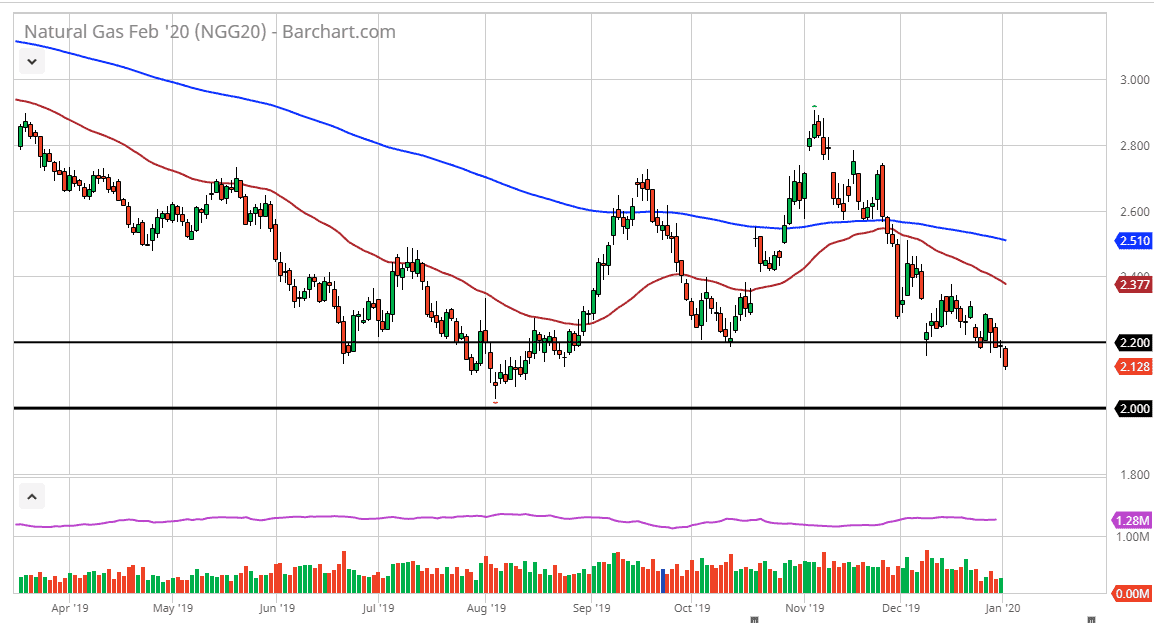

Natural gas markets broke down a bit during the trading session on Thursday as traders came back to work, making the back of a hammer from the previous trading session. That shows signs of further bearish pressure, which is something that it’s quite remarkable considering how low the market truly is. At this point, there are reports that the next week or so is going to be warmer than usual in the lower 48 states, and that is as bearish as it can be for this market. Adding more of a problem is the fact that the 17% increase in drilling coming out the United States. All things being equal, this is a market that is reaching a major support zone, and therefore it won’t necessarily be easy to slice through it. Beyond that, the $2.00 level on the bottom is a large, round, psychologically significant figure that could keep the market somewhat supportive.

It’s very difficult to short this market, but it isn’t exactly easy to buy it either. This is an absolute disaster for the natural gas markets, because if we cannot chew through the supply in the dead of winter, the question then is going to be, when can we? This sets up for a disastrous 2020 for natural gas suppliers and also a commodity itself.

At this point, the market probably gets a major spike sooner or later due to sudden cold snaps in the United States, but those will be sold into, as we clearly have major supply issues in the form of oversupply. If we were to break down below the $2.00 level, it would be a major breakdown and could cause absolute havoc in this market. All things being equal, this is a market that could be forming a bit of an expanded bottom, but we are going to need to see some type of major change for that to be true. This market is extraordinarily volatile and will probably continue to be going into the future. Because of this noise, it is going to continue to be very difficult to trade and therefore it’s probably best trade it in the options markets or perhaps even the CFD markets. The easiest trade is to probably short natural gas suppliers in the stock market if you have that ability as well. Otherwise, fading rallies will probably be the best way going forward