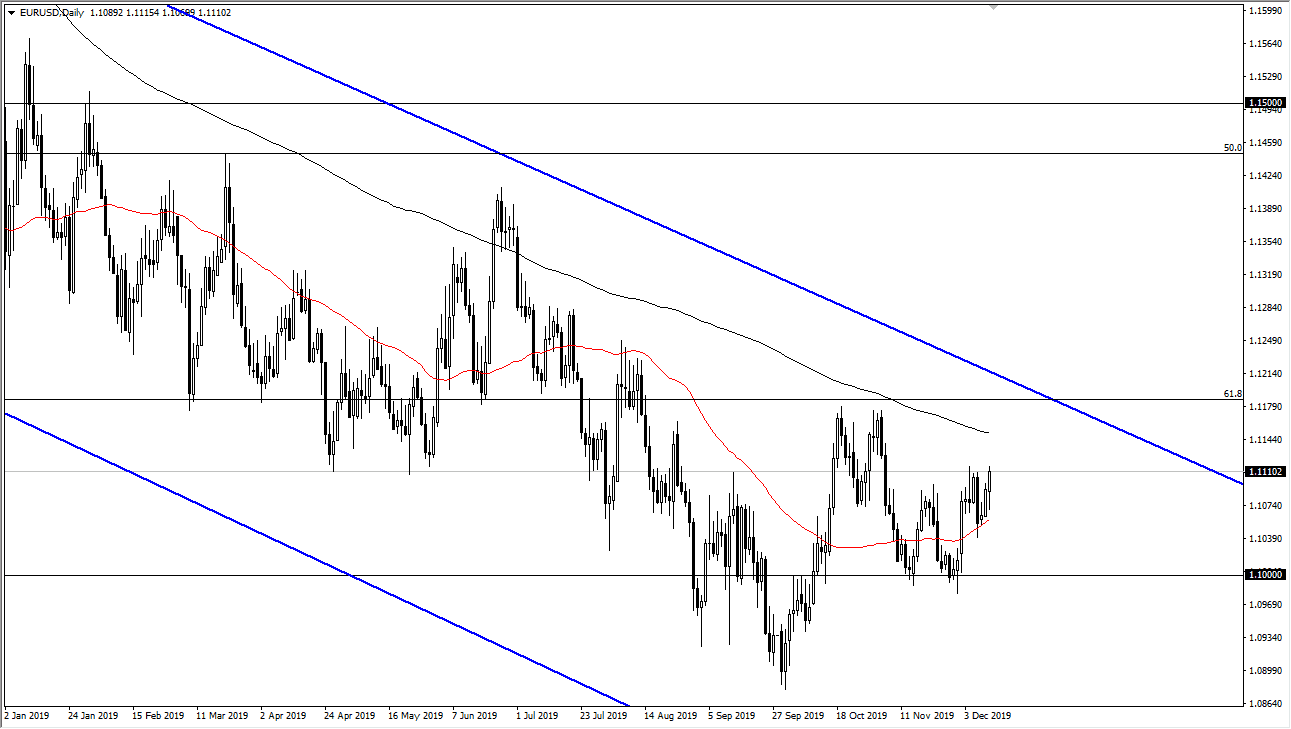

The Euro initially pulled back a bit during the trading session on Wednesday but found enough support underneath to send the market higher. In fact, we crashed into the 200 day EMA, a technical indicator that of course does continue to offer a lot of trouble. We are in a longer-term downtrend, and there is also resistance not only at the 200 day EMA but also the 1.12 level which has been massive resistance more than once. If we were to break above, there it would change everything but right now it doesn’t look as likely to happen. Quite frankly, even if the Federal Reserve is on the sidelines for the longer-term, the reality is that the ECB is engaging in quantitative easing, which of course is negative for the currency.

We have been in a downtrend for quite some time, but occasionally we will get the pop higher that we are witnessing right now. Ultimately though, we are in a downtrend and that doesn’t change with this single candlestick. I anticipate that we will probably pull back a bit from here and go looking towards the 50 day EMA again. At that point, we could then break down to the 1.10 level. This is more chop as per usual and I still like the idea of fading rallies when they occur.

The downtrend line above also is worth paying attention to as it is the top of a downtrend in channel, and at this point it’s likely that the sellers will still be out there looking to get involved. There is still a gap done at the 1.0750 level that has yet to be filled, and I do think that longer-term traders are still trying to aim for that. Having said that, the market needs to build up enough inertia to make that happen and we don’t have it yet. This continues to be a “short-term market”, with a downward slant regardless of what this candle tells. I’m looking for signs of exhaustion that I can take advantage of, and as a result, it’s likely that the biggest trick in this market is going to be waiting for a bit of clarity. That being said, it’s simply a matter of taking time to get the right set up and take advantage of. I see a significant amount of resistance just above and buying at this point certainly would be very difficult.