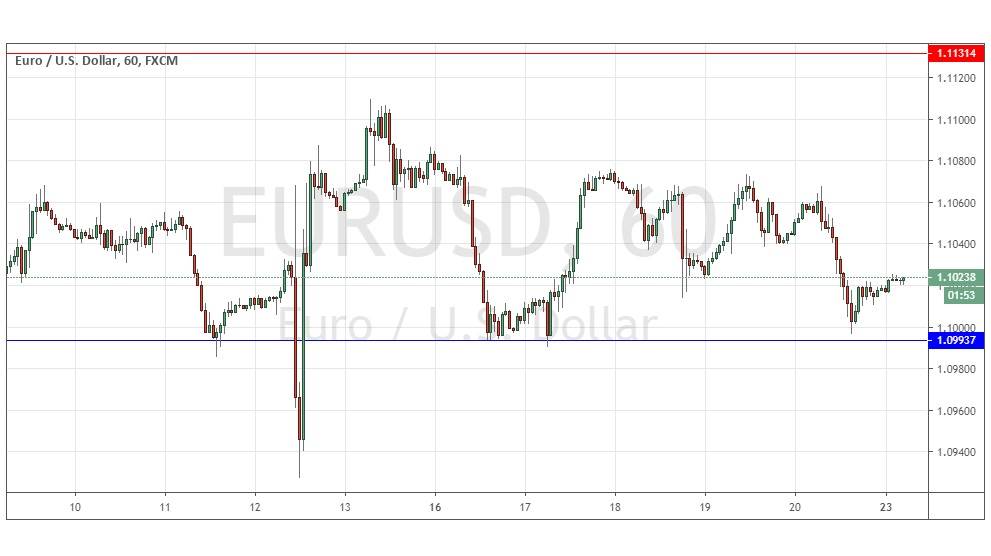

EURUSD: Swinging consolidation above 1.1000 area continues

Last Thursday’s signals were not triggered, as none of the key levels were reached that day.

Today’s EUR/USD Signals

Risk 0.75%.

Trades must be taken before 5pm London time today only.

Short Trade Idea

Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.1131 or 1.1162.

Put the stop loss 1 pip above the local swing high.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

Long Trade Idea

Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.0994.

Place the stop loss 1 pip below the local swing low.

Adjust the stop loss to break even once the trade is 20 pips in profit.

Take off 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote last Thursday that I did not want to take any directional bias until we got a breakout from the zone between 1.0994 and 1.1131. The price has remained within this zone, so I correctly identified a ranging area.

There is a weak long-term bearish trend, so a bearish breakout will probably be more interesting than a bullish one.

However, the support at 1.0994 is very confluent with the big psychological level and major round number at 1.1000 so I could see a bullish bounce at this support level being an excellent long trade. If it sets up, I would take a bullish bias here. There is nothing of high importance due today concerning the USD. Regarding the EUR, there will be a release of French Flash Services PMI data at 8:15am London time, followed by German Flash Manufacturing & Services PMI at 8:30am. The President of the ECB will be giving a minor speech at 2pm.

There is nothing of high importance due today concerning the USD. Regarding the EUR, there will be a release of French Flash Services PMI data at 8:15am London time, followed by German Flash Manufacturing & Services PMI at 8:30am. The President of the ECB will be giving a minor speech at 2pm.