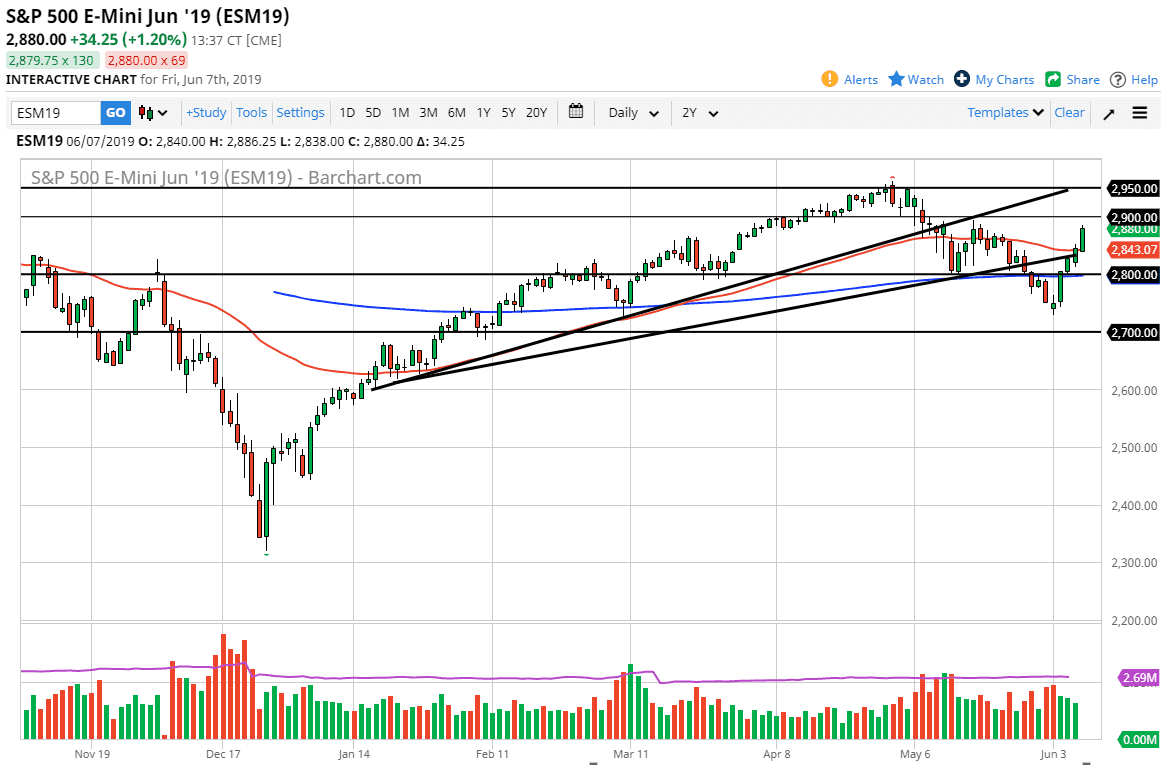

S&P 500

The S&P 500 rallied significantly during the trading session on Friday as the jobs numbers missed. This is a scenario where traders start to pay attention to the idea that the Federal Reserve is going to ease its monetary policy, and with a jobs report that misses, that gives one more reason to think that rate cuts are coming. Stock traders love rate cuts, so therefore we took off to the upside.

Looking at the S&P 500, we have broken above the 50 day EMA which is pictured in red, cleared the uptrend line underneath which should have been resistance once we revisited debt, and now find the market testing the 2880 handle. There is a band of resistance extending to the 2900 level, which could cause a lot of selling pressure. If we can break above there, then the market looks at the 2950 level. Either way, I think that short-term pullbacks are going to offer buying opportunities based upon the Federal Reserve.

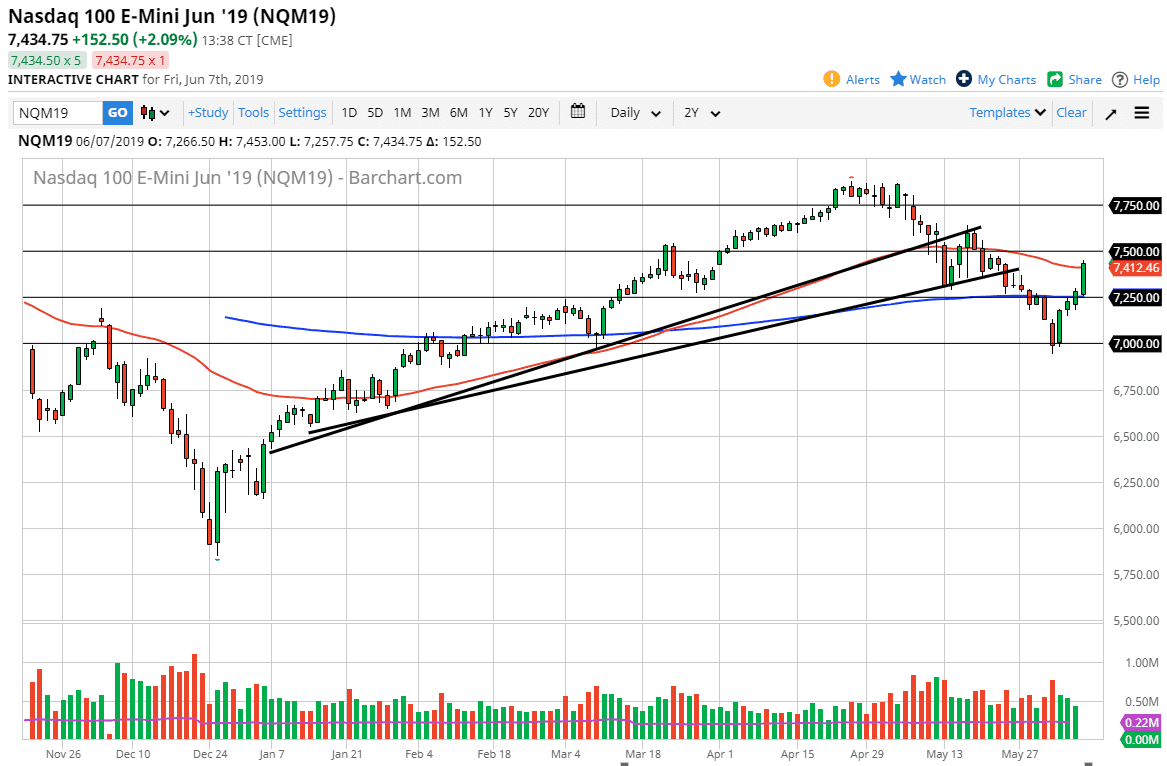

NASDAQ 100

The NASDAQ 100 also rallied significantly during the trading session on Monday, breaking above the 50 day EMA which was a pretty significant turn of events. Beyond that, the White House suggested that they were willing to push back tariffs on some Chinese goods, and that has a significant amount of influence on the NASDAQ 100. With all of that, it looks as if we are going to try to go to the 7500 level. If we can clear that level, then we are free to go another 250 points.

If we do pull back I believe that the 7250 level should offer support, and therefore it should continue to give plenty of buying opportunities on dips as we are well supported. At this point it looks like the attitude has shifted to the upside for a longer-term move.