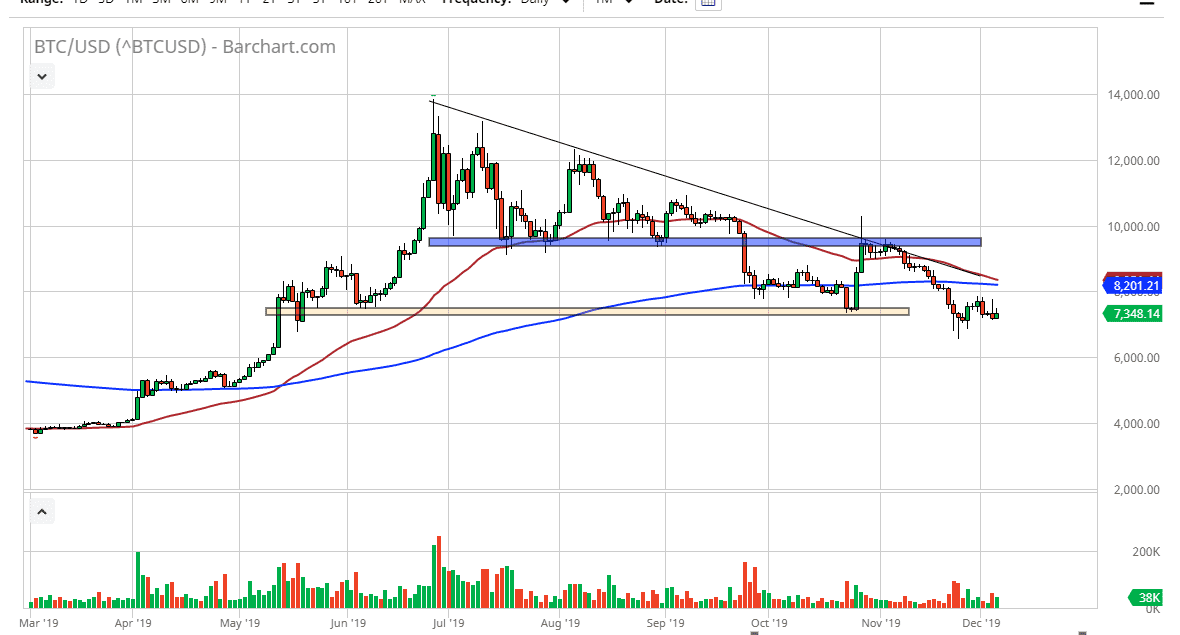

Bitcoin did gain just a bit during the training session on Thursday, but it was and lackluster trading. Beyond that, it’s worth noting that the previous candlestick was very bearish looking from the Wednesday session as the buyers simply cannot hang on to the gains. If that’s going to continue to be the case, it’s only a matter of time before we get a “flush” lower from this level.

The $7000 level will of course offer a certain amount of psychological support, as it was structural support previously. Breaking below that level opens up the door to the $6500 level, followed by the $6000 level. When you look to the longer term, the 50 day EMA is dangerously close to crossing below the 200 day EMA, the so-called “death cross” that tends to have a lot of psychological influence on financial markets. Beyond that, we are clearly being influenced by a negative trend line, so that also gives up the idea of a potential downtrend continuing going forward.

With the jobs number coming out on Friday, it will have a massive influence on the US dollar, which of course is half of the equation here. If the US dollar continues to strengthen then it will be yet another bashing for Bitcoin. Bitcoin simply is not been adopted in the ways that it was advertised to do so, and it is not stable enough to be used as that money utility that people had talked about for so long. Yes, there are arguments for decentralized crypto currency, but at this point it just simply isn’t happening. In fact, in 10 years there hasn’t been a highly adopted use for block chain in general. I’m afraid that Bitcoin will be one of those things that we will be watching on TV “remember when” shows in about a decade. Financial markets do this occasionally, has anything with .com attached to its name could lose in the late 90s. After that, anything involving housing could lose either. This has simply been yet another financial bubble, and I think at this point Bitcoin has to do a bit of soul-searching to decide whether or not it’s going to last for any length of time. There is the very real possibility at this point that if we break down significantly again, interest may simply disappear. There are also a lot of concerns that most of the large holders of Bitcoin are just a handful of people, meaning that liquidity just isn’t there. In the short term, continue to sell every time it rallies.