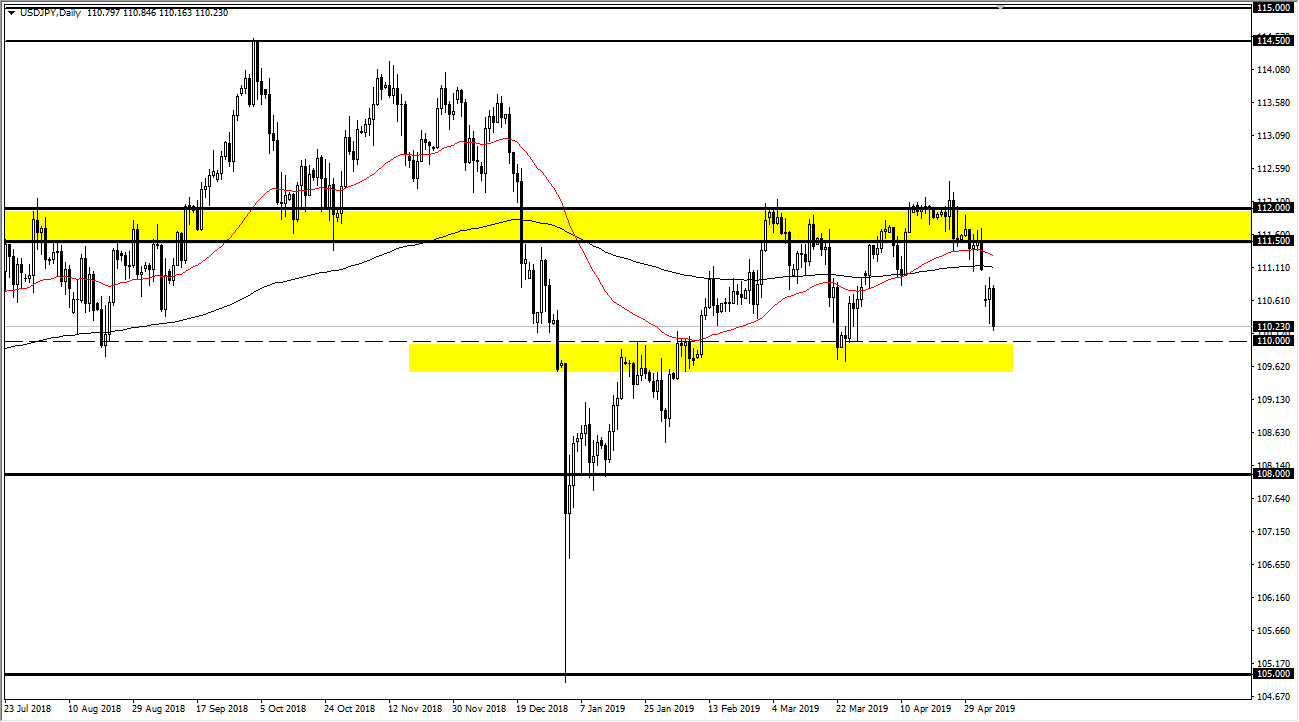

USD/JPY

The US dollar fell rather hard against the Japanese yen during the trading session on Tuesday, as the stock markets came undone in the United States. We are now approaching the vital ¥110 level, and quite frankly if we do not find support there, it’s very likely that this market will break down significantly. The ¥108 level would be the next major support barrier that the market will be paying attention to. With that being the case, keep in mind that we are at crucial levels, so if we get a recovery at the ¥110 level, it could be a nice buying opportunity to try to fill the gap from the beginning of the week. This is a pair that moves with the overall risk appetite of the markets, so with that being the reality, you simply must pay attention to things like the S&P 500 as they tend to move in the same direction.

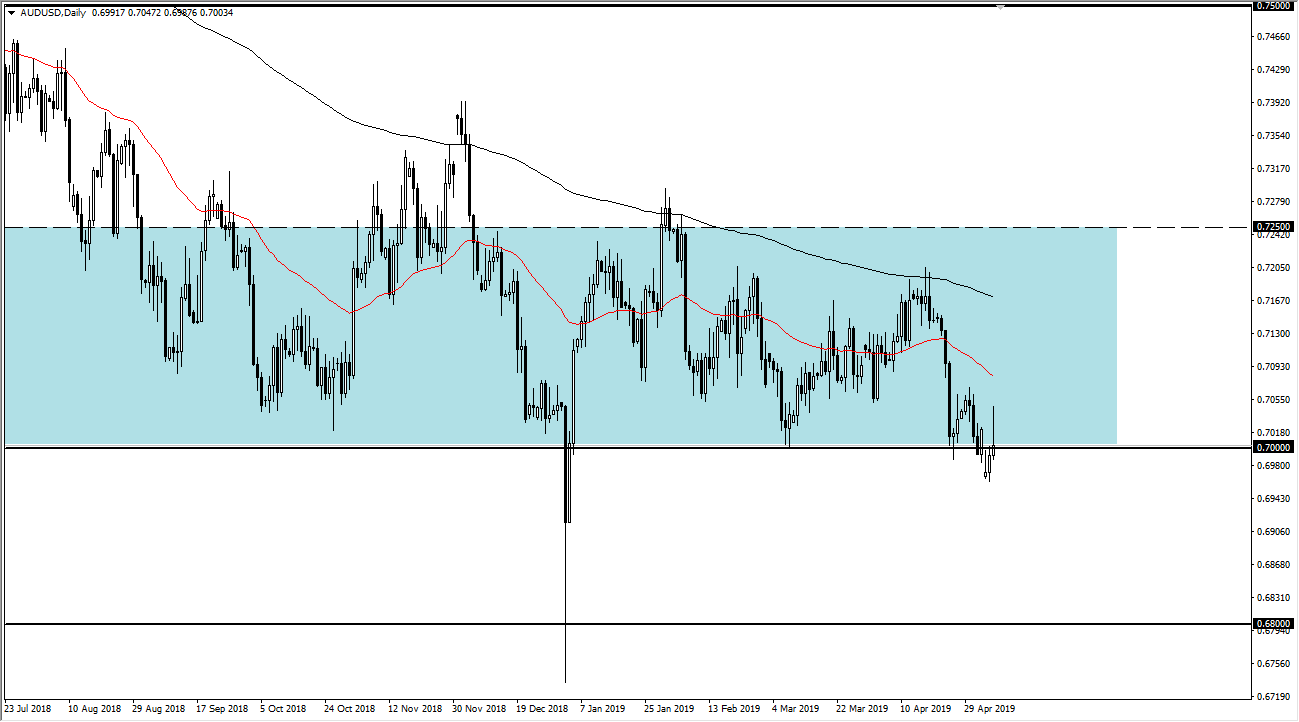

AUD/USD

The Australian dollar is testing the 0.70 level yet again, an area that is massive support. I believe at this point we will continue to find buyers underneath but the question now is whether or not we can get enough support to turn the thing around with any measure. Keep in mind that this is all about the US dollar at this point, and if it starts to strengthen everywhere we will more than likely have this pair drift a bit lower but if you’re going to pick up the greenback you will want to do it against other currencies as there is so much in the way of support. However, if we turn around and see the greenback falling in general, it’s very likely that we will see this pair rise quite easily. We are at extreme lows, so trade it as such.