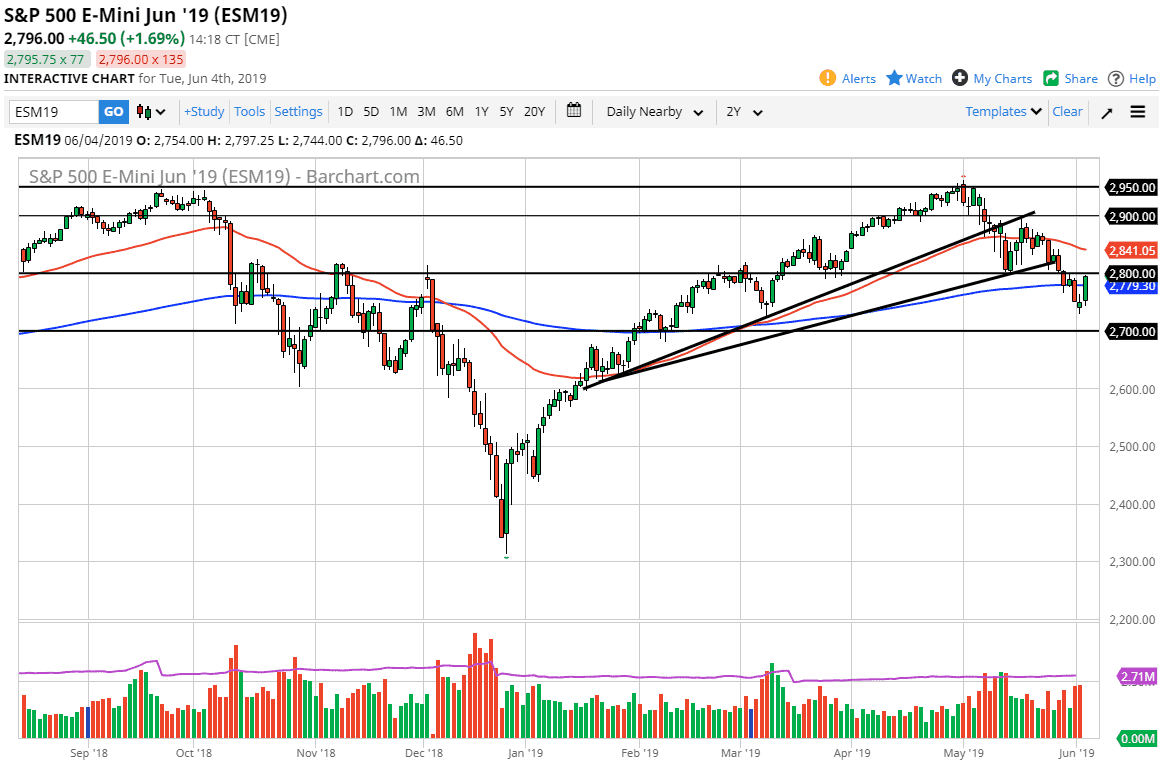

S&P 500

The S&P 500 broke higher during the trading session on Tuesday, slicing towards the 2800 level. This is an area that could be massive resistance, so it will be interesting to see how this plays out. Because it is such a crucial level, I think it’s going to be difficult to trade this market with any type of confidence in the short term. With that in mind I think the daily candle stick on Wednesday is going to be crucial. If we break above the 2800 level and then find the market rolling right back below it, that could form a shooting star which would be a very negative sign.

Alternately, if we close quite a bit above the 2800 level, it could be a buying opportunity. The 200 day moving average looks as if it’s trying to offer support, but in general the one thing you need to keep in mind is that we have broken through a lot of support, and of course we have the jobs number on Friday. For the next 24 hours, I’d be on the sidelines.

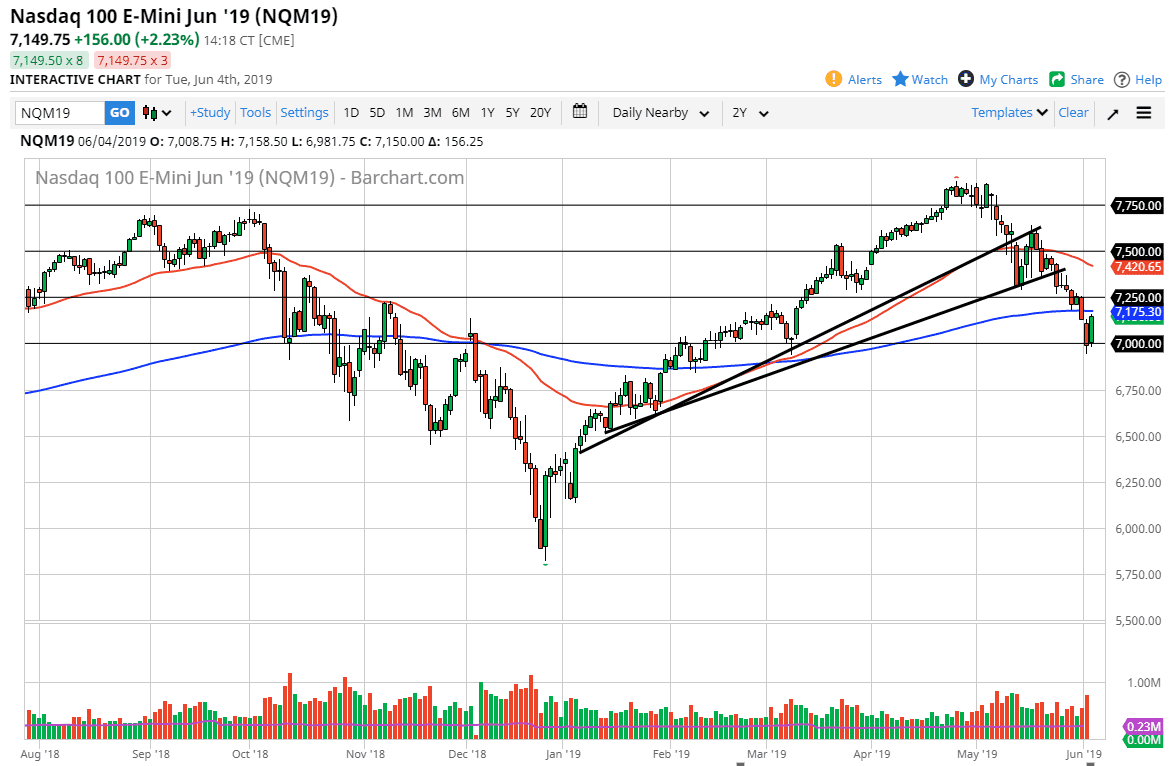

NASDAQ 100

The NASDAQ 100 turned right back around during the trading session on Tuesday, using 7000 as a springboard. We are closing just below the 200 day EMA though, so it will be interesting to see how this market plays as well. I think this is going to be very much like the S&P 500, you are better off letting the market tell you whether or not this is the real thing or if there’s exhaustion just above. I will update you in 24 hours here at Daily Forex, as I believe this is an area that you could get chopped up in pretty quickly.