The Euro has been all over the place during the trading session on Thursday, as we had in ECB interest rate decision and perhaps more importantly an ECB press conference. Christine Largarde suggested that inflation was nowhere near where it needed to be, even going down to 2022, and that of course will put a bit of an anchor around the neck of the Euro. On the other side of the Atlantic, the PPI numbers came out disastrously during the session and Unemployment Claims also failed to reach its target. That being said, it looks as if there is a lot of back and forth and then in this scenario, we have to pay attention to the technical analysis.

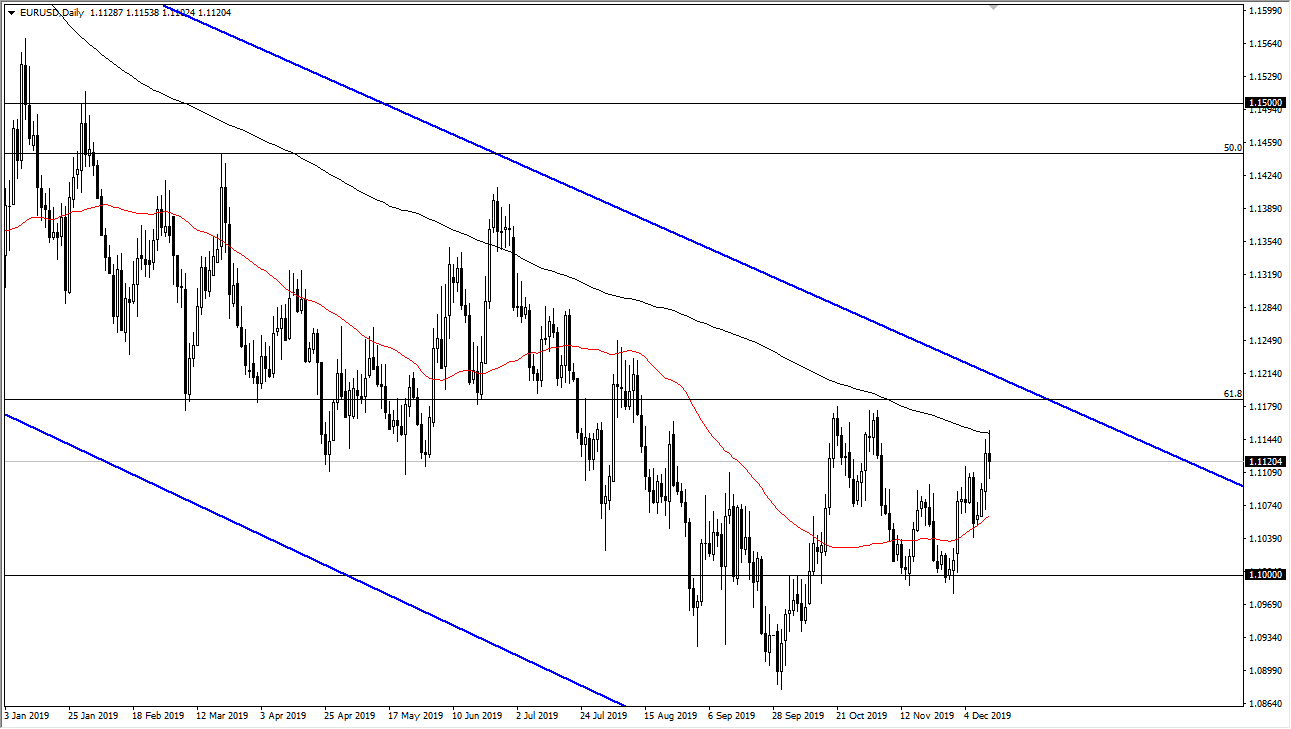

The 200 day EMA is currently offering resistance, and we have seen the market pull back from there. I also believe that there is significant resistance at the 1.12 handle, and the downtrend line just above there that forms part of the descending channel. Overall, this is a market that will continue to see a lot of noise, but we are in a downtrend longer-term. That being the case it makes quite a bit of sense that the market probably revisits the 1.10 level underneath. If we can break down below there then I think the market goes looking to the 1.09 level, and then possibly the 1.0750 level which is the scene of a gap that has yet to be filled.

Ultimately, this is a market that should continue to be very choppy but that’s typical for this pair. The 1.12 level above offers significant resistance and if we can break above that and the downtrend line then I think you could be looking at the beginning of a bullish market. All things being equal though, that is not likely to happen and even if it does it’s hard to imagine the Euro rallying past 1.15 above based upon the central bank and its actions. Ultimately, this is a market that is probably best trade from short-term charts, with the downward bias as the overall attitude of the Euro continues to be one of lackluster performance. The US dollar is somewhat all over the place but with all of the possible external shocks out there, it does make sense that the bond market would see some inflow from around the world, which will of course strengthen the US dollar based upon a “risk off” type of scenario.