For four consecutive trading sessions, the USD/JPY pair has rallied around the top of the 110.00 psychological resistance, with gains reaching the resistance level of 110.66 before settling around 110.45. This was ahead of the release of the US Federal Reserve minutes from their last meeting to date. The dollar and Japanese yen have remained the most prominent as safe havens amid global trade tensions. Japan's economic growth, contrary to expectations, remained strong in the first quarter of 2019 and expectations were for a strong slowdown. The pair's latest losses reached the 109.01 support level at the beginning of last week's trading, the lowest in more than three months, as trade tensions between the United States and China increased and more tariffs were imposed. This global trade war threatens the future of the global economy as a whole, and it was normal for investors to ran to safe haven assets led by the Japanese Yen. US retail sales fell more than expected, negatively impacting the US dollar.

China responds to the United States to impose new tariffs worth $60 billion on US products after Trump carried out the threat and impose more tariffs on $200 billion of Chinese products despite the continued optimism of a close agreement between the two sides to end the trade war which threaten the world economy.

The US economy managed to add new jobs more than expected, the unemployment rate fell to its lowest level in 49 years and the average hourly wages were higher.

The Federal Reserve Board kept the interest rate unchanged as expected, pointing out that it is unlikely to raise or lower interest rates in the coming months amid signs of renewed economic health while at the same time inflation is still unusually low.

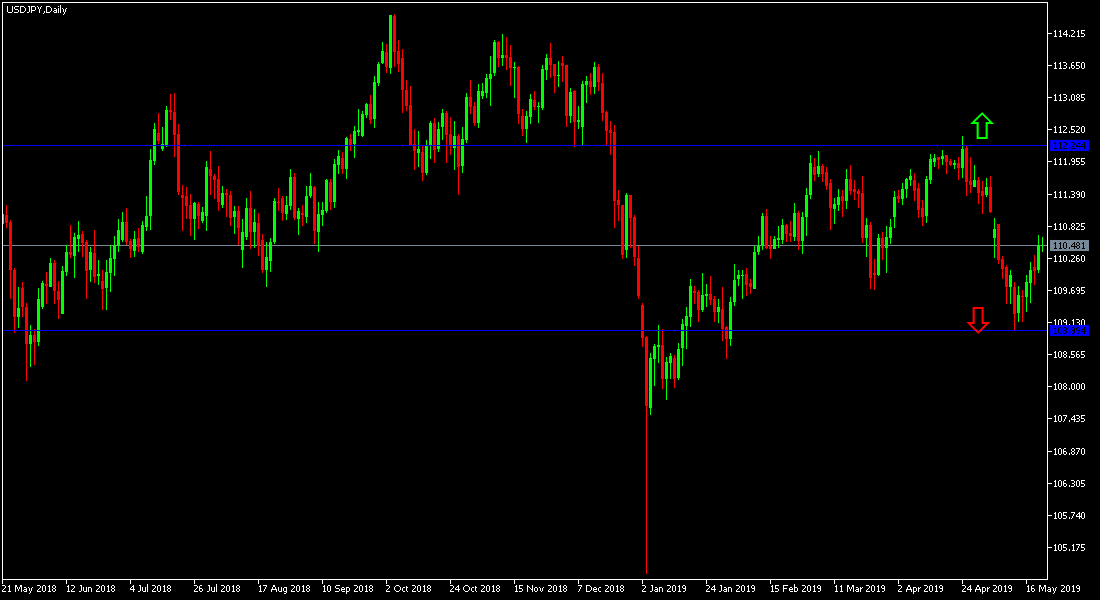

We noted in the previous technical analysis that the daily chart clearly shows a new bullish consolidation zone for the pair and that this performance foreshadows the pair's upcoming move towards further gains or bearish correction with the profit-taking operations.

Technically: As expected, the stability of the USD/JPY below the 110.00 level will increase the bearish momentum for the pair, and the following levels of support to the pair will be 109.30 and 108.70 and 107.80, respectively, which confirm the strength of the downward trend. On the upside, the nearest resistance levels are currently at 110.75, 111.40 and 112.75, respectively. We still prefer to buy the pair from every bearish bounce.

In today's economic data, the economic agenda will focus on announcing the minutes of the last meeting of the US Federal Reserve. The pair will be watched with caution and interest any renewed global geopolitical concerns and all about Trump's internal and external policy.