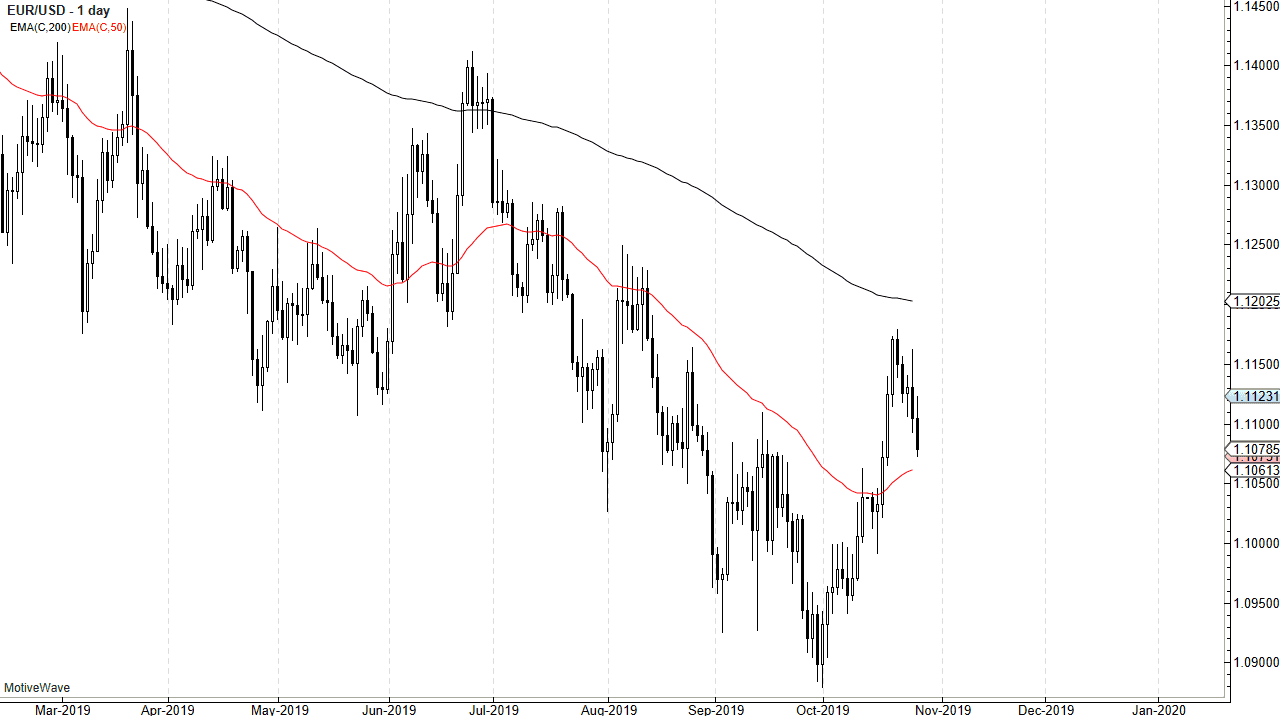

The Euro has initially tried to rally during the trading session on Friday, reaching down below the 1.11 level. At this point, the 50-day EMA underneath is obviously going to cause some type of technical support, but some type of supportive candlestick could be a nice buying opportunity. However, if we were to break down below the psychologically and structurally important 1.10 level, then the market will more than likely drop from there.

At this point it’s a matter of waiting for some type of bounce to take advantage of if you are bullish, but if you are bearish, then selling at this point makes sense. Short-term rallies can be used as an opportunity to pick up a little bit of a better entry point for sellers, and when you look at the longer-term charts we have recently seen a nice pop higher, but it’s not the first time this has happened over the last couple of years. The 200-day EMA above has caused a significant amount of resistance, as it has multiple times over the last three years.

The Euro is going to suffer at the hands of the recession possibilities in places like France and Germany, and of course the negative yields coming out of the bond markets. While the bonds in the European Union have gotten a little bit stronger as far as yield is concerned, the reality is that they still pay far less than US bonds, and that should continue to skew the market to the downside. Beyond that, although the United States is starting to show signs of negativity as far as the economy is concerned, it is still much stronger than what we are seeing currently in the European Union. Overall, this is a market that will continue to find plenty of reasons to go short, as if nothing else trying traders will simply be looking at these pullbacks as an opportunity to pick up the US dollar “on the cheap.” There is a US dollar shortage, even though the Federal Reserve has been doing repo operations as of late to try to combat illiquid conditions when it comes to the US dollar. With that, if the US dollar strengthens this is one of the first places you will see it and it should be noted that we are in a longer-term downtrend that shows no real signs of relenting.