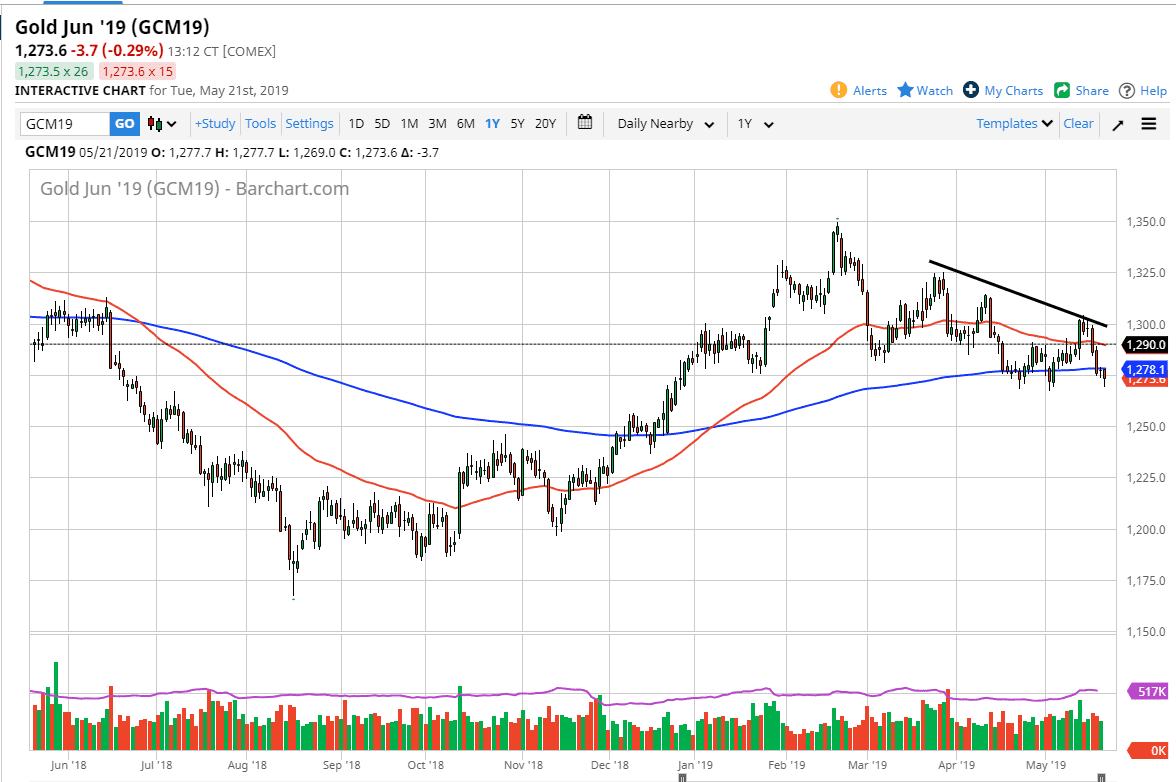

Gold markets fell during trading on Tuesday, testing the $1270 level yet again. This is an area that has been tested several times and does seem to be holding rather well, but at the end of the day one has to wonder how much longer can sustain the selling pressure.

If we were to break down below the $1270 level, then I think the floodgates open. At that point I anticipate that the market will make a move towards the $1250 level, and right now that’s my base case scenario. This isn’t to say that we couldn’t perhaps bounce occasionally from here, but I think those short-term bounces will only end up being sold into. Just above, we have the $1290 level offering resistance not only from a structural standpoint, but also because we have the 50 day EMA there as well.

Above that, we have the obvious round number of $1300, and of course a downtrend line that crosses through it. Because of this, it’s very likely that we will continue to see sellers come back into this market. That being said, if we were to break above the $1300 level that would obviously be something that would have me rethinking the entire situation and giving me pause when it comes to selling again.

The US dollar of course has its part to play, as a strong dollar can sometimes work against Gold. However, if we get some type of panic and rush for the exits when it comes to risk assets, you may see temporary gold buying as a knee-jerk reaction. In other words, just about anything can happen at this point but to me it looks like the easiest path is probably lower over the longer-term. I believe that the absolute “floor” in the gold market is probably close to the $1200 level.