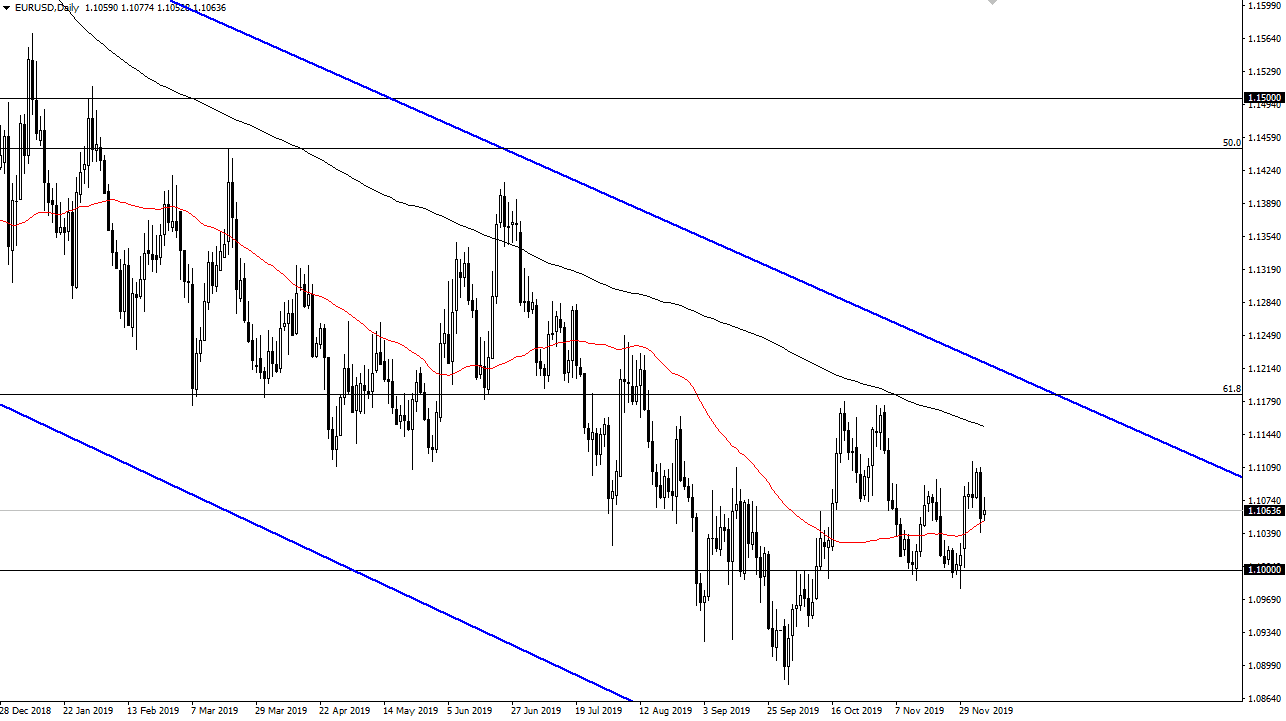

The Euro rallied a bit during the trading session on Monday but gave back quite a bit of the gains to form a less than impressive candlestick. We are currently sitting above the 50 day EMA and that in and of itself could offer a little bit of support. Having said that, if we break down below the candlestick for the trading session on Monday in the 50 day EMA, it’s likely that we go towards the 1.10 level, an area that has been extraordinarily important more than once.

If we do break down below that level, it’s likely that the Euro will reach towards the 1.09 level underneath. This market continues to be one of extraordinarily noisy action but looking at the longer-term chart it still favors selling off. I think rallies should continue to be seen as buying opportunities when it comes to the US dollar, which is paramount amongst global currencies. The Euro is plagued by the European Union being soft, so it makes quite a bit of sense that we should continue to see the Euro fall a bit. Beyond that, the European Central Bank has just started quantitative easing so it’s difficult to come up with a reason to get overly bullish of the Euro.

I believe that even if we were to break above the top of the candlestick for the session on Monday, there is still a significant amount of pressure near the 1.10 level, and most certainly the 1.12 level after that. In fact, there is so much pressure above that I think it’s not until you clear the 1.12 level that you can even remotely suggests that there has been a bit of a change in attitude. This is an important area because it is not only significant resistance, but it is near the 200 day EMA. Because of this, if we were to break through both of those levels, it’s likely that we would see a bit of a trend change. Right now, though, I don’t think that happens anytime soon and therefore I continue to sell rallies. Eventually, we could go down to the 1.09 level and then down to the 1.0750 level where there is a massive gap that has yet to be filled from a longer-term perspective. Ultimately, this is a market that will continue to be very choppy and noisy, but still has a downward slant to it.