The Euro went all over the place during the day on Thursday as we have the ECB monetary policy statement and of course the press conference afterwards to think about. This trope algorithmic traders insane, as the machines continue to try to base trades upon words coming out over the wires. However, in the real world, which is where we trade, the market is relatively unchanged. That being said though, there is a significant amount of importance to this candlestick, as it tells us where the market won’t go, which quite frankly sometimes is more important than any educated guess you have.

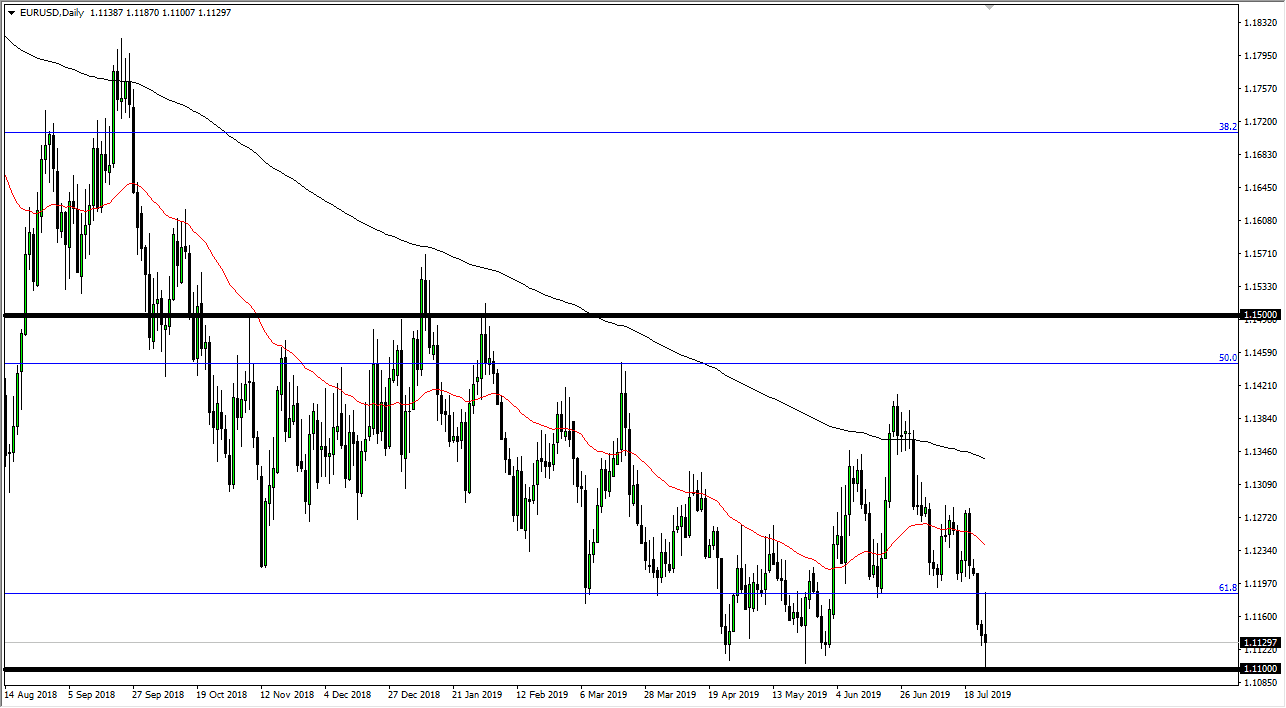

Looking at the chart, it’s very obvious to me that the 1.11 EUR level is crucial. It’s an area that has offered quite a bit of support previously, and it now looks that after the massive move that we have seen during the trading session, that it’s going to continue to be very supportive at this point. To the upside, the 1.12 level of course has offered resistance, but I think based upon the candlestick that we have formed during the trading session, we aren’t ready to make a huge move, but it does set up a nice trading opportunity.

There are a couple of different ways you can look at when it comes to the charts, one of which is going to be that the candle stick for the trading session on Thursday is essentially a “binary trade” setting up. In other words, if we can break one side or the other of this very neutral candle, that tells us where we are going next. One thing that’s important to note however, is the fact that we could not break down below the 1.11 handle, and that tells me that it remains very crucial support. In that sense, the market favors the upside break.

Another way that you can look at this chart is that you simply scale down to very short time frames and play the 100 point range between 1.11 EUR and 1.12 EUR. This would be a replay of what we had seen previously, as we bounced in a tight rectangle above. The market is probably going to start focusing on the Federal Reserve now, and that could give us a little bit of a boost in this pair. That being said, I’m not looking for fireworks, this is the wrong time of year for that to happen.