The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases, it will be trading the trend. In other cases, it will be trading support and resistance levels during more ranging markets.

Big Picture 22nd September 2019

In my previous piece last week, I forecast the best trade would be short of EUR/USD following a daily close below 1.1000. The price closed just a fraction below 1.1000 on Tuesday, but then rose from there to the end of the week by 0.17%, which was a loss.

Last week’s Forex market saw the strongest rise in the relative value of the Japanese Yen, and the strongest fall in the relative value of the Australian Dollar.

Last week’s market was dominated by Australian and New Zealand Dollar weakness and Yen strength, but we also saw the U.S. Dollar come back, leading to a resumption in the health of a couple of long-term trends in the Forex market.

There is strong weakness in the New Zealand Dollar and weakness in the Euro, but the latter is subject to deep pullbacks.

Fundamental Analysis & Market Sentiment

Fundamental analysts still see the Federal Reserve as likely to cut rates by one additional quarter-point over the next few months, although many economists believe last week’s cut should be sufficient for the medium-term. Goldman Sachs expects another quarter-point cut next month in October.

The U.S. economy is still growing quite strongly, but there are increasing fears of a pending recession.

The British Pound has been boosted by a greater expectation that the British Parliament may be able to stop Brexit against the wishes of the government. As Parliament is also refusing to allow an election, they are forcing the Prime Minister into an impossible position and hanging him out to dry. It is hard to see how the Prime Minister can escape from this unless he has legal advice that Parliament’s instruction to him to request a Brexit delay cannot be lawfully enforced. Furthermore, the supreme court seems poised to rule that the recent suspension of Parliament was unlawful, meaning that Parliament may be recalled before 14th October.

Stock markets have continued to advance weakly, especially the U.S. market. The benchmark S&P 500 Index is close to its recent all-time high price. Sentiment is broadly risk-on, but that remains quite fragile.

Technical Analysis

U.S. Dollar Index

The weekly price chart below shows that last week the USD Index rose, printing a relatively small bullish candlestick. The support level at 12355 seems to have held. The price is still up over both 3 months and over 6 months, indicating a bullish trend. These are bullish signs. Overall, the odds are very slightly in favour of a continuing U.S. Dollar advance.

NZD/USD

The past week printed a large, strongly bearish candlestick which closed right at its low, just above the key support and psychological level at 0.6250. This was the lowest weekly closing price in this pair which has been seen in decades. These are all very bearish signs, suggesting that we will see still lower prices over the coming weeks. However, the support at 0.6250 may be strong and could hold over the week, so I want to see a daily close below 0.6250 with some more bearish momentum first.

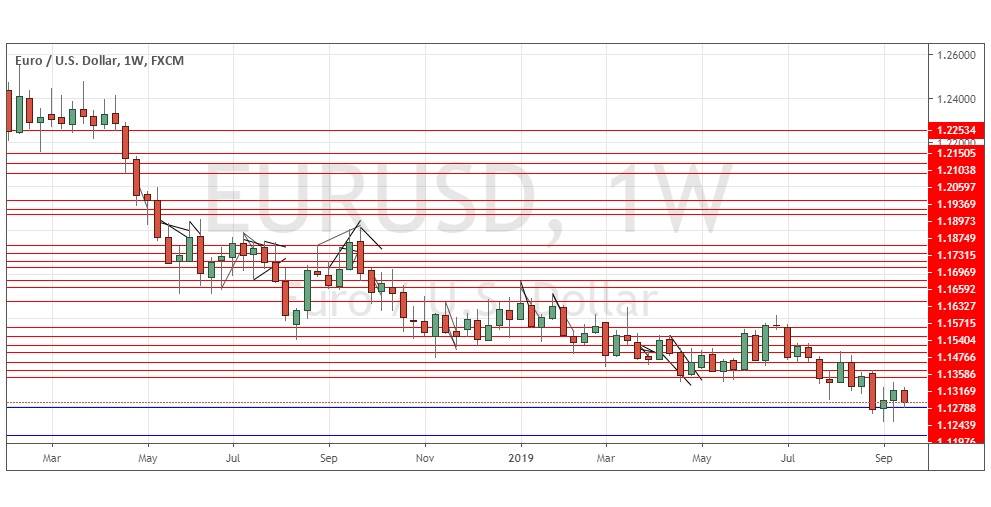

EUR/USD

The previous two weeks saw a small recovery in this pair, but the past week printed a small bearish engulfing candlestick. The price is clearly in a weak though persistent long-term bearish trend. It is not clear whether the price will fall further, but a bearish move resulting in a daily close below 1.0989 would trigger a change in probability which would see stronger downwards than upwards price movement as more likely to happen over the short term.

Conclusion

This week I forecast the best trade will be short of NZD/USD following a daily close below 0.6250 and short of EUR/USD following a daily close below 1.0989.