After the US Federal Reserve cut interest rates by 25 basis points in a move which was expected, it also announced that a pause may be warranted and another cut should not be taken for granted. The US Dollar was able to spike against the South African Rand, but after briefly eclipsing its short-term resistance zone, the USD/ZAR reversed direction and bearish pressures are now on the rise. This may lead to a breakdown in price action below its entire Fibonacci Retracement Fan sequence, today’s US NFP report may provide the fundamental catalyst for a sell-off.

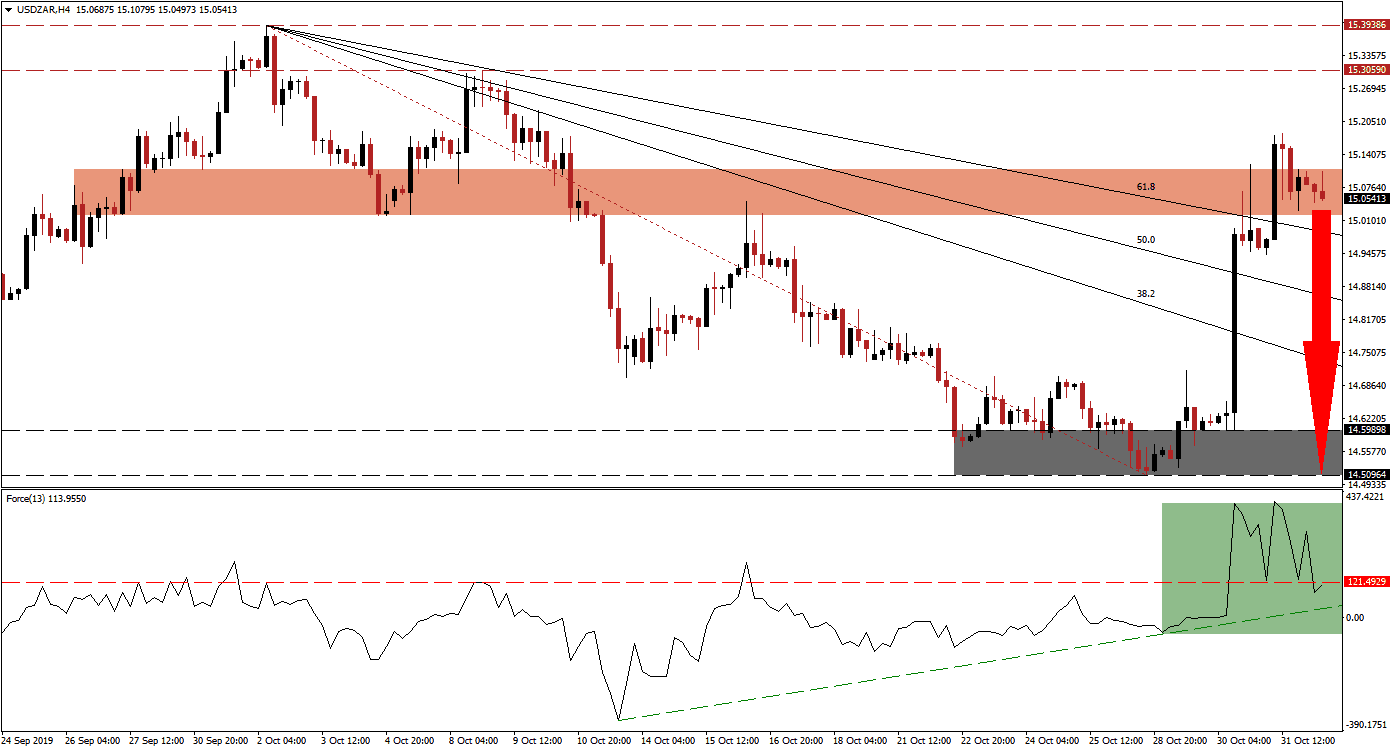

The Force Index, a next generation technical indicator, shows the loss in bullish momentum after the USD/ZAR reached its short-term resistance zone. Price action is now vulnerable to a bigger corrective phase on the back of a profit-taking sell-off, especially after the Force Index completed a breakdown below its horizontal support level which turned it into resistance. Its ascending support level is approaching the horizontal resistance level, and given the magnitude of the momentum loss in this technical indicator, another breakdown is likely to follow. This may take the Force Index into negative conditions and place bears in charge of this currency pair, further fueling the expected breakdown sequence. You can learn more about the Force Index here.

While bearish pressures are one the rise inside the short-term resistance zone, located between 15.02079 and 15.11065 as marked by the red rectangle, the Fibonacci Retracement Fan sequence is moving further away from price action. Forex traders should now pay close attention to the intra-day low of 15.03068 which marks the current low following the reversal of the price spike above the short-term resistance zone; a move lower is likely to result in more selling pressure and attract fresh net short positions in the USD/ZAR.

Another key level to monitor following a breakdown is the intra-day low of 14.94492, this level represents the low which resulted in the most recent push higher; it is also located above the 50.0 Fibonacci Retracement Fan Support Level, but below the 61.8 Fibonacci Retracement Fan Resistance Level. A breakdown below this mark should extend the sequence until the USD/ZAR can challenge its next support zone which is located between 14.50964 and 14.59898 as marked by the grey rectangle. You can learn more about a breakdown here.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 15.06000

- Take Profit @ 14.52500

- Stop Loss @ 15.18250

- Downside Potential: 5,350 pips

- Upside Risk: 1,225 pips

- Risk/Reward Ratio: 4.37

Today’s NFP report out of the US is likely to provide the next fundamental catalyst and while a downside surprise should be expected given the series of economic disappointments released over the past few weeks, data can be volatile. A push higher in the Force Index, supported by its ascending support level, could further provide a boost for a breakout in the USD/ZAR. The next resistance zone is located between 15.30590 and 15.39386 which should be considered a good short-selling opportunity.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 15.22750

- Take Profit @ 15.37250

- Stop Loss @ 15.15750

- Upside Potential: 1,450 pips

- Downside Risk: 700 pips

- Risk/Reward Ratio: 2.07