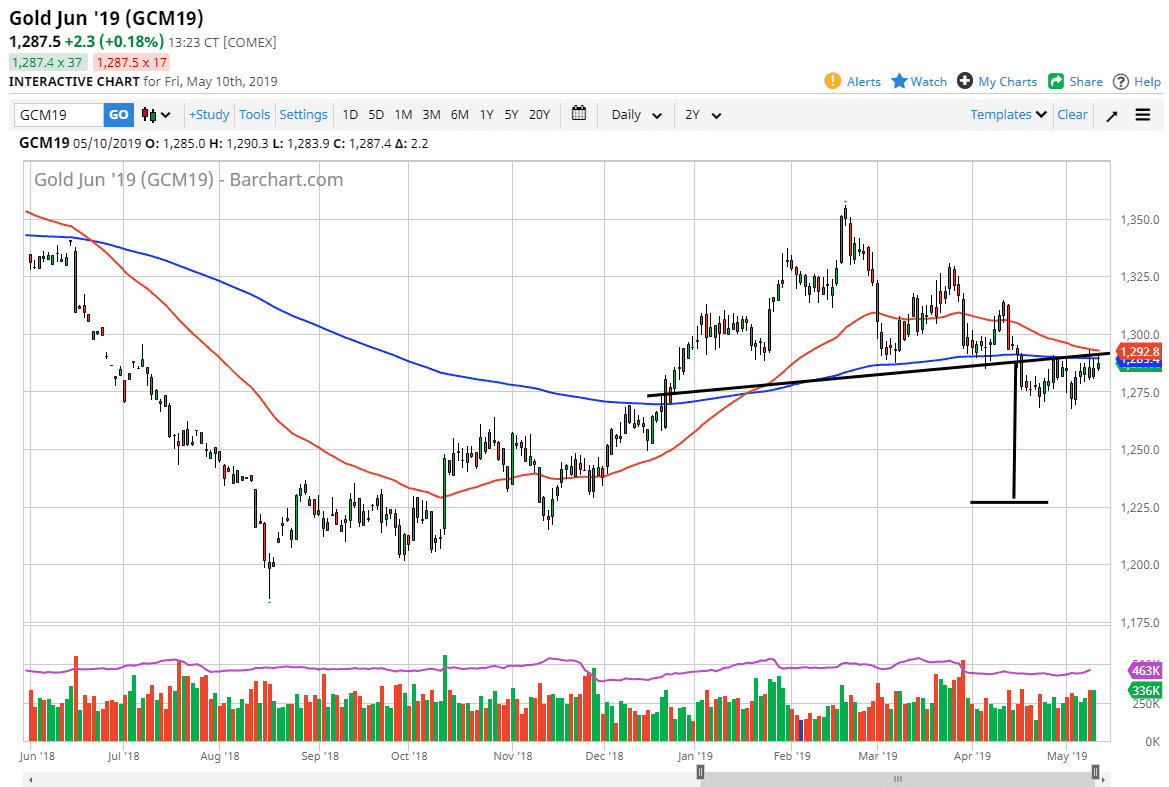

Gold markets tried to rally during the day on Friday, reaching towards the 200 day EMA before showing signs of exhaustion again. We have formed a couple of shooting stars ahead of the session, so now it looks likely that we are getting ready to roll over.

Gold markets rallied initially tried to take on the 50 day EMA which is in red but continues to find plenty of resistance at the 200 day EMA, and of course the neckline from the previous head and shoulders pattern. With that being the case it’s likely that the market will find sellers given enough time, and if that’s the case it’s likely that we could just kind of come back to the bottom of the range, reaching down towards the $1275 level, perhaps even the $1268 level. A move below that level could send this market down to the $1225 level.

At this point, the market looks very vulnerable, but I also recognize that there are couple of different scenarios that could come out. The US/China trade relations continue to be a major problem, so if the market get some type of relief I suspect that the Gold markets may roll over just a bit as the safety trade will wear off. Alternately, if we can break above the neckline on a daily close, which would be essentially wiping out the last couple of candlesticks and braking significant resistance. If we do that, then I think the market continues to grind higher. A move above that area sends the market looking towards the $1300 level, and then eventually the $1315 level after that. This is a market that will be volatile, but certainly looks as if there is a lot of things pressing lower on the market.