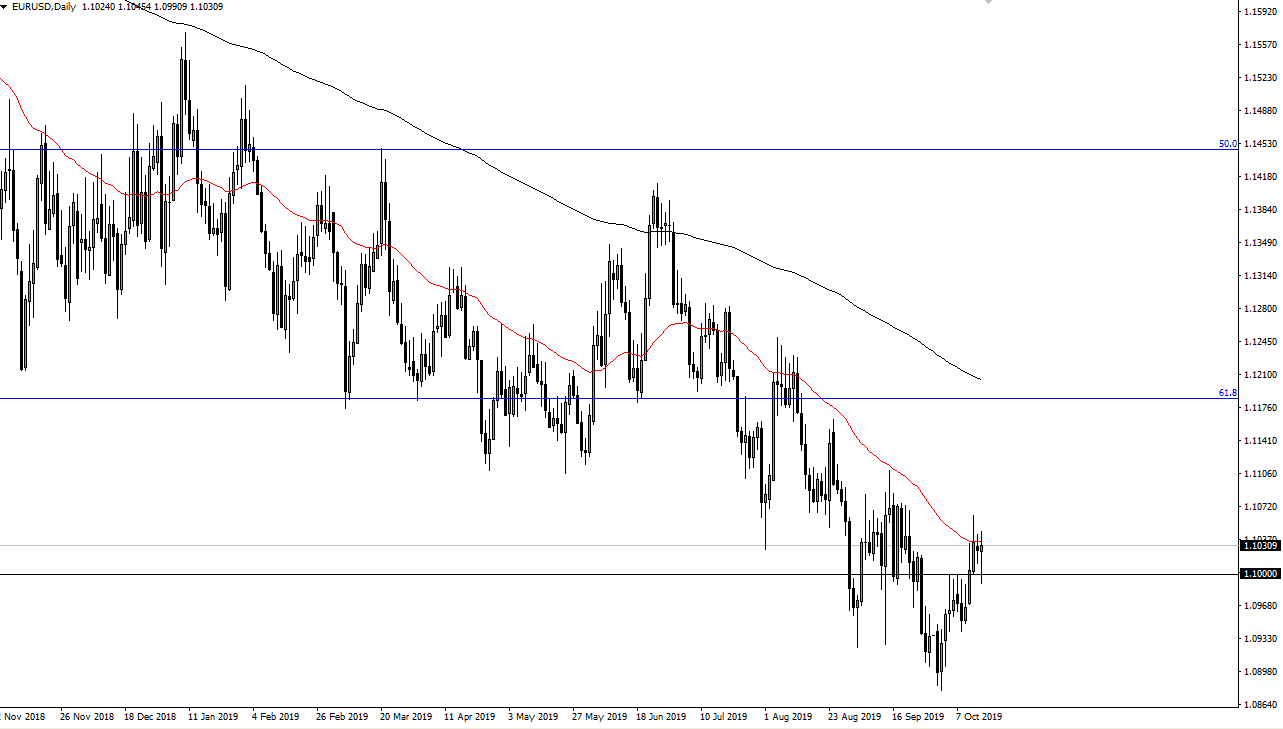

The Euro fell initially during the trading session on Tuesday, but as we are starting to see on an almost daily basis, the market turned around in the middle of trading. At this point, each headline continues to throw the market into disarray, but at this juncture it looks as if the Euro is trying to break above the recent highs from last week. If that happens, it will then threaten the 1.11 level above which is significant resistance.

Longer-term, the Euro rallying doesn’t make much in the way of sense, but unfortunately the Federal Reserve has bowed to Wall Street and started to do quantitative easing, despite whatever they may choose to call it. This of course has attracted the attention of currency traders, who are now starting to sell the US dollar against selected currencies. With that being the case, people are starting to try to reprice the Euro, but it is still most decidedly in a negative trend. We are probably going to see a bit of a rally, followed by selling pressure above. The 1.12 level currently serves as the “ceiling” in the market as it is the scene of the 200 day EMA and a significant amount of trading.

If we did break down below the bottom of the candle stick for the trading session on Tuesday, then the market will probably unwind. Right now, all one has to do is look back over the last several months in see that although this has been a nice rally, we see this every couple weeks before rolling back over. At this point, there’s not a whole lot that changes the situation from what I can see. Yes, sentiment goes back and forth and with the idea of there being a less damaging Brexit in the air, that could help the Euro as well but at the end of the day the reality is that the European Union is still or than likely going to go into recession. Offering negative yields in your bond market doesn’t help either, so it’s probably only a matter of time before this market rolls over. I will look for selling opportunity based upon longer-term charts, which means I will probably be on the sidelines for a few days. The one thing that could get me to jump into the market quicker than that is probably the break down below the bottom of the hammer that we are forming for Tuesday.