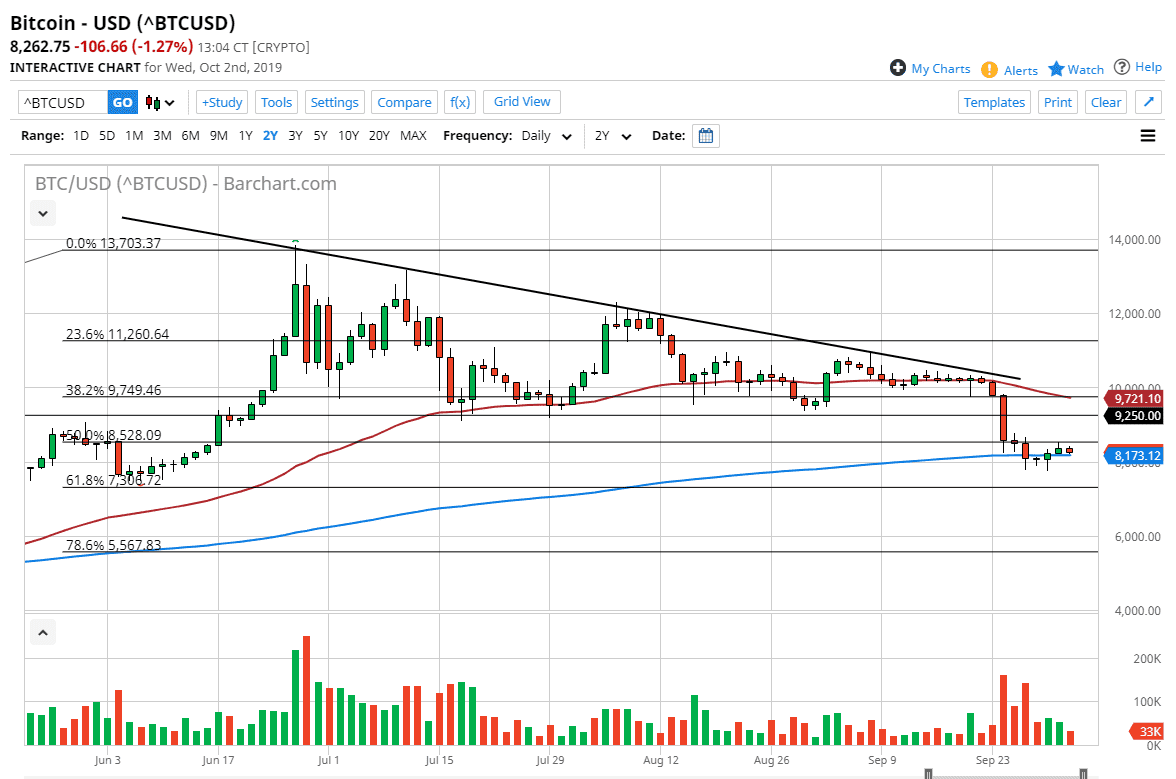

Bitcoin markets have gone sideways for several days in a row, as we continue to dance around the 200 day EMA. This of course will attract a lot of attention as quite a few longer-term traders will look at it as a way to determine the overall trend of a marketplace as we are going sideways in this general vicinity it’s obvious to me that we are trying to make a decision for a bigger move. That being said, there are a few clues that could tell us where we are likely to go.

At this point, I believe that the market will continue to drop, basically because of the descending triangle that we had broken down below recently, as the market has been showing quite a bit of lackluster performance for months. The market has broken through an area of at the bottom of that descending triangle that could have offered quite a bit of support for several months. The fact that we are below there now tells me that there has been a shift in momentum.

The descending triangle measures for a move down towards the $5000 or so, and that makes quite a bit of sense to me considering that Bitcoin has not been acting well for months. Yes, it was somewhat sideways for a while but the highs kept getting lower, while people were jumping away from fiat currency in the form of silver and gold. As central banks continue to look to loosen monetary policy and add quantitative easing, it’s difficult to imagine a scenario where bitcoin should fall. However, it has and I suspect a lot of this comes from a lack of outflows from places like China. There was quite a bit of capital control put in place and the Chinese mainland several months ago, and now that that money has gotten out of China, those people are turning it back into usable cash.

Bitcoin still has a major head wind ahead of it, as it can’t be used for transactions. It simply isn’t stable enough and obviously it’s far too expensive. Yes, I’m aware that you can buy down to 8 decimal points, but nobody wants to be bothered messing around with that. I believe that the long-term outlook for Bitcoin is minimal at best. I do believe crypto will be used for currency, but I also think it will be on the backs of central banks. That being said, I trade what I see and not what I think. If we do break to the upside expect the $9250 level to offer a lot of resistance.