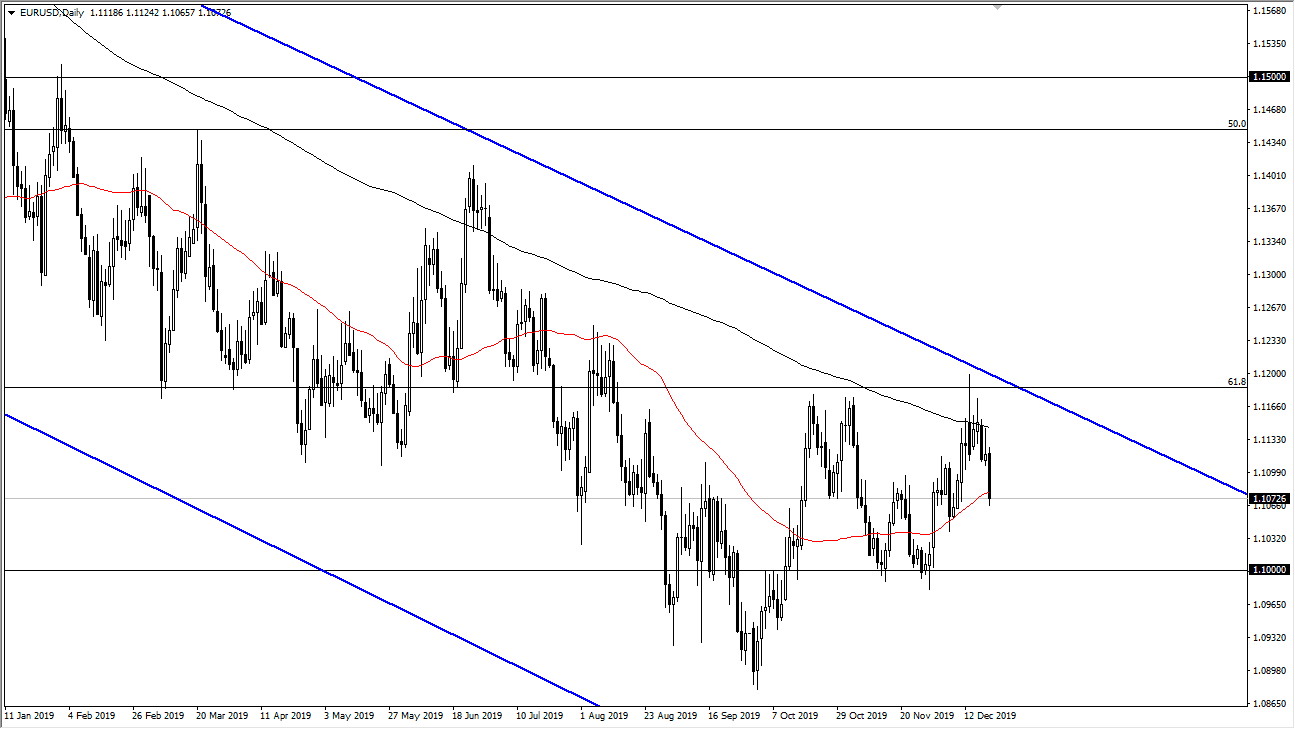

The Euro has broken down a bit during the trading session on Friday, showing signs of exhaustion and has broken through the 50 day EMA a bit. At this point, we are below the 1.11 handle, so it is underneath the “fair value” level that I have marked on the chart most of this week. The 1.12 level is the resistance barrier, while the 1.10 level underneath is the support level. Ultimately, I think that this market will continue to see a lot of negativity in general and I do think that given enough time we will probably reach towards the bottom of the range. Eventually we can break down below the 1.10 level and then go looking towards the 1.09 level after that.

The market should continue to see a lot of noisy trading in general, but I do think that we will probably have the ability to trade short-term charts at best, as most traders will be away for the week. In fact, you can make a real argument for nothing but algorithmic trading going on between now and January 6 which will be the first normal workday. Having said that, this is a market that is going to continue to be very noisy, but I still think that the longer-term negativity is something that you should be paying attention to. Overall, I like fading short-term rallies show signs of exhaustion, and therefore I don’t have any interest in trying to buy this market, unless of course we get some type of bounce from the 1.10 level for short-term trade. Longer-term, I believe that we are going to break down below the 1.09 level and go looking towards the 1.0750 level which is the gap on longer-term charts that I have been talking about for some time.

To the upside, if we can break above the 1.12 handle and the downtrend line then the Euro is likely to go looking towards the 1.14 level as it is an area where I see a lot of longer-term resistance as well. That being said though, I don’t think it happens anytime soon and I still favor the downside all things being equal. The European Central Bank is likely to be very loose going forward, so I don’t see anything changing in this market from a longer-term standpoint anytime soon as the Federal Reserve is still on the sidelines.