The Euro rallied significantly during the trading session on Tuesday, reaching towards the 1.11 handle. This is an area that has offered resistance over the last several sessions, and quite frankly even if we break above here there’s even more resistance closer to the 200 day EMA and the 1.12 handle. Because of this, I’m looking to fade signs of exhaustion, and quite frankly it’s likely that a lot of what we have seen during the trading session on Tuesday has been due to the German ZEW results that were almost 10 times what was expected.

That being said though, you should understand that the ZEW was so much stronger due to the fact that the ECB is going to step in and loosen monetary policy. It’s more likely that the Euro will be hampered by that longer-term than lifted, so I’m looking for an opportunity to start shorting. At the first signs of exhaustion I’m all over that. I would anticipate that the 1.10 level would be targeted as it is a major support level, but if we were to break down below there it’s likely that the 1.09 level then gets targeted.

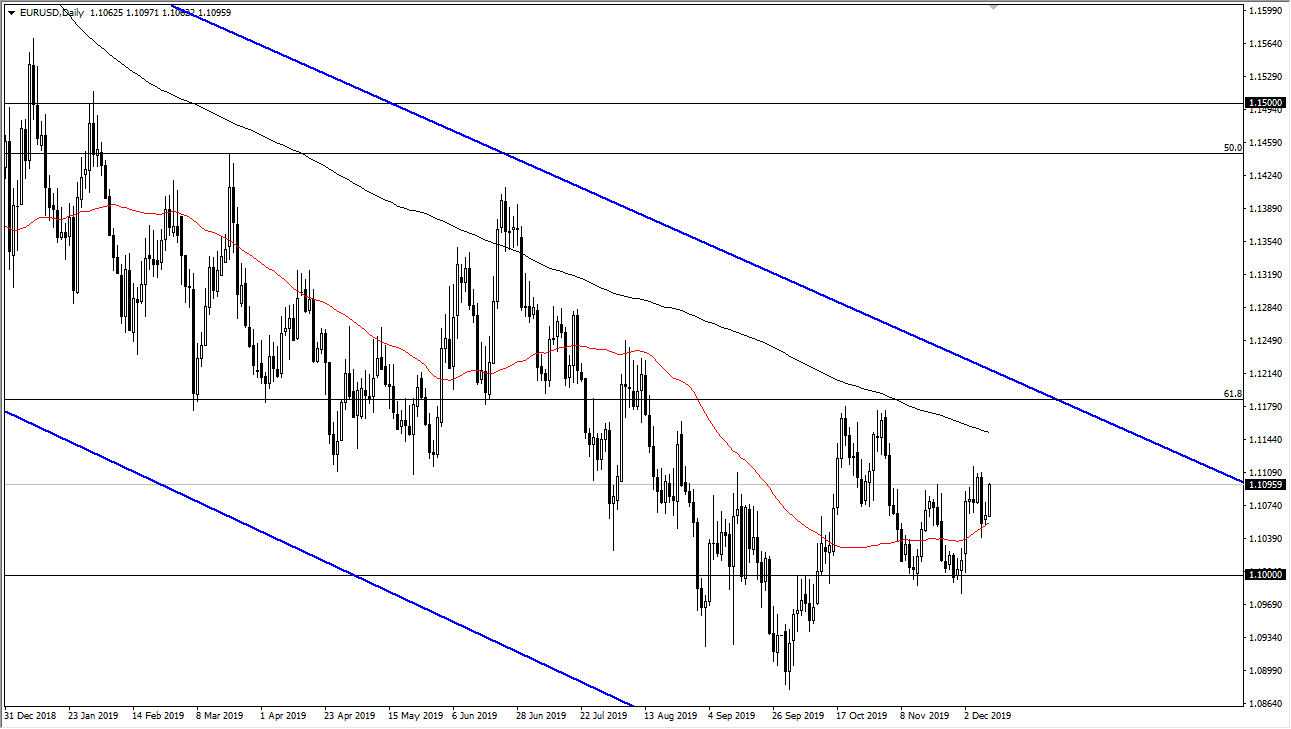

The Euro has essentially been in a downtrend for three years, even though it shops around the way we have seen. This is a market that continues to show a lot of noise and it, and therefore I suspect that the downtrend will be the best way to follow this, and I’m looking for signs of failure in order to take advantage of it. However, if we were to break above the 1.12 level, then it’s likely that we could continue to go much higher. At that point I would anticipate a move to the 1.14 handle.

Looking at this chart, this is just more of the same in in the short term we may have a simple consolidation area forming between the 1.10 level on the bottom and the 1.12 level on the top. At this point, we are still in a downtrend so I’m still looking for signs of exhaustion and I still favor selling, even if we were going to be sideways. In general, I believe that the Euro is essentially “dead money”, as the ECB is going to continue to be very dovish going forward. By contrast, the Federal Reserve is on the sidelines and not looking to cut interest rates anytime soon.