The USD/JPY started trading today, Thursday, after returning from the Christmas holidays to launch to the 109.56 resistance. Despite the weak movements in light of the absence of any important economic or political data affecting the pair, the opportunity for an upward correction still stands, and is waiting the rally towards 110.00 psychological resistance to confirm the strength of the trend. Traders are awaiting developments on the trade front after China announced plans to reduce tariffs on a range of products, and in the same context, US President Donald Trump said that a preliminary trade agreement between the United States and China will be signed soon.

Moreover, Chinese Premier Li Keqiang said the government will consider taking further measures to reduce financing costs for smaller companies.

On the Japanese side. The minutes of the Bank of Japan meeting held on October 30 and 31 showed that few members of the bank’s board share the view that the central bank should not only carry out monetary policy, but also enhance its cooperation with the Japanese government in terms of economic policies and preparedness for the coming economic contraction. Another member indicated that the Bank of Japan should continue to study whether additional cash facilities were necessary.

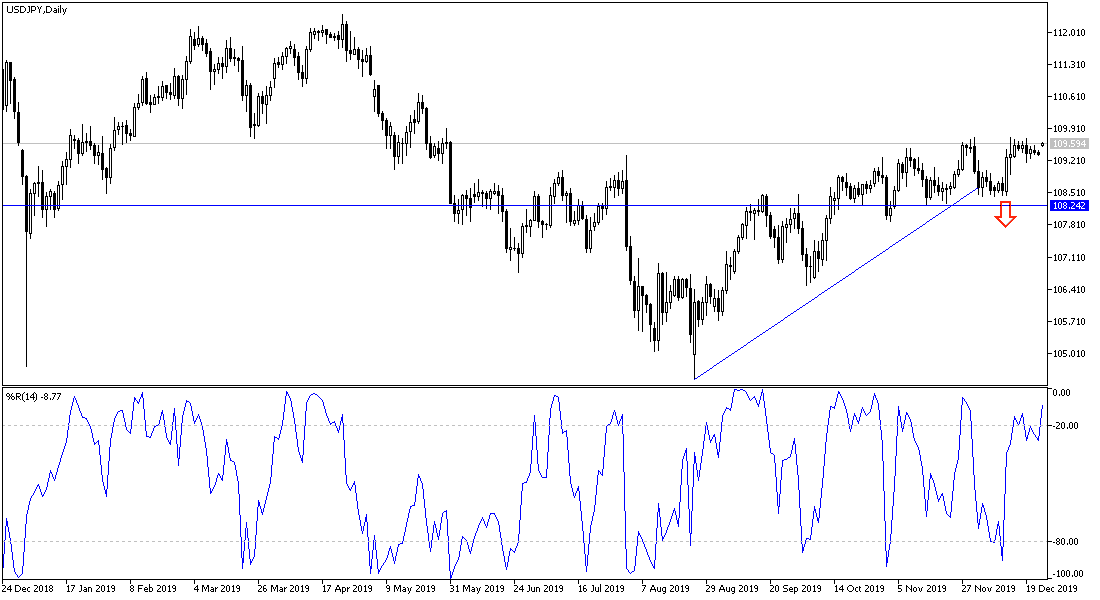

According to the technical analysis of the pair: The USD/JPY is a very sensitive currency pair to the global trade and political tensions, as the Japanese Yen is one of the most important safe-haven currencies. The strength of the bullish correction depends on the pair's breach of the 110.00 psychological resistance, which is still unable to move towards it since last May. The luster of the pair’s downtrend will return if it moves towards the support levels of 109.10, 108.55 and 107.90, respectively.

As for the economic calendar data: From Japan, housing starts were announced, which continues to decline, recording -12.7% from -7.4%, with expectations were for a decline of -8.1% only. Later in the day, US jobless claims will be announced amid expectations of a decline to 222,000, after an increase of 234,000 in the past week.