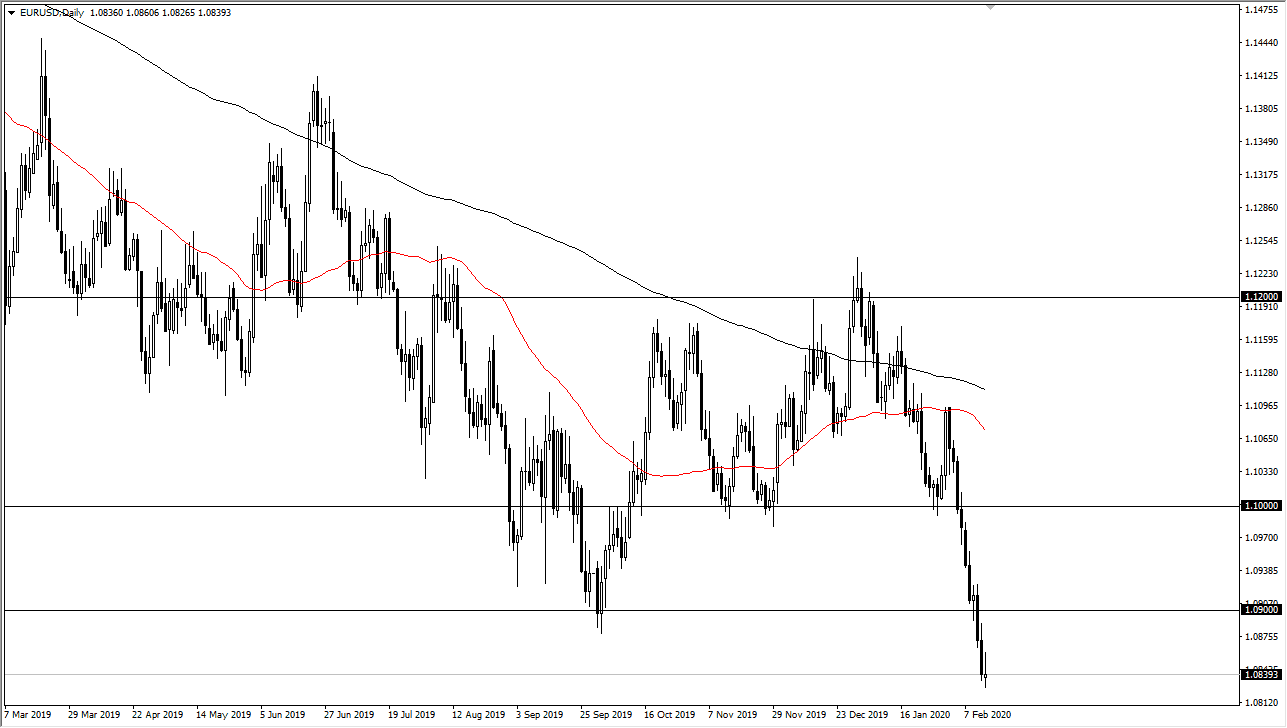

The Euro has bounced a bit during the trading session on Friday but gave back the gains late in the day to form an ugly looking candlestick. There was some short covering coming out of the European Union, but the Americans seemed it as it would be essentially “chasing the trade.”

Rather than that, I like the idea of fading rallies as they occur. The 1.09 level above would be a very interesting place to short, because it had previously offered so much in the way of support. It should now, based upon “market memory” offers significant resistance. Furthermore, I feel the same way about the 1.10 level, so that would be the same play. Notice that I have no scenario in which a willing to buy this pair in that general vicinity, as the European Union is struggling, and the German economy is a full 2% GDP lower than the United States.

If we do break down below the bottom of the candlestick for the trading session on Friday, then it’s likely that the market goes down towards the 1.0750 level which is my longer-term target anyway. That is the gap that has yet to be filled, and I think that it’s only a matter of time before that happens. However, the market has fallen apart and now is likely to bounce in the short term because if nothing else there will be a lot of short covering. However, if we break down from here it will represent an extraordinarily negative scenario that will only extend and accelerate.

The US dollar continues to be the favored currency around the world, because that’s the only place you are finding a significant amount of growth. Beyond that, the bond market has its say, as the European bonds are all drifting in negative territory while the American bonds still offer positive yield, something that is becoming more and more rare around the world. With that, the US dollar will continue to attract a lot of inflow, and then finally there is the stock market in America which is being used as a bit of a safe haven asset as well. Money is flowing from across the world into the US, and therefore you see a lot of dollar strength. Almost by default due to the flows of trading, the Euro has to fall as it is considered to be the “anti-dollar.”