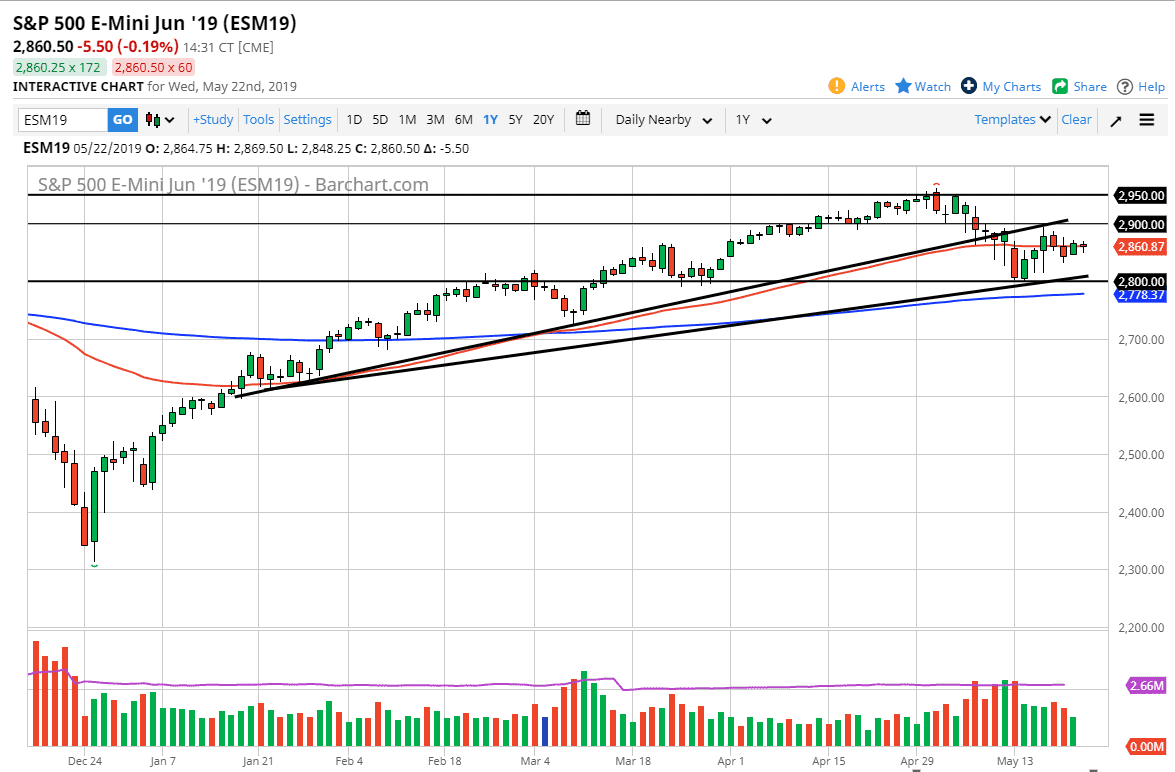

S&P 500

The S&P 500 went back and forth during trading on Wednesday as we continue to dance around the 50 day EMA. I don’t know what kind of catalyst will move the market next, as we are waiting for some type of momentum. Looking at the chart, I think that the 2900 level above will continue to be resistance, just as the 2800 level underneath will be supported. We are stuck between two uptrend lines, so of course it makes sense that there’s a lot of confusion at this point from a technical perspective.

Beyond that, there are a lot of concerns when it comes to global trade, so at this point I think that we are all over the place and looking for some type of certainty. I highly doubt were going to get it in the near term. I suspect we will end up finishing the week within this range.

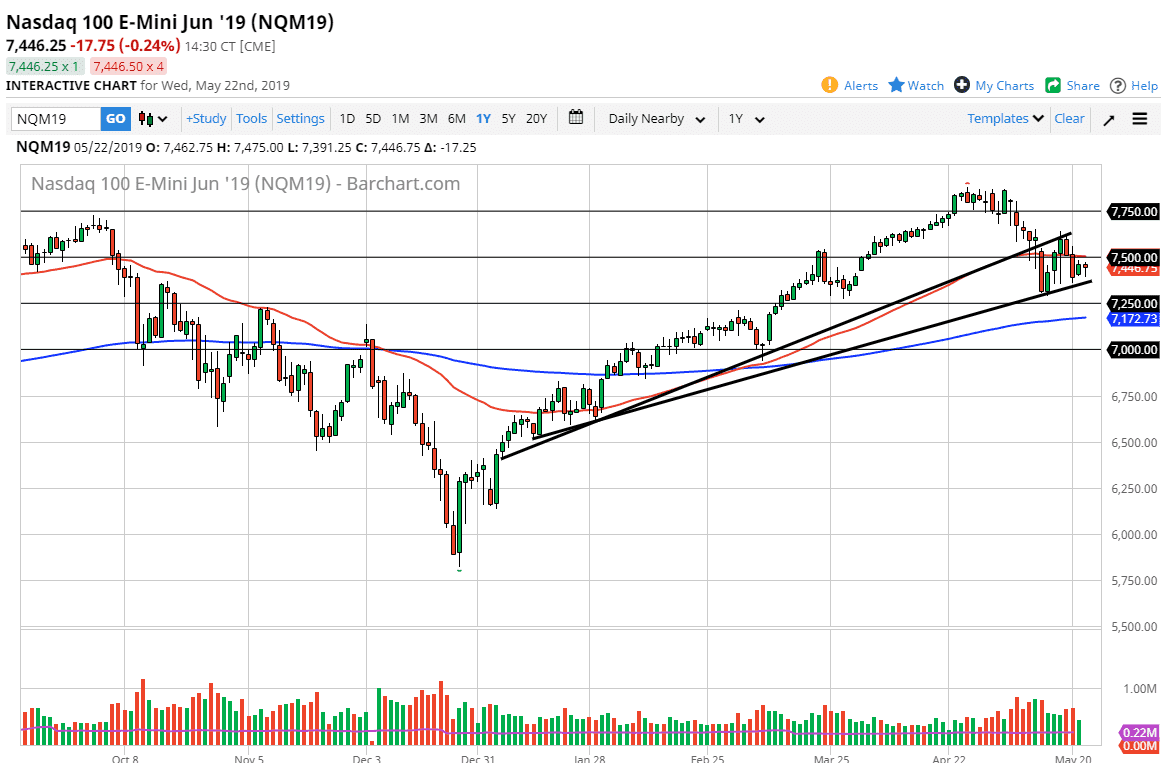

NASDAQ 100

The NASDAQ 100 is firmly in the crosshairs of the US/China trade war. That being said, we have formed a hammer during the trading session on Wednesday and that of course is a good sign. If we can break above the 7500 level we could go to the 7600 level before facing resistance in the form of the previous uptrend line that we had broken through. However, we turned around to break down below the uptrend line that is just underneath, that could send this market looking towards the 7250 handle, perhaps down to the 200 day EMA pictured in blue.

This continues to be very noisy situation but it certainly looks as if the short-term traders are willing to come in and pick this market up just a bit. With that being said, I do think that the upside is limited.