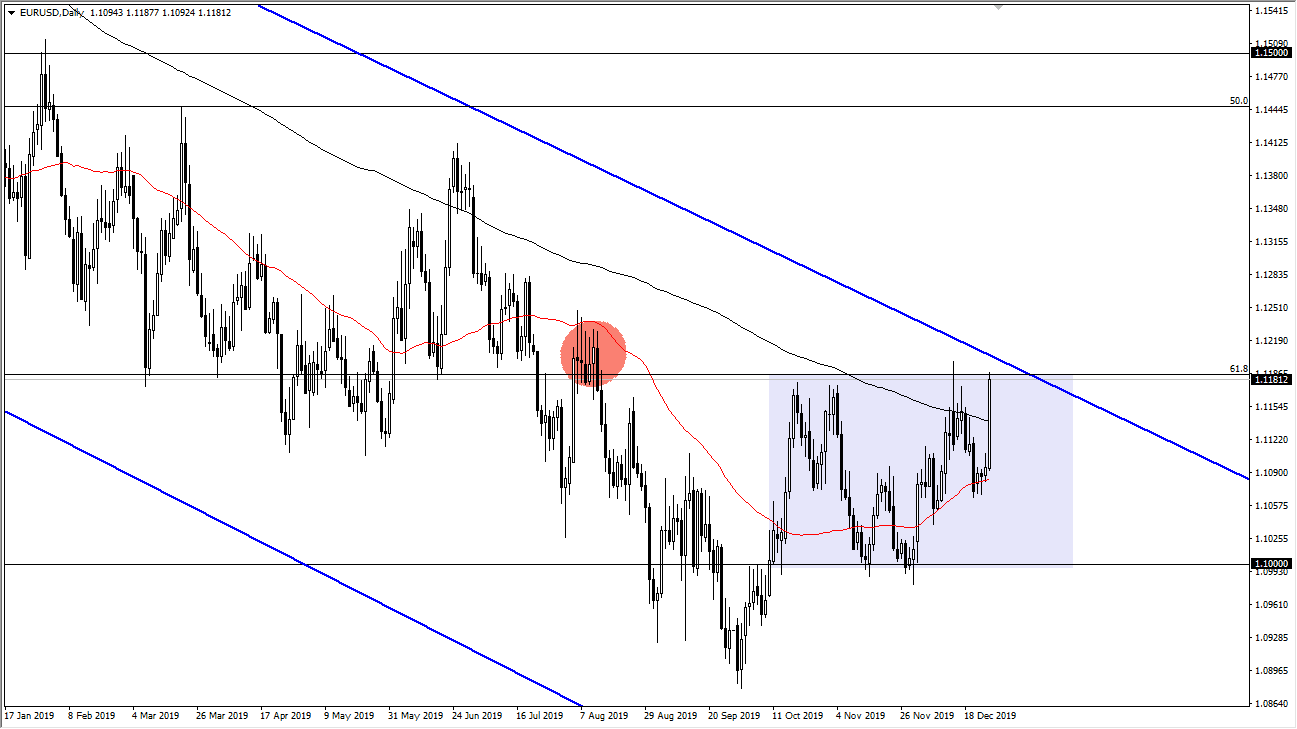

The Euro has exploded to the upside during the trading session on Friday, slicing through the 200 day EMA and even reaching towards the 1.12 level. That is an area that should continue to see a lot of interest, as it has been massive resistance in the past and has shown itself to be an area where a lot of money will flow into the marketplace. Beyond that, there is a downtrend line that sits just above and as you can see by the red circle on the chart, it is an area where we had seen a lot of selling pressure. That being said, the candlestick from Friday was rather impressive.

At this point, I think that if we can break above the 1.1250 level on a daily close, then all of this resistance will have been broken through, and we should go to the upside. At that point I would anticipate that the Euro would go to the 1.14 handle, but the only reason I’m not as excited as they should be based upon the candlestick from Friday, it’s the holidays and liquidity has to be a major issue. On my professional proprietary platform, the spread on the Euro/US dollar has been the 0.5 pips during most of the day, which while decent for retail platform, it’s not good for what I am used to seeing. This tells me that there aren’t as big enough players.

Looking at the chart, I think the next day or two will give us a lot of answers. If we were to break back down below the 1.1170 level, at that point I am more than willing to take a small short-term selling position. The 1.11 level continues to be “fair value”, as the market participants will continue to see that level act like a magnet. If we were to break down below there, then the 1.10 level will be massive support. If that were to be broken to the downside than the longer-term downtrend continues to go much lower. At this point, I am a bit cautious about putting a lot of money into the market, but I do have some levels worth paying attention to. Keep in mind that most of the liquidity won’t truly return until January 6 or so, so only so much can be read into this move, and therefore you should be cautious about your position size.