For the third day in a row, the EUR/USD is trying to have a bullish correction after the recent violent bearish wave, but the recovery gains were not strong as the pair did not exceed 1.1132 and its recent losses reached the 1.1026 support level, the lowest level in two years. By the end of last week, there was a divergence in the US job numbers, which prompted the pair to achieve some gains. But the fundamentals of its decline are still in place, as the economic performance and monetary policy of both the Eurozone and the US are different, which will be in favor of the US dollar, with the ECB being ready to adopt negative interest rates along with other stimulus plans with the continued weakness in economic performance.

In contrast, the Federal Reserve cut US interest rates by a quarter point to 2.25%, and the US dollar was little affected by this, with the bank confirming that the reduction will not be a permanent policy and that what happened was only as a modernization of the policy cycle. The US-China trade war got support for its continuation with Trump's approval of more tariffs on China's imports after the failure of their trade talks in Shanghai. Financial markets are currently awaiting retaliation from China. Trump accuses Beijing of delaying the passage of an agreement until the end of the next US election.

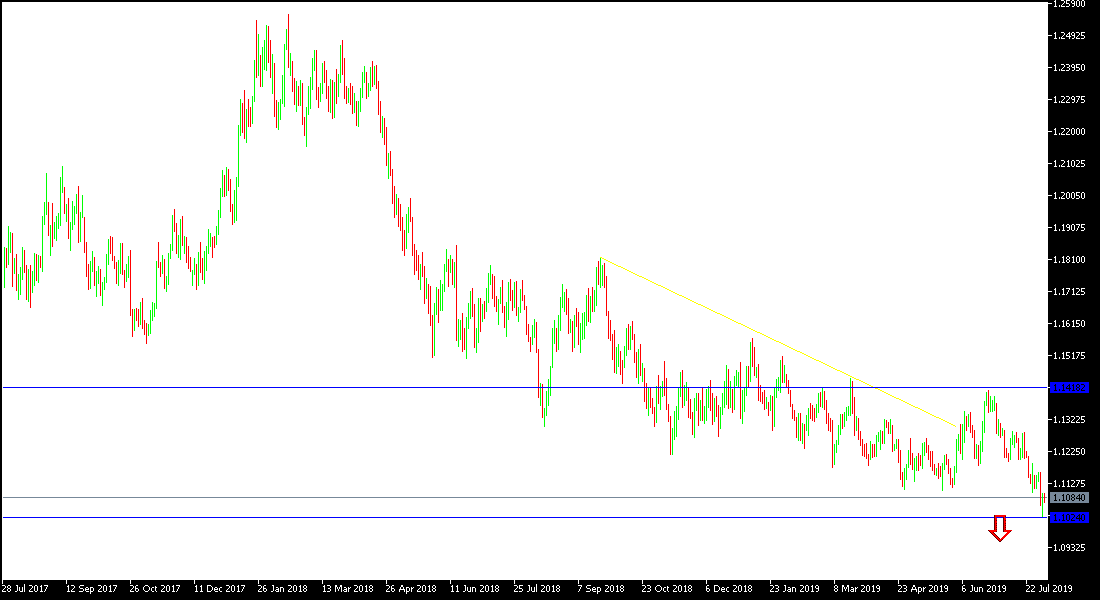

Technically: EUR/USD price performance remains bearish, upward correction attempts are still weak. If the pressure persists, it may move towards 1.1000 psychological support as it will push the pair to stronger support levels reaching 1.0970 and 1.0900 respectively. It should be noted that technical indicators reaching strong selling saturation areas may motivate investors to turn to buy the pair. In the case of a bullish correction, the resistance levels will be 1.1140, 1.1200 and 1.1310, respectively, as the targets for correction.

On the economic data front, today's economic calendar will focus on the announcement of the Purchasing Managers' Index for Euro-Zone Economies. From the US, the ISM purchasing PMI will be released.