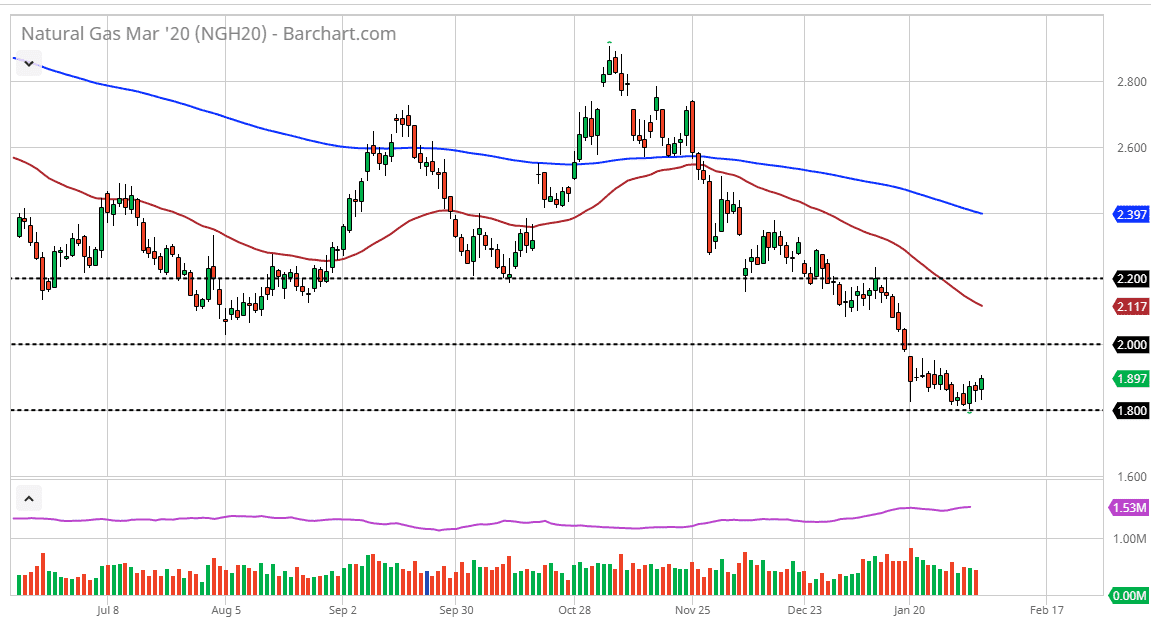

Natural gas markets initially fell during the trading session on Thursday but have found a bit of a boost after the inventory figure came out a bit better than others. Ultimately the market reaching towards $1.90 level should bring in a significant amount of resistance, but if we were to break above there it’s likely that the market goes looking towards the $2.00 level.

Signs of exhaustion after rallies will be a nice buying opportunity, but I recognize that the market is extraordinarily beaten down. The 50 day EMA is starting to slope lower, and perhaps reach towards the $2.00 level as well. Ultimately, there is an opportunity to start selling on signs of exhaustion, as although the inventory figure was a bit better, the reality is that there is a massive overabundance of supply out there.

In other words, this is a market that you simply fade the rallies going forward on short-term charts, but I’m not looking for huge moves one way or the other due to the fact that the market continues to chop back and forth. The $1.80 level underneath is massive support, but if we were to break down below there it’s likely that the natural gas markets will go looking towards the $1.60 level. Rallies at this point simply offer opportunities to start shorting as the trend is very much ensconced, and quite frankly the market should offer plenty of opportunities to get involved.

It’s not until we get mass bankruptcies in the United States with natural gas drillers and suppliers that we will have a sustainable rally. That being said, we are at extreme lows, so it’s only a matter of time before we start to see some type of recovery, if nothing else a “dead cat bounce.” Ultimately, this is a market that is one that you want to stand out away from if we get some type of impulsive candle to the upside, and simply be patient as possible to start fading that rally. In fact, I do not anticipate that you will be able to buy natural gas with any type of confidence until at the end of the year at the very least. If we do break down below the $1.80 level, that I think the move down to the $1.60 level could have the market selling off quite rapidly as it would be a bit of a “trapdoor opening.”