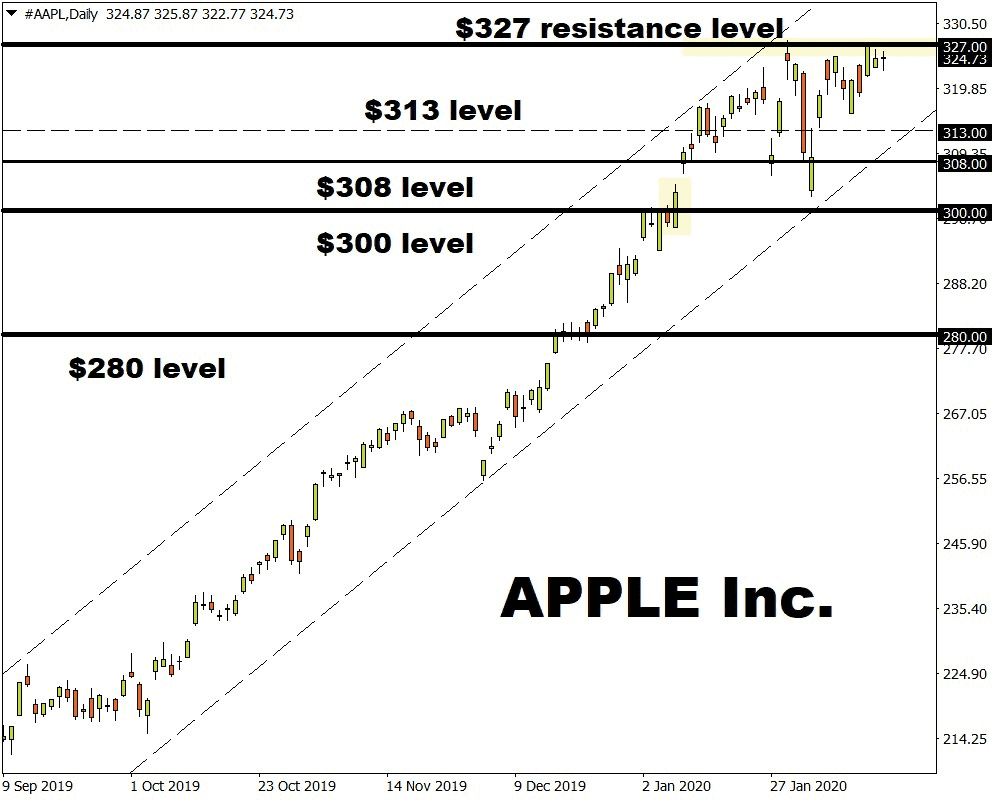

2020 can be considered as a relatively muted start to the year so far for the Apple stock, with its share price ranging between marginally below $300 and just beneath $330 at time of writing. This is a sharp a contrast to the missile advance that Apple enjoyed in 2019, where an Apple share valuation of $170 in February 2019 rocketed to $320 by February 2020.

2020 can be considered as a relatively muted start to the year so far for the Apple stock, with its share price ranging between marginally below $300 and just beneath $330 at time of writing. This is a sharp a contrast to the missile advance that Apple enjoyed in 2019, where an Apple share valuation of $170 in February 2019 rocketed to $320 by February 2020.

While the mild pause in buying momentum could suggest that investors are simply taking a breather from positions, one can also consider that following such a blast higher that investors taking profit can’t be overlooked.

An opportunity for such an event could be presented from one of the most unusual circumstances – the unforeseen Coronavirus in China. Late February 17, Apple released a press statement that it “no longer expects to meet the revenue guidance it provided for the March quarter” due to the impact the coronavirus has had less than three weeks after issuing Q1 2020 expectations. It is no secret that China is a massive consumer market for Apple products and while the press statement did highlight that consumer demand outside of China remains strong, it still stressed that demand within China has been impacted and that worldwide iPhone supply has been temporarily constrained by the closure of factories.

This warning in pre-market trading sent Apple shares lower by 3.4% and erased $48 billion in market capitalisation.

Should investors react negatively over Apple’s announcement prevail and send the share price lower from its at time of writing value $324, the February 2 share value of $308 is a potential area of interest. Should prices fall below $308, expectations can look at the possibility that Apple shares will be at risk to falling below $300 for the first time since the January 8 market open of $297.

Although it would be a surprise for Apple shares to fall below $300 given the resilience and popularity of its range of products, a hypothetical fall below $300 opens the discussion that Apple shares can fall as low as $280 for the first time since December 23 2019.

For more information, please visit: FXTM

Disclaimer: This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 81% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.