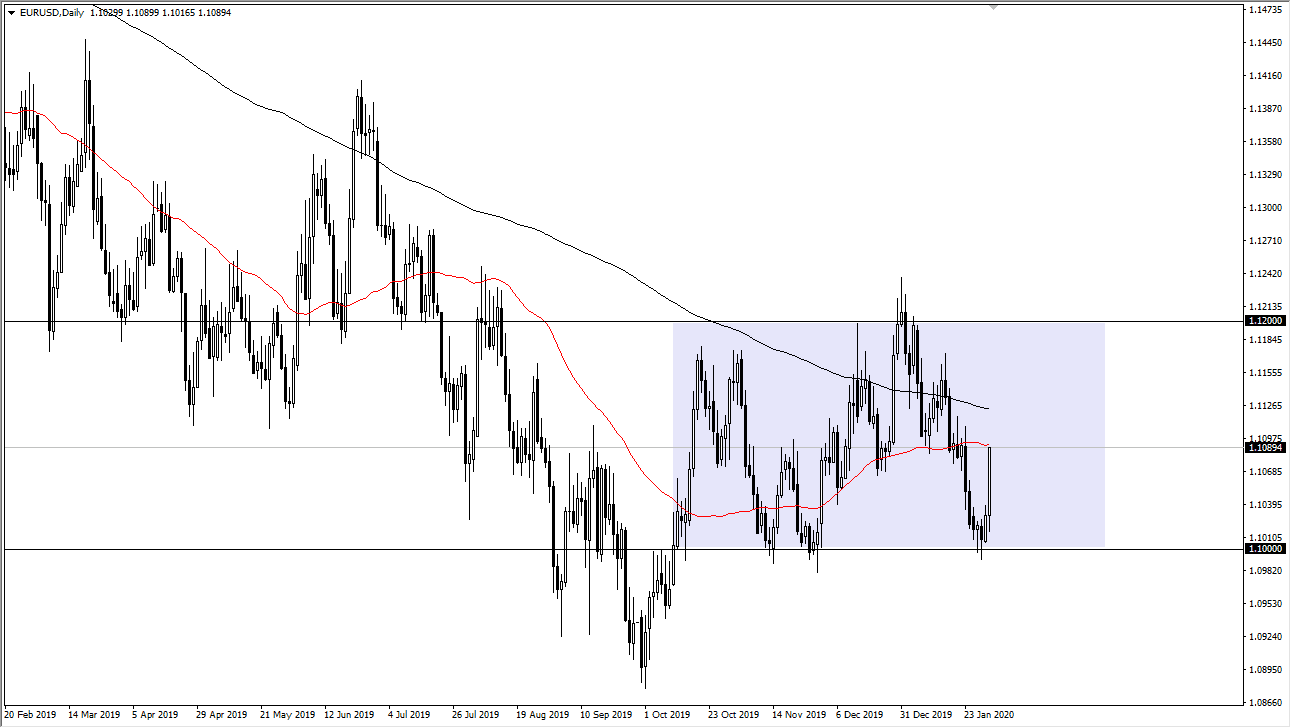

The Euro has rallied significantly during the day on Friday, reaching towards the 1.11 handle. That is essentially “fair value” as far as I can see, as the market has been bouncing around between the 1.10 level and the 1.12 level. This being the case, the market looks likely to continue to go back and forth and cause a lot of volatility. That being said, we are essentially in the middle of the area which of course means that it is “fair value.” The 1.12 level above should continue to bring in plenty of sellers, and if we reach that area it’s likely that we will see the market pull back again. Alternately, the market does see a significant amount of support at the 1.10 level, so at I think we can continue to look at this market from a back-and-forth type of scenario. Since we are in the middle of the range, there isn’t much to do.

Looking at this chart, we are attacking the 50 day EMA, and at this point it should show quite a bit of resistance. However, I think the real resistance is not only the 1.11 handle, but the area between 50 day EMA and the 200 day EMA. Think of this more or less as a “zone” of interest by both the buyers and the sellers, so at this point it’s likely that there just won’t be any clarity in this area. You will notice that the bounce over the last couple of days has been rather stringent, but still hasn’t broken out to the upside for a bigger move.

The market has been sideways for several months, and I think until something fundamentally changes between the central banks or the global economy, it’s very unlikely that this market will change its fundamental attitude radically. That being said, the market could be trying to change its trend, but obviously we need to see a major breakout to the upside. If we break down below the 1.0980 level, then the market probably goes down to the 1.08 handle. That would go with the longer-term trend, but as the market has gone sideways, and that of course is the first sign of stabilization after a major downtrend. I do not believe that this market breaks out to an uptrend until we clear the 1.1250 level though, so keep that level in mind as it is important.