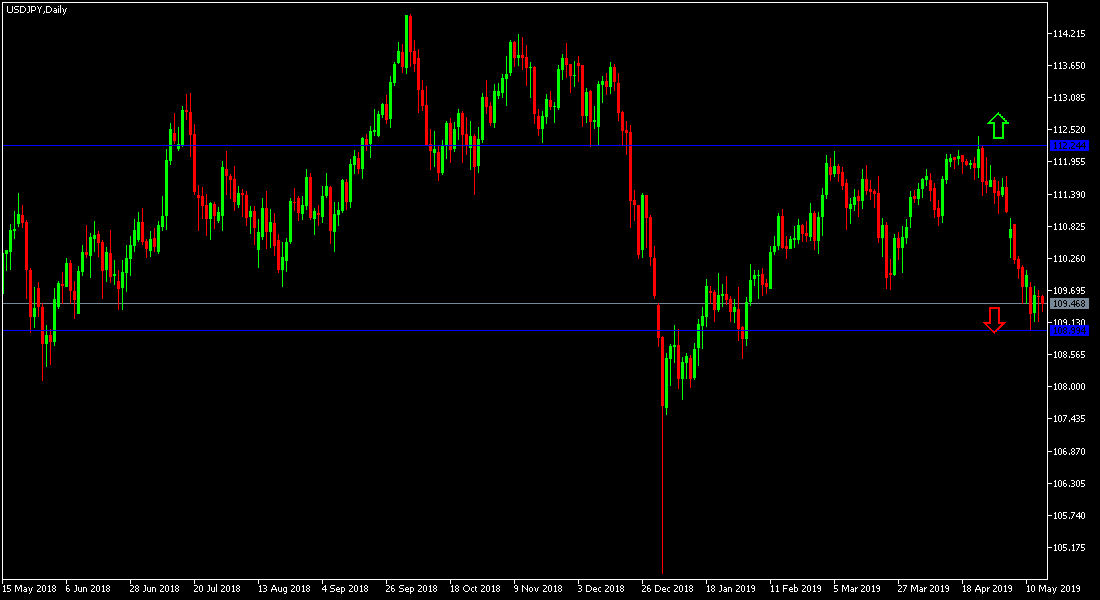

US retail sales fell more than expected, negatively impacting the US dollar. With renewed US-Chinese trade tensions and the US dollar and Japanese Yen's safe-haven currencies, this helped the USD / JPY break to109.02, its lowest support level for more than 3 months, and for the session the pair is trying to move above 109.76, but the Yen remains stronger. The pair is stable around 109.55 at the time of writing the analysis. A move below 109 will increase the downward pressure for the pair to move away from the 110.00 resistance which separates the bullishness from the bearishness.

China responded to the United States by imposing new tariffs $ 60 billion of US products after Trump carried out its threat and imposed more tariffs on the $ 200 billion worth of Chinese products despite the continued optimism that the agreement between the two sides was close to end that trade war which threatens the world economy.

The US economy managed to add new jobs more than expected, the unemployment rate fell to its lowest level in 49 years and the hourly average wage rose.

The Federal Reserve Board kept the interest rate unchanged as expected, pointing out that it is unlikely to raise or lower interest rates in the coming months amid signs of renewed economic health while at the same time inflation is still unusually low. The Bank's policy statement highlighted its continued failure to raise the annual inflation rate to at least 2%. Referring to a drop in inflation, the statement may have raised expectations that a change in the next federal interest rate is a rate cut to stimulate inflation or growth.

We noted in the previous technical analysis that the daily chart clearly shows a new bullish consolidation zone for the pair and that this performance foreshadows the pair's upcoming move towards further gains or bearish correction with the profit-taking operations.

Technically: As we had previously predicted that the stability of the USD / JPY below 110.00 will increase the bearish momentum of the pair, and the next support levels may be 109.30, 108.70 and 107.80 respectively, which confirm the strength of the bearish trend. On the upside, the nearest resistance levels are 110.25, 111.30 and 112.75, respectively. We still prefer to buy the pair from every bearish bounce.

In today's economic data, the economic calendar will focus on US data, building permits, housing starts, jobless claims and the index of the Philadelphia industrial index. The pair will watch with caution and interest for any renewed global geopolitical concerns and all about Trump's internal and external policy.