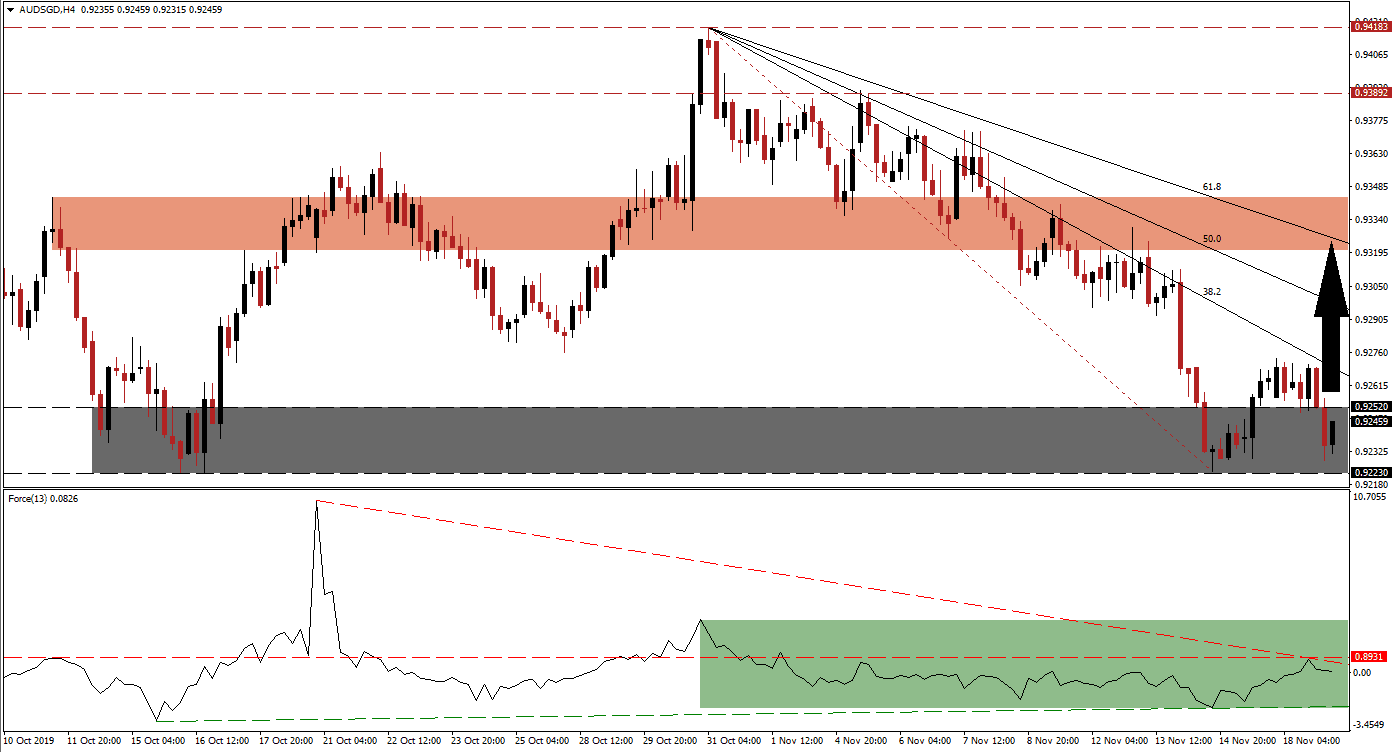

RBA minutes from the November policy meeting were released during the Asian trading session but had no material impact on the Australian Dollar. This kept the AUD/SGD locked inside its support zone as the 38.2 Fibonacci Retracement Fan Resistance Level is approaching the top range of this zone. Bullish momentum started to rise and as pressure on price action is expanding from its Fibonacci Retracement Fan, a double breakout is expected. Uncertainty over the state of the phase one negotiations between the US and China have prevented this currency pair from a breakout.

The Force Index, a next-generation technical indicator, remained confined to an area below its horizontal resistance level and above its shallow ascending support level. After the AUD/SGD approached its support zone, the Force Index started to drift higher and a positive divergence formed; this bullish development is anticipated to lead price action into a breakout above its support zone. This technical indicator was rejected by a double resistance level, the descending resistance level crossed below the horizontal resistance level, as marked by the green rectangle. The Force Index remains in positive territory and bulls are in charge of price action. You can learn more about the Force Index here.

Price action attempted a breakout above its support zone, located between 0.92230 and 0.92520 as marked by the grey rectangle, but failed to sustain it as its 38.2 Fibonacci Retracement Fan Resistance Level pressured it into a reversal. Bullish momentum started to increase since then, and this currency pair is now positioned for a second breakout attempt. Disappointing trade data out of Singapore, released yesterday, temporarily eliminated a fundamental support factor for the Singapore Dollar and the AUD/SGD is expected to reflect this development with a counter-trend advance.

Forex traders are advised to monitor the intra-day high of 0.92731 which marks the peak of the failed breakout attempt in this currency pair. A push above this level is expected to ignite a short-covering rally while also elevating price action above its 38.2 Fibonacci Retracement Fan Resistance Level, turning it into support. This should clear the path to the upside for the AUD/SGD until it can challenge its next short-term resistance zone, located between 0.93206 and 0.93437 as marked by the red rectangle; the 61.8 Fibonacci Retracement Fan Resistance Level is currently passing through this zone. You can read more about a resistance zone here.

AUD/SGD Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 0.92450

⦁ Take Profit @ 0.93250

⦁ Stop Loss @ 0.92200

⦁ Upside Potential: 80 pips

⦁ Downside Risk: 25 pips

⦁ Risk/Reward Ratio: 3.20

Should the descending resistance level push the Force Index to the downside, the AUD/SGD may attempt a breakdown below its support zone. Downside potential remains limited as the fundamental picture favors long-term upside, supported by technical developments. The next support zone awaits this currency pair between 0.90760 and 0.91610, a wide zone established in November 2008; this should be considered an excellent buying opportunity.

AUD/SGD Technical Trading Set-Up - Limited Breakdown Scenario

⦁ Short Entry @ 0.91900

⦁ Take Profit @ 0.91500

⦁ Stop Loss @ 0.92100

⦁ Downside Potential: 40 pips

⦁ Upside Risk: 20 pips

⦁ Risk/Reward Ratio: 2.00