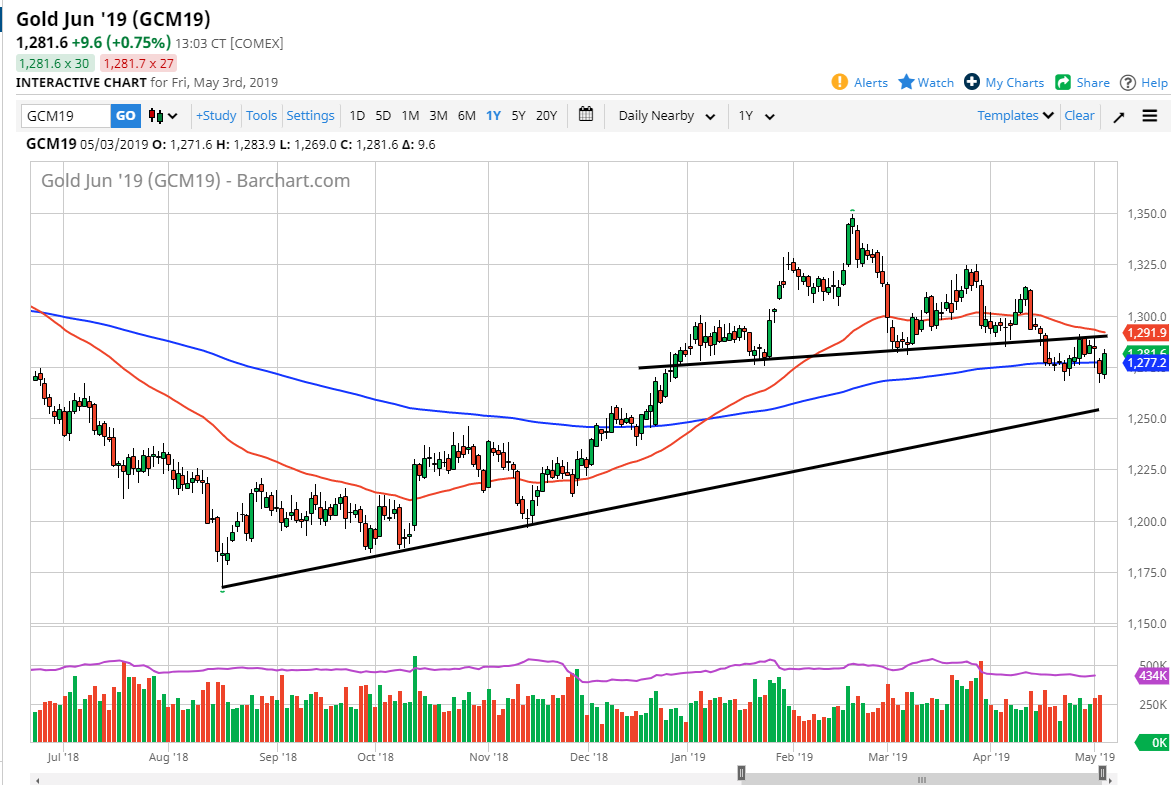

The Gold markets rallied rather significantly during the trading session on Friday as we trying to fill the gap from the beginning of the Thursday session. We rallied significantly but are starting to find resistance just above. With that in mind, it makes quite a bit of sense that we get a bit of selling up at these lofty levels. However, we need to keep an open mind as the US dollar will have a huge influence on what happens next. With all of that in mind, I anticipate that sellers will return rather soon. If we get any US dollar strength whatsoever we will more than likely fall.

There is a bit of conflicting technical information here though, as the 200 day EMA is sitting in this general vicinity, and of course we have seen the $1270 level offer support as well. Ultimately, if we do break down below the $1270 level, I think that the market will probably go down towards the uptrend line underneath, which is a bit closer to the $1250 level.

When you look above, you can see that there is a neckline from the head and shoulders pattern that is still intact, and it does coincide with the 50 day EMA. Looking at this market, if you measure the move that is potentially waiting to happen due to those head and shoulders, you could be looking at $1225 or so. Keep in mind that the US dollar of course is going to have its influence, so if it starts to strengthen again I suspect that the Gold markets will get hammered again. As far as rallying is concerned, we need to clear the $1290 level on a daily close to even have that conversation for a long position.