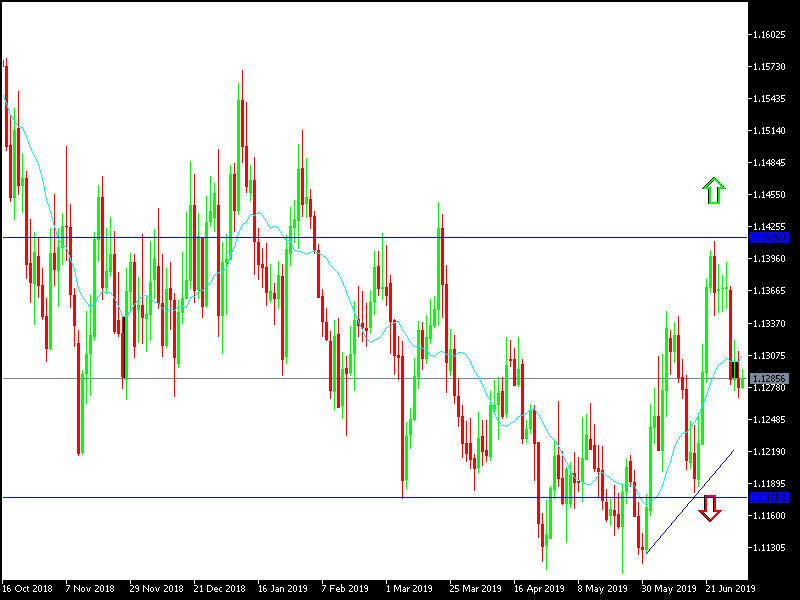

European leaders agreed to nominate Lagard, director of the International Monetary Fund (IMF), for the post of governor of the European Central Bank, replacing Mario Draghi, whose term expires in October. The reaction to the EUR / USD performance was limited as the pair remains stable and below the support level of 1.1300 to 1.1276. The general trend of the pair as shown on the chart below is still bearish.

The pair's recent upward correction was very weak as the US dollar gained stronger momentum after a truce was declared to stop imposing more tariffs between the United States and China after the positive results from the Trump and Xi summit on the sidelines of the G20 summit in Japan.

We have mentioned in the previous technical analysis that the bullish correction for the pair is still weak and is expected to decline again if the Euro does not find stronger catalysts. That is as expectations of a rate cut to the negative region by the European Central Bank (ECB) amid growing weakness in economic data from the Eurozone.

Markets are constantly questioning Trump's policy and the fears still linger over its trade file with China, as they have often been negotiating and eventually new tariffs were imposed. US economic growth figures have not changed as expected, but economists expect the US economy to start slowing from the next announcement with Trump's stimulus plans evaporating.

The continuation of the global trade war means that the Eurozone economy is slowing increasingly and the Euro may lose its recent gains and more.

Both the European Central Bank and the Federal Reserve have confirmed readiness to cut interest rates to cope with the economic slowdown. The recent US economic data confirm the US economic slowdown and therefore market expectations are that the US interest rate could be reduced as soon as possible.

Technically: We had expected and recommended in the previous analysis for a long time to sell the pair from every ascending level. Turning to the EUR / USD bullish trend needs a move towards the resistance levels 1.1355, 1.1440 and 1.1515 to confirm the upward correction strength. On the bearish side, the nearest support levels are currently 1.1240 and 1.1180 respectively. There has been no signs of a strong bullish correction on the way.

On the economic data front, the pair will watch for the Eurozone retail sales data. There are no important data from the U.S, as today is the 4th of July holiday.