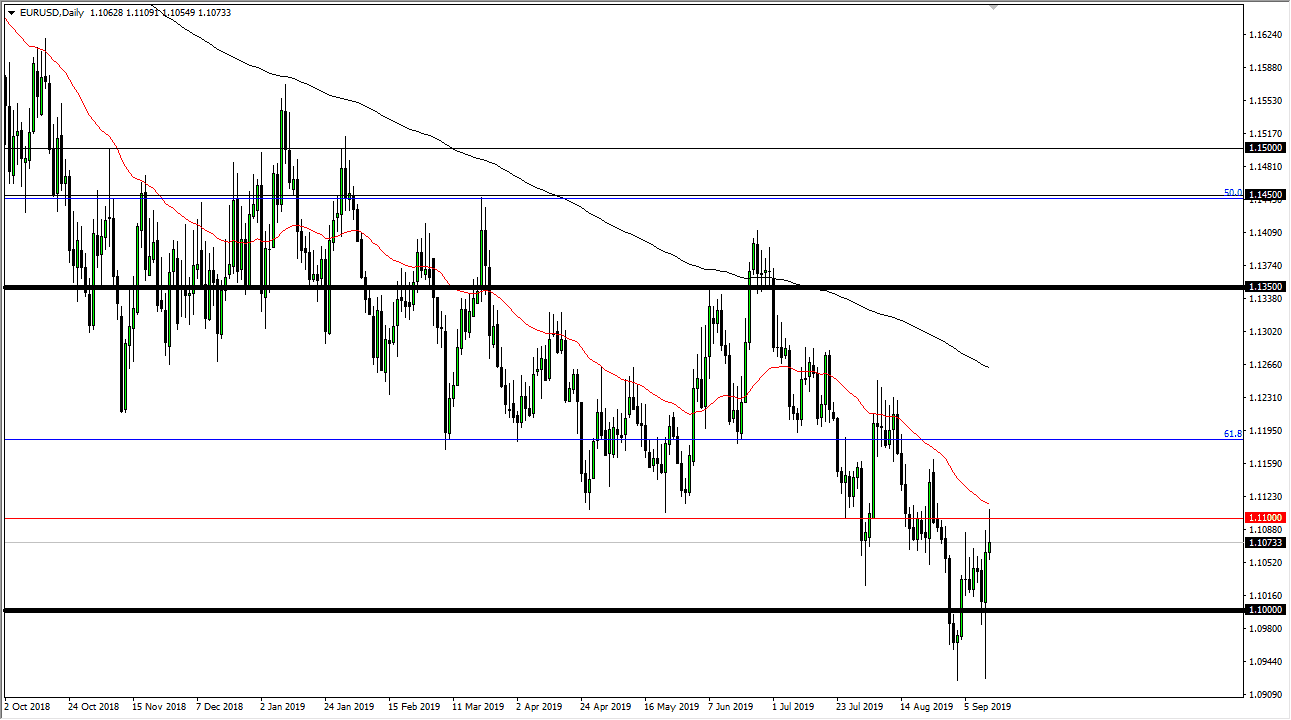

The Euro initially rallied during the trading session on Friday, reaching towards the 1.11 EUR level, and perhaps just as importantly the 50 day EMA. By running into resistance and rolling over again, they ended up forming a massive shooting star. The shooting star of course is a very negative sign, and it’s likely that we will continue to fall from here. A break down below the candle stick for the Friday session is technically a selling signal and should send this market down to the 1.10 EUR level. Below there, we probably go looking towards the lows again.

The Euro has had a strong bounce due to the underwhelming amount of stimulus that the European Central Bank offered, but at this point it’s very likely that we are going to continue to see a lot of volatility so you will have to be cautious about getting overextended as far as position size is concerned. Looking at this chart, you can see that we have been zigzagging on the way down, and that should continue to be the case going forward.

The alternate scenario of course is that we were to break above the 50 day EMA which is not only a technically strong sign in and of itself, but it would also involve breaking the top of the shooting star which means quite a few sellers would be trapped. At this point in time it’s likely that the market would then go looking towards the 1.12 level, but I find this to be a little less likely. This is a market that is very noisy going forward, but at this point it’s very likely that we continue to go lower. We are below the 61.8% Fibonacci retracement level, and it’s likely that we will then go down to the 100% Fibonacci retracement level over the longer-term. It’s going to take months if not a few years to get down there if that happens though, so it’s obvious that this is more or less an investment in the US dollar. However, if something changes in the attitude of the Federal Reserve, that could be the one thing that sends this market higher but that seems to be very unlikely at this point. It doesn’t necessarily mean that they can’t disappoint, but they certainly won’t have the audacity to go against Wall Street as far as interest rates are concerned.