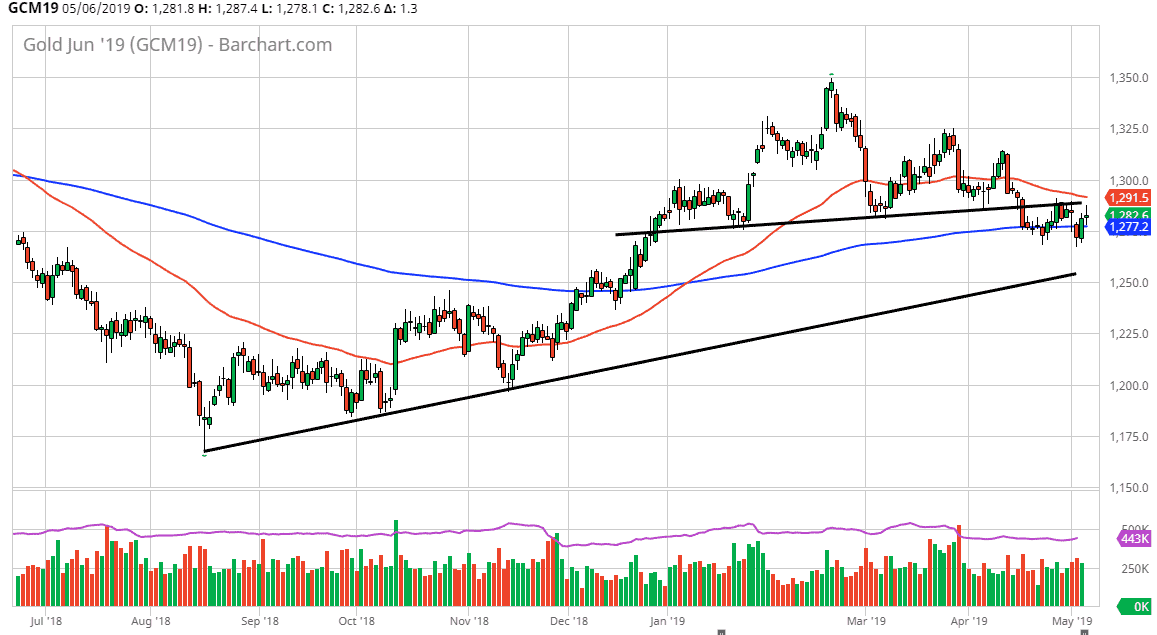

Gold markets rallied a bit during the trading session early on Monday, as we have seen a lot of order flow. Remember, the Japanese were network so there was a serious lack of liquidity, but there was a horrible reaction to the tweets that Donald Trump put out that the Chinese were going to face more tariffs going forward. The reaction was that the Chinese were going to avoid the trade discussions going forward. If that actually happens, then it makes sense that the Gold markets would rally as a bit of a safety trade. However, the technical set up from previous trading came back into play as well.

After all, there was a neck line from the previous head and shoulders pattern that offered resistance, as one would expect. Beyond that, we have the 50 day EMA just above there that could push this market lower. One thing that seems to be holding it up is the 200 day EMA underneath, so that could cause a bit of volatility but it looks as if Gold is trying to unwind at this point. If it does, we could then go down to the uptrend line underneath. However, if we turn around and break above the $1300 level, this market could really start to pick up momentum.

Pay attention to the US dollar, because if it starts to strengthen again it could weigh upon Gold markets. That could be the catalyst to send this market lower as people run to the US for returns as there are almost no other markets behaving as well as American ones. That being the case, this is a market that continues to show a lot of choppiness and volatility so it’s probably best to short this market on short-term charts for small trades.