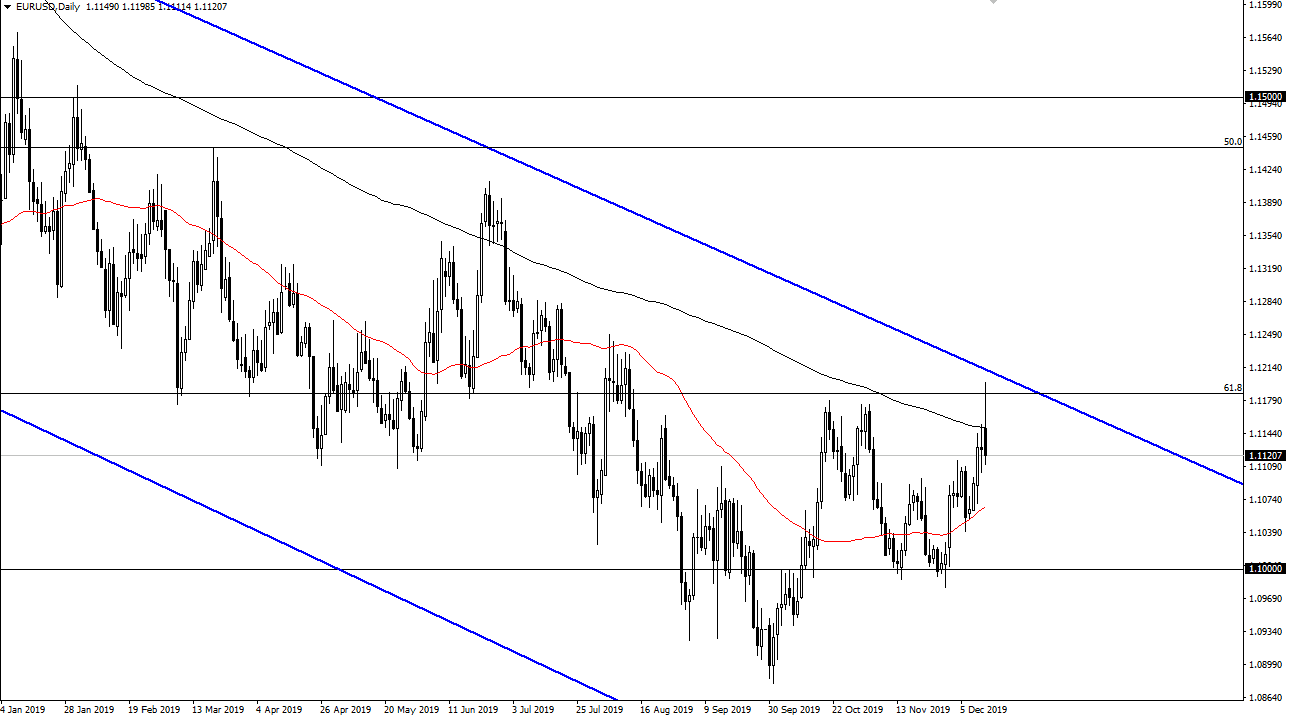

The Euro initially tried to rally during the trading session on Friday but found the same 1.12 level yet again. We have turned around to form a nasty looking candle, and it shows that the Euro simply cannot break out. By turning around the way we have at the 200 day EMA, it’s likely that the market will probably go back down towards the 50 day EMA. Beyond that, the 1.10 level underneath should offer massive support, but at this point it looks likely that we have a lot of selling pressure just waiting to get involved in the market and therefore I believe that the ECB outlook continues to be a major issue as well.

The European Central Bank has recently said that the quantitative easing program is going to continue for the foreseeable future, so it makes quite a bit of sense that the Euro would rally significantly. The market has been in a major down trending channel for some time, and you can see that we turn around just below the top of the trading area. It looks as if we are going to continue to go lower longer term and therefore, I think that if we can break down below the 1.10 level then we will continue the overall malaise in the Euro, reaching down towards the 1.09 level.

If we can break down below there, then the market is very likely to go looking towards the 1.08 level, and then the 1.0750 level which is the scene of a major gap. On the other side of the equation though, if we can break above the 1.1250 level then it’s likely that the Euro will go looking towards the 1.14 level. That could be the beginning of a trend change, but quite frankly we need to see some type of massive change in the attitude of the Federal Reserve to make that happen. While economic figures in the United States have been a bit lackluster as of late, the reality is that the Federal Reserve is miles away from doing any type of cutting or quantitative easing. As far as tightening is concerned, it’s all but impossible to see that happening anytime soon. With this, I think we continue the overall downtrend, in a relatively choppy manner. With this, fading rallies continues to work as we have seen during the trading session on Friday.