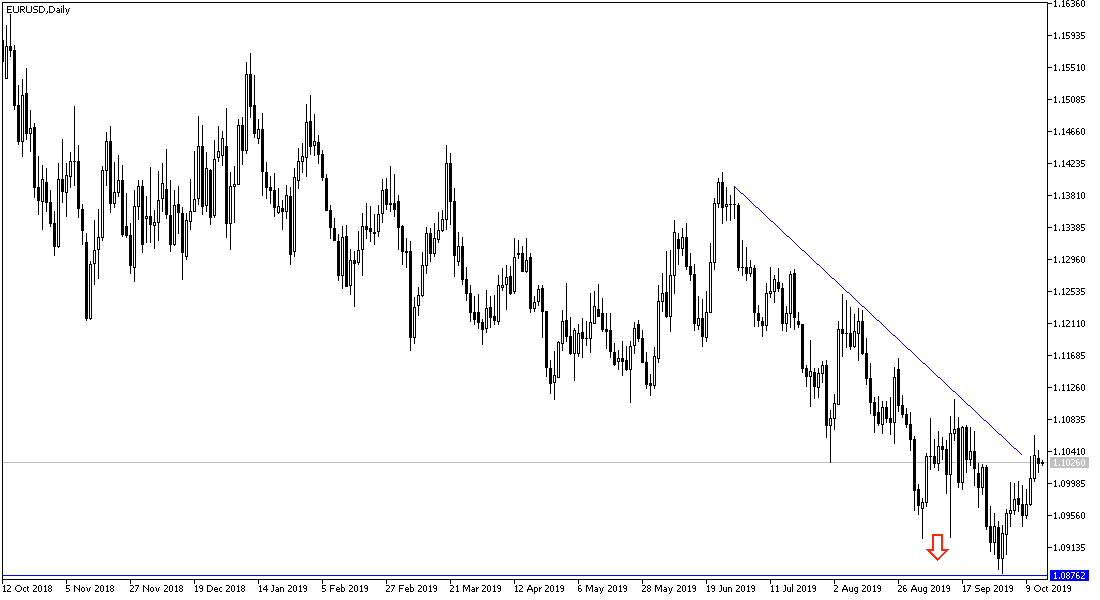

We did not see a strong move for the EUR/USD at the beginning of this week, with the lack of liquidity amid the holiday in the US markets. The price ranged between 1.1012 and 1.1042 and found no momentum to complete the upwards correction. The single European currency is on a date with the announcement of an indicator that measures sentiment towards the Eurozone's largest economy, which is still pessimistic, and an event may push the pair back below the important 1.10 level. The pair is now in a short-term uptrend since it tested its October 1 lows around the 28-month low of 1.0880, and following the “make the trend your friend” principle, it is expected that this bullish trend to continue. But for more momentum, we would like to see a clear break above 1.1063 highs, as this move continues to the upside towards 1.1100 - or perhaps higher - in the short term.

The daily chart shows how the pair managed to break above its downtrend line, touch the 50-day moving average (MA), and then retreat slightly. The 50-day moving average is likely to present a difficult obstacle to further upward movement, and to have confirmation, we would like to see a clear breakout above 1.1063 highs, which could then continue to the next target at 1.1200.

The main event for the Euro is likely to be the outcome of the Brexit negotiations, which will be the most prominent dossier at the EU summit on Thursday and Friday, as this is the last chance for both sides to reach an agreement. It is in the Eurozone's interest to reach an agreement as the UK is an important trading partner for the bloc, and if a deal is agreed, the Euro will rise, even if not as much as the GBP.

Likewise, the disagreement could increase uncertainty and weaken the single European currency. Stronger expectations currently is that the Brexit parties may reach an agreement formula before the official exit date of October 31.

From a technical perspective of the EUR / USD: In the long run, the EUR / USD price is still bearish, and so far attempts to correct upwards lack momentum. This will not happen without a return to confidence in the performance of the German economy, which is leading the bloc economy. We want to see resistance levels 1.1085, 1.1145 and 1.1200 to confirm the strength of the correction. Conversely, stability below 1.10 support will irritate the bears to take the pair to stronger bearish levels again.