Ahead of the release of the US Federal Reserve meeting’s minutes, gold prices are still facing strong pressure to maintain their recent losses, which reached support level of $1269 an ounce before settling around $ 1274 at the time of writing. With stronger gains for the US dollar being second only to the Japanese yen as safe haven gains, as the US-China trade war recently intensified. In general, the absence of a final and formal agreement that ends the trade dispute between the United States and China will continue to be a factor contributing to stronger gold price gains, and the stability above the psychological peak of $ 1,300 will increase purchases and test stronger bullish levels. Trump's recent comments, which bear the prospect of reconciling with China after raising tariffs on their products, have eased investors' concerns and have contributed to a halt in gold price gains.

The Federal Reserve Board kept the interest rate unchanged as expected and indicated it was unlikely to raise or lower interest rates in the coming months amid signs of renewed economic health while at the same time inflation was still unusually low. The Bank's policy statement highlighted its continued failure to raise the annual inflation rate to at least 2%. The statement may have raised expectations that a change in the next Fed interest rate is a rate cut to stimulate inflation or growth.

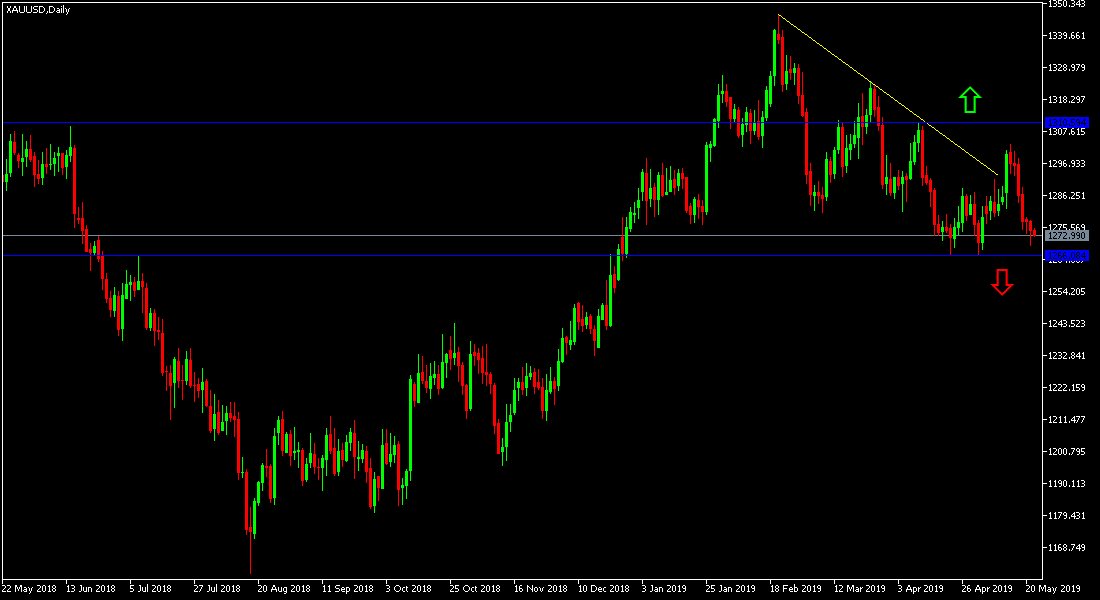

Technically: If gold prices stabilized today below $ 1300, that will increase the bearish momentum and the nearest support levels will be 1273, 1265 and 1258 respectively, which support the strength of the bearish trend while at the same time levels can be bought for close targets. On the upside, the nearest levels of gold resistance are currently 1286, 1300 and 1312, respectively. We still prefer to buy gold from every bearish bounce.

In terms of economic data: the yellow metal will all focus on the US dollar level. Gold will also be affected by investors' risk appetite. Gold is one of the most important safe havens.