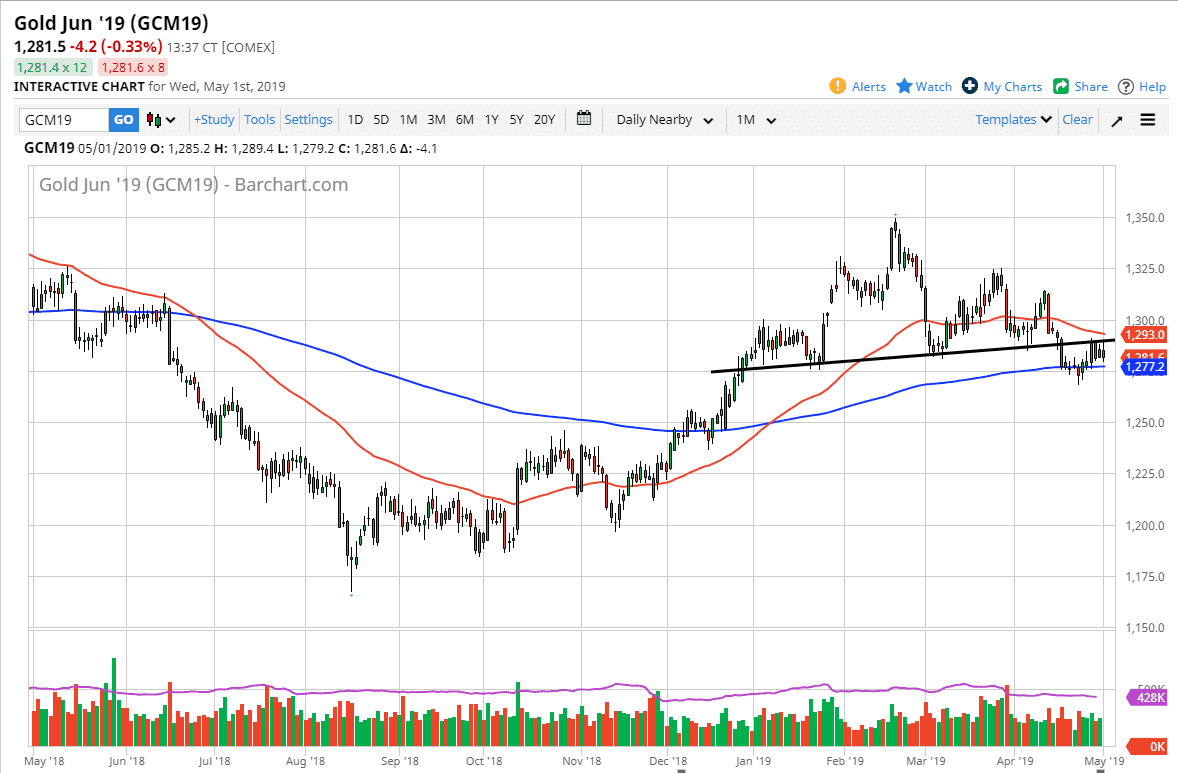

Gold markets fell during the trading session on Wednesday, reaching down towards the 200 day EMA after initially trying to rally and test the neck line of the head and shoulders pattern that I have marked on the chart. We are currently testing an area that will obviously attract a lot of attention as the 200 day EMA is a longer-term signal of sorts. Trim traders of course following, but at this point it still looks as if the market is going to struggle a bit to continue to go higher.

If we break down to a fresh, new low, then it’s possible that we could start to see Gold markets take off to the downside. Based upon the head and shoulders, it could measure for a move towards the $1225 level. That is an area that has a significant amount of volume in interest at it. It doesn’t mean that we will get there overnight, but it certainly looks like we could grind down towards that level.

To the upside, if we were to break above the neckline from the head and shoulders, we could then clear the 50 day EMA which is pictured in red. That opens the door to a potential move to the $1300 level, and possibly even the $1310 level after that. Although possible, I don’t like this trade as much because I see far too many technical issues above. Longer-term though, the buyers do take over we will probably reach towards the $1325 level and then eventually the $1350 level after that. All things being equal, this is a market that stays range bound but I think is starting to get a bit heavy. All we need at this point is perhaps a stronger US dollar to send it over the edge.