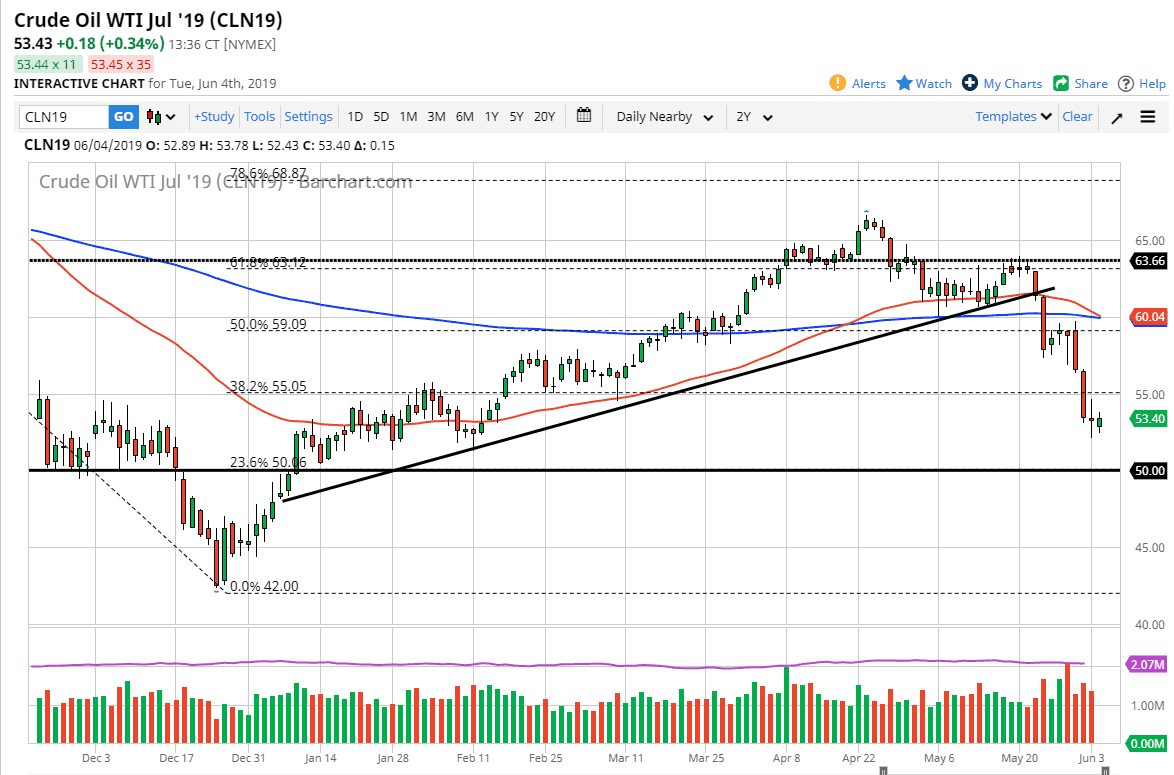

WTI Crude Oil

The WTI Crude Oil market has gone back and forth during trading on Tuesday as we continue to see a lot of choppiness. Quite frankly, this is a market that looks like it is trying to find some stability, which makes quite a bit of sense as we have gotten a bit oversold. Once we broke down below the $55 level, it opens up the idea of going down to the $50 level, which of course is a large and round psychologically significant figure, as well as very structurally important. If we were to break down below that level, it would be like the trap door opening up for further downward pressure.

That being said, I believe that rallies at this point should be selling opportunities, especially near the $55 level. Even if we break above there, I think it’s very likely that the market could struggle at the $57.50 level as well. We have gotten oversold, and I am looking for an opportunity to take advantage of exhaustion so that I can start selling again.

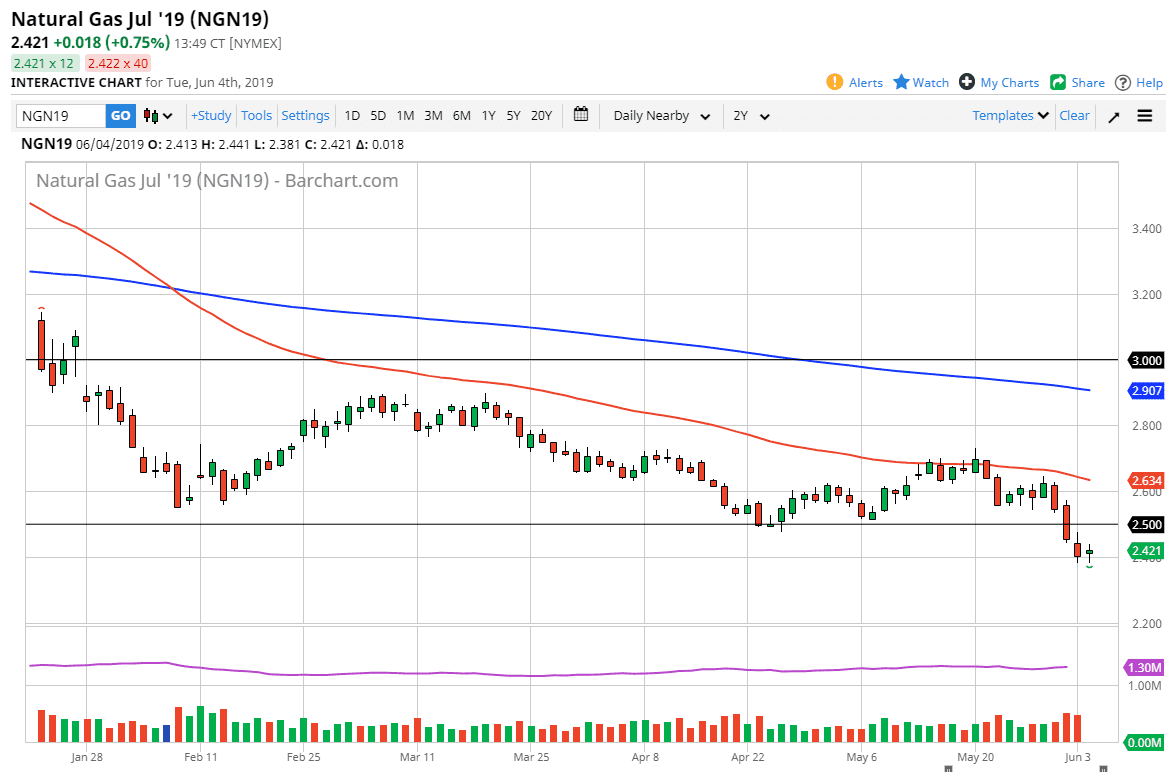

Natural Gas

Natural gas markets went back and forth during trading on Tuesday, using the $2.40 level as momentary support. I still believe that we go lower though, and rallies at this point in time will more than likely be selling opportunities, especially near the $2.50 level where we had previously seen quite a bit of support. Then support should now be resistance, and quite frankly this is a market that is in the wrong season to be bullish. Fading short-term rallies continues to be the way forward, as we are very choppy and negative, but I do think that we could very easily find this market going down to the $2.25 level. Even if we broke above the $2.50 level, we will find resistance at the $2.60 level as well.