Gold's current stability may be negatively affected by investors' risk appetite and strong US dollar. Gold losses this week extended to the $1450 support before settling around $1457 dollars per ounce at the time of writing. Attempts to bounce back to $1,462 stalled after the dollar's gained support from positive US economic growth in the third quarter of 2019, reversing expectations of a slowdown. The yellow metal could collapse quickly if the differences between the United States and China are announced closed, and the first phase deal is ready for the official signing by President Trump and the Chinese president.

The results of the US economic data will be in favor the Federal Reserve Bank’s policy led by Jerome Powell, the Bank stopped the rate cut until the reaction of the three rate cuts that took place during 2019 is measured. The Bank, and Jerome Powell himself, often sharply criticized by US President Trump for not cutting US interest rates deeper as other global central banks do to counter the global economic slowdown caused by the global trade war. Powell stresses the independence of the bank's work and that its policy deals with the economic performance of the country and not according to political wishes.

Positive US GDP growth and increased durable goods orders was met by lower than expected CPI, the Fed's favorite measure of US inflation. The index rose for October by 0.1% and markets were expecting gains of 0.2%, pushing annual inflation down from 1.7% to 1.6%, away from the Fed's 2% target. PMI and CPI data point to lower inflation pressures and slowing growth in the fourth quarter, which is hardly positive for the Fed rate outlook, although the absence of a slowdown in the third quarter may be enough to prevent investors from betting heavily on US rate cuts for the fourth time anytime soon.

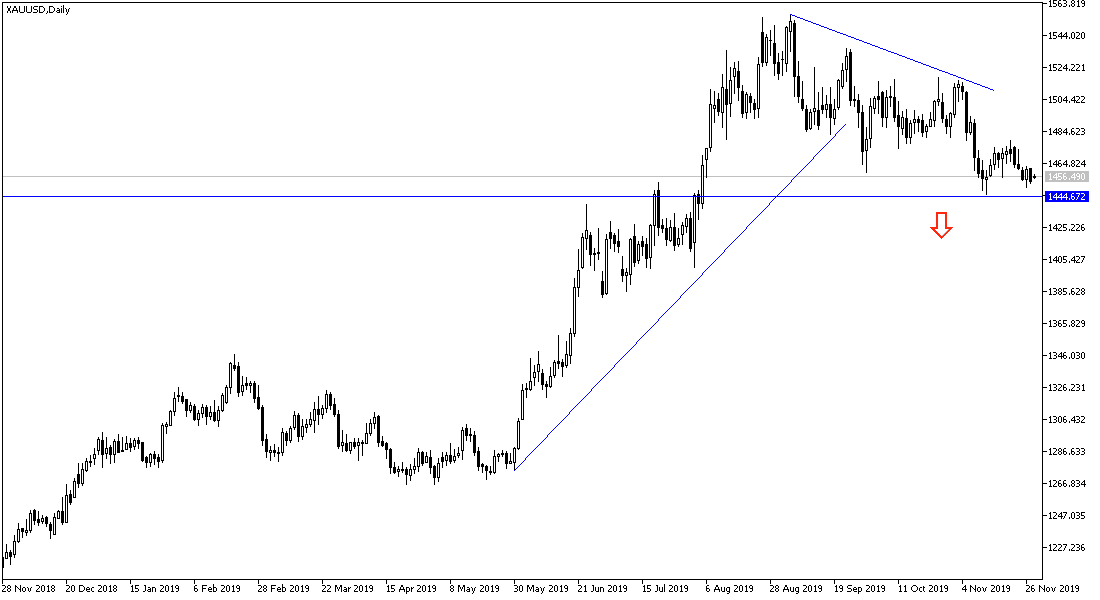

According to the technical analysis of gold: There is no change in my technical view of the yellow metal, as gold prices remains under downward pressure as long as the dollar is strong and investors want to take risk. Bearish correction faces a strong support level, which if was broken, will support further selling and thus test stronger support levels. We wait for the support to break $1445 an ounce. If renewed geopolitical and economic concerns around the world renewed, then gold may jump as a first stage to the resistance levels of 1467, 1480 and 1495 respectively. We still prefer to buy gold from every bearish level.

As for the economic calendar data today: Today is a holiday in the United States on the occasion of Thanksgiving and thus less liquidity in the markets. The most notable in the calendar today is the German Consumer Price Index and Canadian Current Account data.