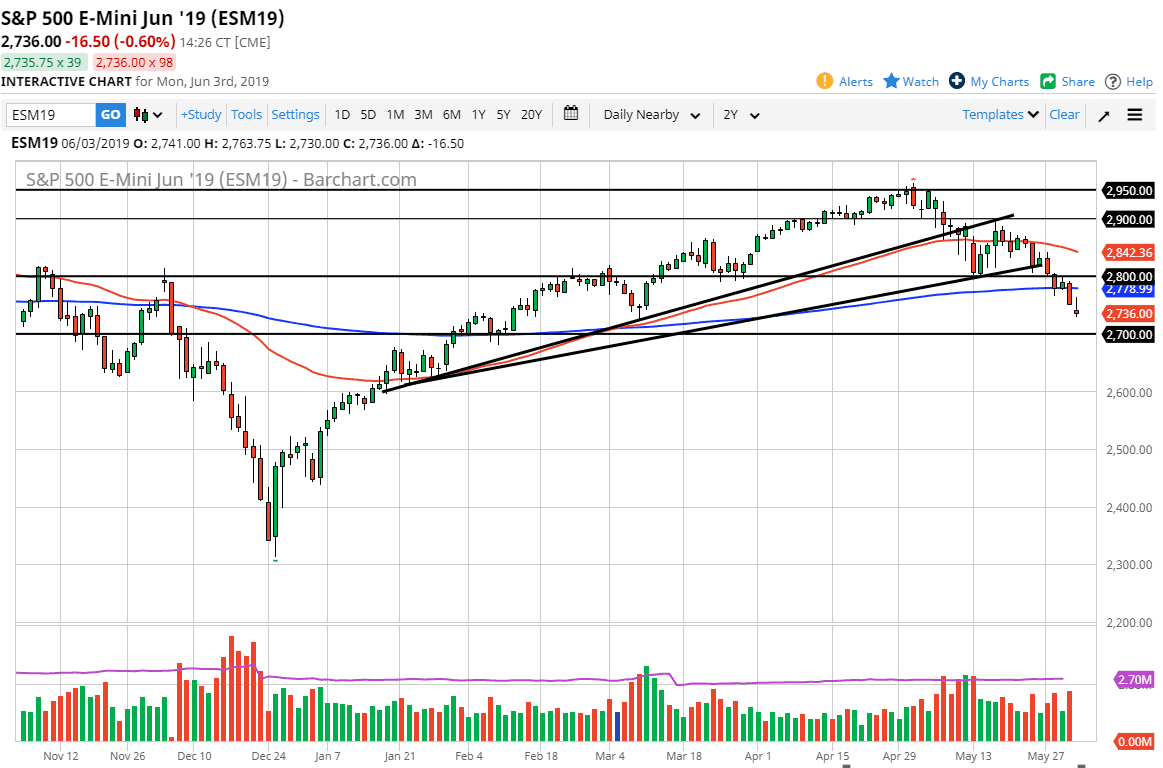

S&P 500

The S&P 500 initially gapped lower during the trading session on Monday, but then turned around to fill that gap. By doing so, we found sellers again and we ended up forming a bit of an inverted hammer. At this point in time it’s likely that the market will continue to go lower, perhaps down to the 2700 level. Ultimately, the large, round, psychologically significant figure at 2700 could offer significant support. A break down below there should open the door to the 2600 level, via the 2650 level. I have no interest in buying this market, it’s obvious that we are very negative. As long as we stay below the 200 day EMA, which of course is blue, this is a seller’s market and shows plenty of negativity that we can take advantage of on short-term rallies.

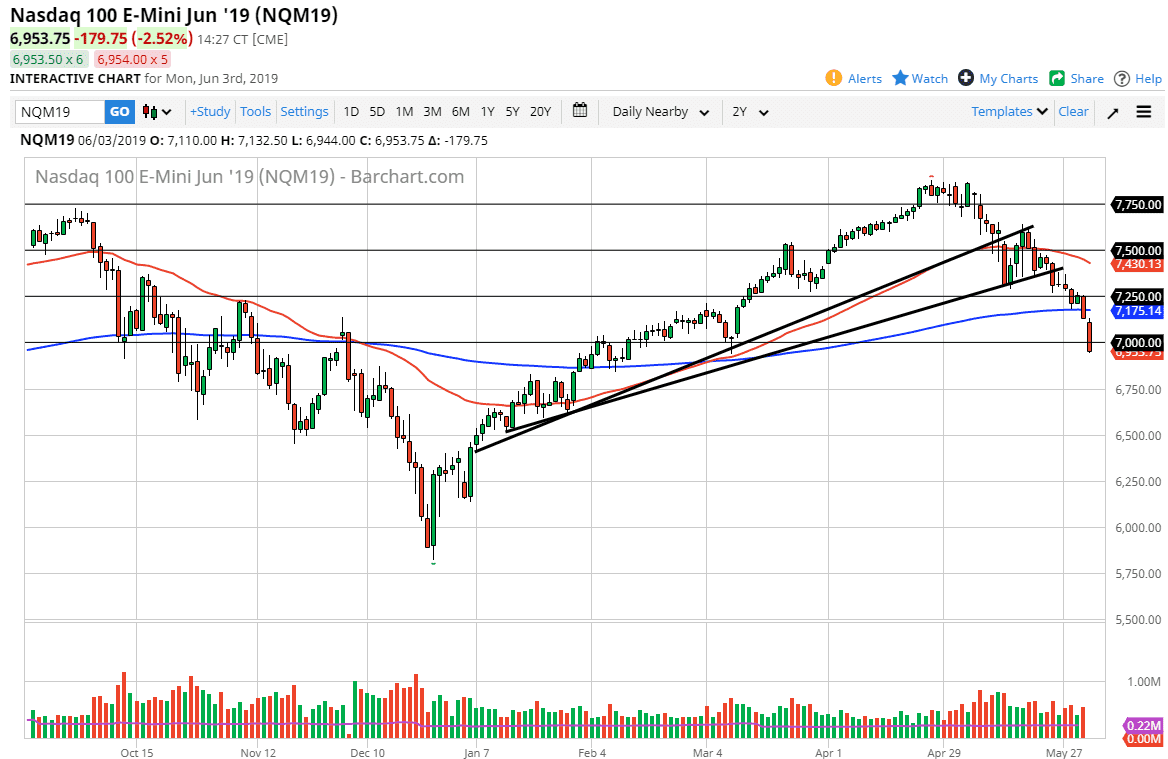

NASDAQ 100

The NASDAQ 100 broke down significantly during the trading session on Monday, slicing through the 7000 handle. This is a pretty big turn of events and as we are definitely below the 200 day EMA, it’s likely that we should continue to go lower. Clearing the 7000 handle is extraordinarily negative and could open the door to the 6750 handle. Rallies at this point would be sold into on signs of exhaustion, as the NASDAQ 100 is extraordinarily sensitive to the US/China trade relations. With that in mind, Wayne stock markets fall in the United States that should be the first place you start shorting.

The alternate scenario of course is that the US/China trade relations get a bit better, which should continue to drive this market higher. That seems very unlikely at the moment, so therefore I sell rallies that show signs of exhaustion.