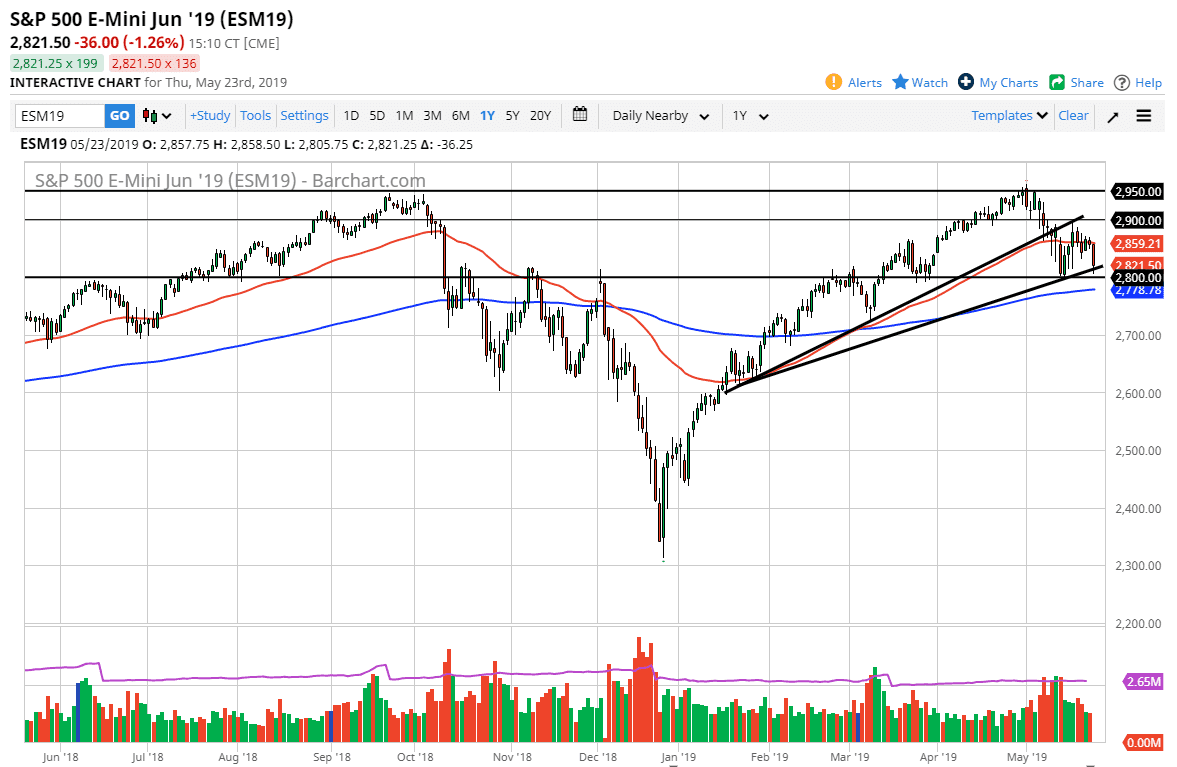

S&P 500

The S&P 500 broke down during the trading session on Thursday, slicing through the uptrend line that I have painted on the chart. However, we have turned right back around to show signs of life again, so it’s a bit difficult to get excited quite yet, but clearly we had a horrific day during the trading session. The 2800 level underneath continues to be important, and as long as we can stay above there, the market is very likely to stay somewhat resilient. However, we have seen a lot of concerns globally, so it looks to me like the market will probably sell rallies until we break down below the 2800 level and get things going much quicker. It’s obvious that market participants are starting to worry about the US/China trade situation and of course the Federal Reserve perhaps being a bit more hawkish than expected.

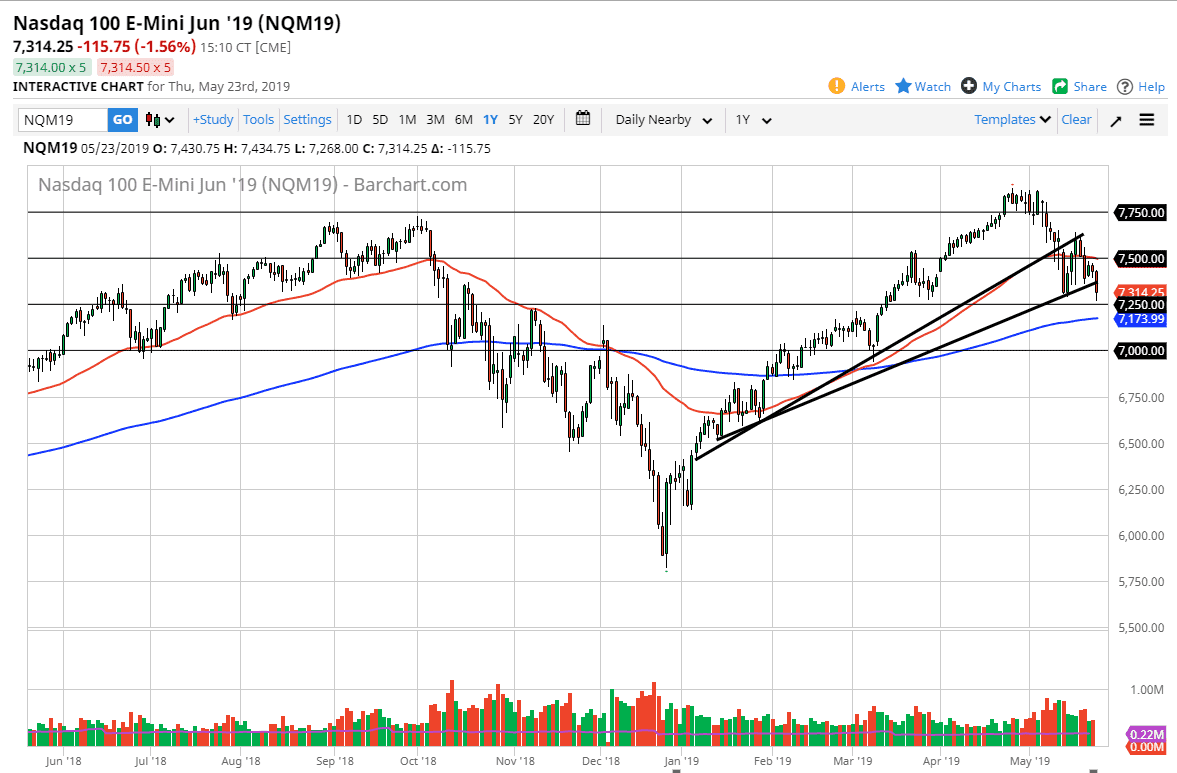

NASDAQ 100

The NASDAQ 100 also broke down through an uptrend line, reaching down towards the 7250 level, that is your next support level, and at this point I think short-term rallies are selling opportunities. Signs of exhaustion are sold on short-term charts, and quite frankly I have no interest in buying this market because of the US/China trade war so it’s very likely that short-term rallies will continue to offer opportunity to the downside. I think it’s not until we break above the 7500 level on a daily close that my mind would be changed. This is a market that looks as if it is in the midst of a major trend change, and the extreme volatility that we have seen as of late continues to be an issue.

You should also keep in mind that Monday is Memorial Day in the United States, so volume is going to be light late in the day on Friday.