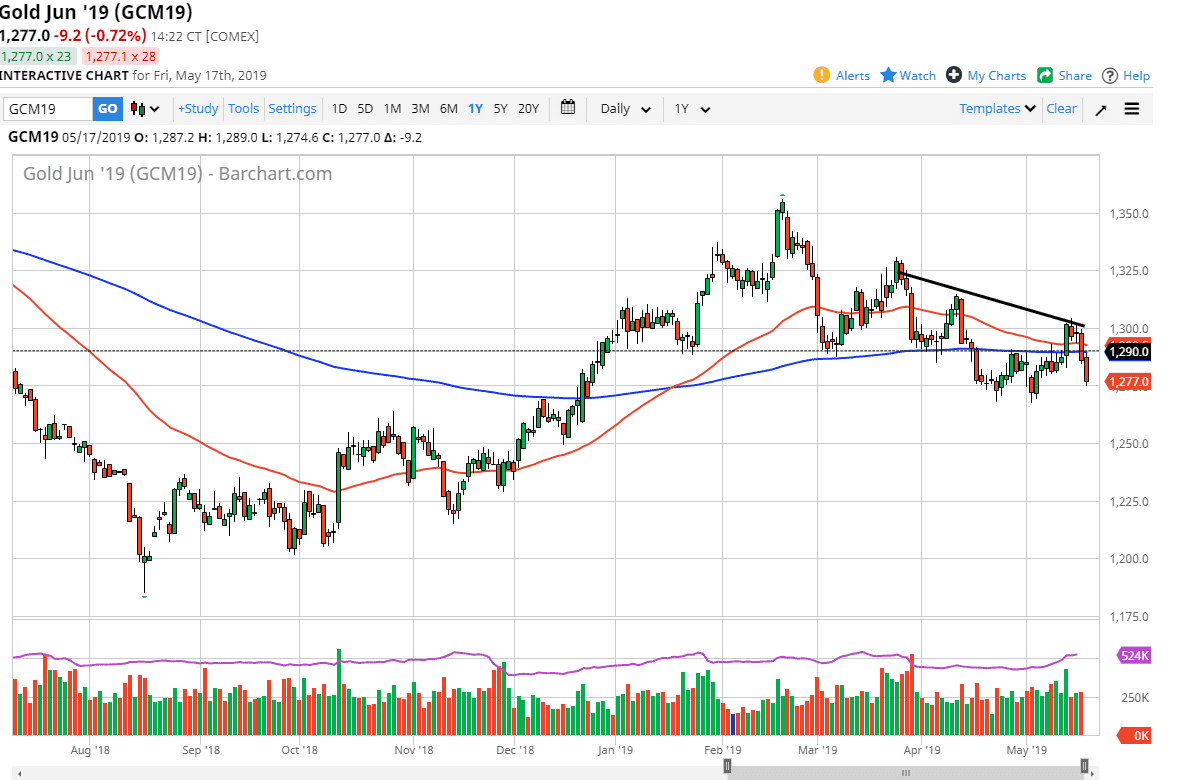

Gold markets got hammered again on Friday, breaking down towards the $1275 level, an area that has caused a bit of support. That support extends down to the $1268 level, so I think at this point it’s likely that we could start selling off on signs of exhaustion. At this point, I believe that the market is going to continue to drift lower, but we may get a short-term bounce in the meantime. The market of course is usually sensitive to the US dollar, so if it starts to strengthen we could see gold selloff, or perhaps we could see a bit of a selloff due to the simple “risk on” attitude of stock markets. Either way, it looks as if Gold is probably going to struggle in the near term.

The downtrend line that you can see above should continue to cause a bit of resistance as well, as the sellers continue to make “lower highs. If you look at this chart, you can even make an argument for a bit of it down trending channel, so at this point it’s likely that we continue to see selling pressure and perhaps lower pricing. I think you should look to short-term charts to show signs of exhaustion, and then jump on them. As far as buying is concerned, it’s very difficult to imagine doing so until we clear that $1300 level, which looks to be a bit of a barrier at this point.

On a break down below the lows, I think at this point the market would probably go to the $1250 level, the $1225 level, and then eventually the $1200 level after that. At this point, it certainly looks as if the attitude of Gold has changed quite drastically.