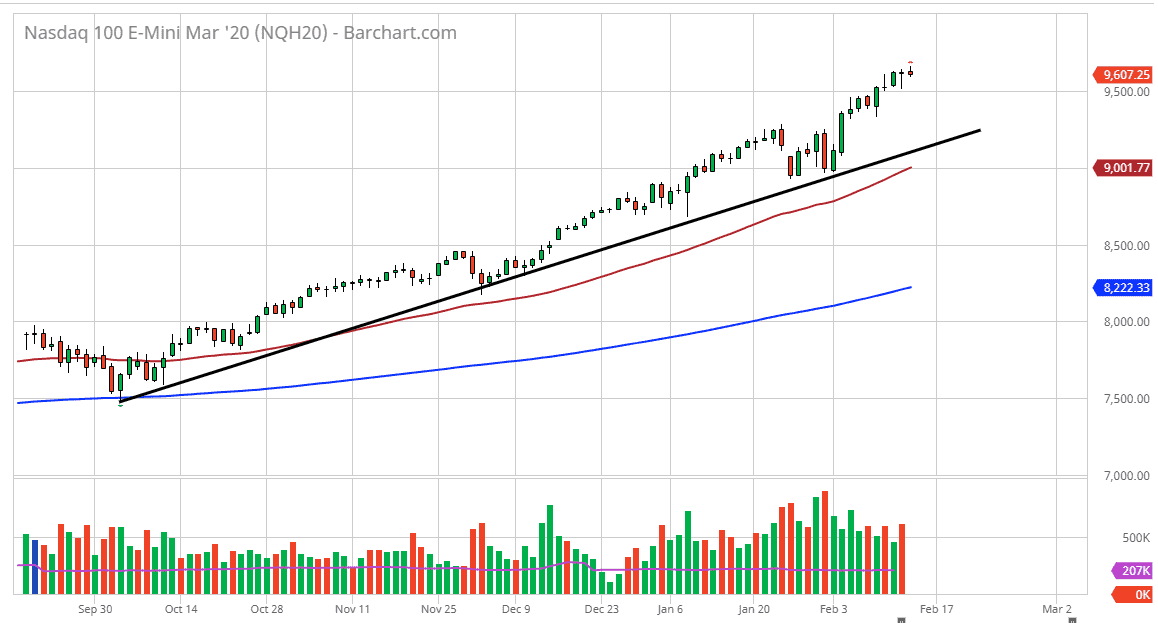

NASDAQ 100 E-mini futures have done very little during the trading session on Friday, as we continue to hang around the 9600 level. That’s not a huge surprise though, because we are a bit overextended and of course people don’t want to put a lot of money into the market heading into the weekend. After all, there are huge amount of issues that could come into play, not the least of which would be the coronavirus. However, there is also a concern about global growth, so we could get a bit of a shock announcement that sends this market right back down to kick off the week. Regardless though, the Federal Reserve is likely to continue liquefying the markets, and essentially protect Wall Street from taking massive losses. In fact, that might be the only thing truly driving this market, but as monetary policy continues to favor equities and drives yields down, it comes down to a fact that we simply can’t make any money in bonds as far as yield is concerned. With that, it essentially forces money into the stock market.

The 9500 level underneath should offer plenty of support, but even if the market breaks down below there, I think the 9400 level, and then eventually the uptrend line should both come into play. The 50 day EMA is just below there, and it could offer support as well. I have no interest in trying to short this market, at least not until we break down below the 9000 handle, which would be a major turnaround. That 600 points away though, so it’s very unlikely we get there during the trading session on Monday. Having said that though, you need to look at it as a potential move over the next several sessions if things get ugly.

Obviously though, we could avoid pulling back altogether and simply go higher. If we break above the highs from the one-day session then I believe that the market goes looking towards the 9750 level initially, and then the 10,000 level over the longer term, as I believe that is where we are going anyway. Having said that, I prefer buying on a pullback because it offers value that you can take advantage of in a market that has gotten a little bit ahead of itself. Keep in mind that a lot of foreigners are buying US stocks as a way to protect their capital, so that is another reason why we have seen the trajectory pick up as it has.