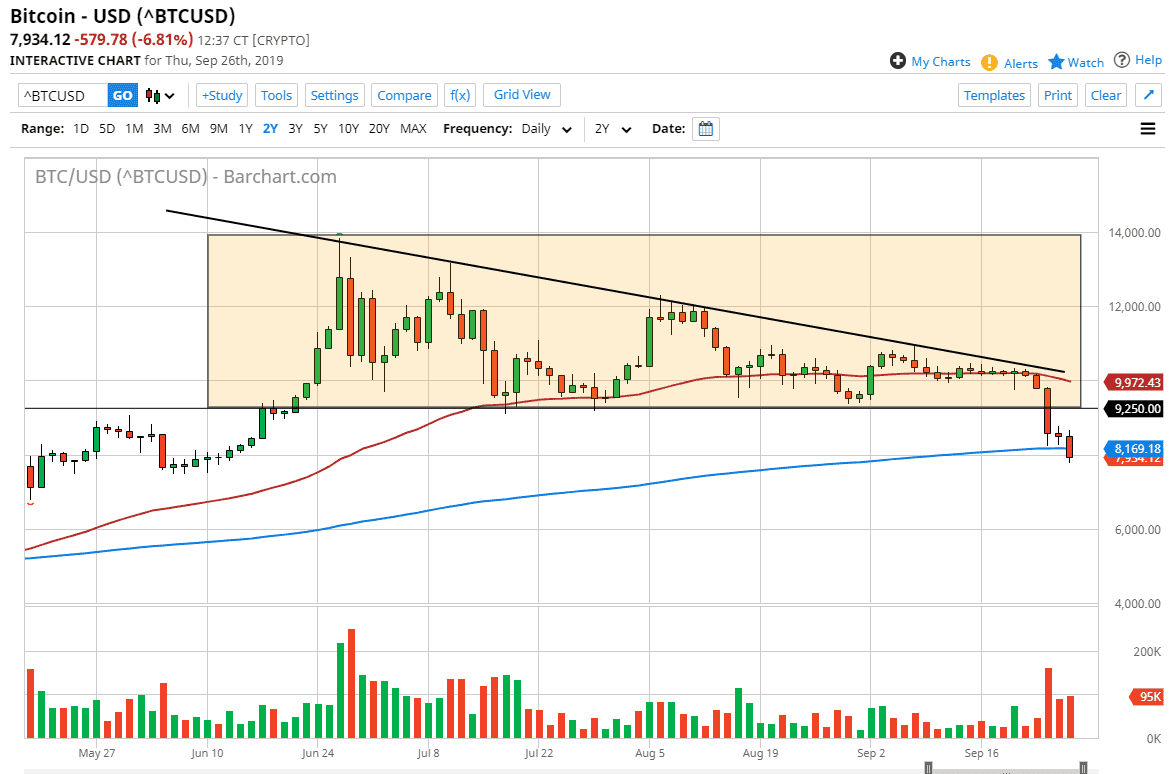

Bitcoin markets tried to rally to kick off the trading session on Thursday but as you can see on the chart we have sliced through the 200 day EMA. By doing so, the market looks very likely to continue the downward trajectory, something that I have been warning about for several days now. We have broken the bottom of a massive descending triangle, which initially looked to be forming a bit of a rectangle. This is exactly how Bitcoin broke down last time, and while history doesn’t always repeat itself, it does tend to rhyme over the longer-term.

Now that we are getting below the 200 day EMA, and have even cracked the $8000 level, there will be a lot of people who are long Bitcoin looking to get out and this will only exacerbate the situation to the downside as longer-term algorithms will be firing off. If we stay below the 200 day EMA, it’s very likely that the market is going to go down towards the $6000 level, and if the descending triangle is to be believed, we will more than likely see Bitcoin drop below the $5000 level as well based upon the “measured move.”

Further telling is the fact that although gold has been rallying as central banks around the world continue to loosen monetary policy, Bitcoin has stopped doing the same. Remember, the main allure for Bitcoin to go higher is to get away from fiat currency, and quite frankly that just hasn’t happened in the last several months. This brings into focus something that I have suspected for some time, that Bitcoin is used to circumvent capital controls in various countries around the world such as China. Once the Chinese money got off the mainland, this is where Bitcoin slowed down. Simply put, Bitcoin isn’t even an investment or speculative tool anymore, rather it’s a way to avoid the Chinese government. It should also be noted that it’s also used in other places such as Venezuela and the like. In fact, I recently had heard a bullish argument made that Bitcoin was likely to continue to grow based upon the surge in use and places such as Venezuela. That’s not a long-term viable solution for a bullish market, because eventually the money runs out in a smaller economy like that, and of course this simply means that Bitcoin is relying on crises.