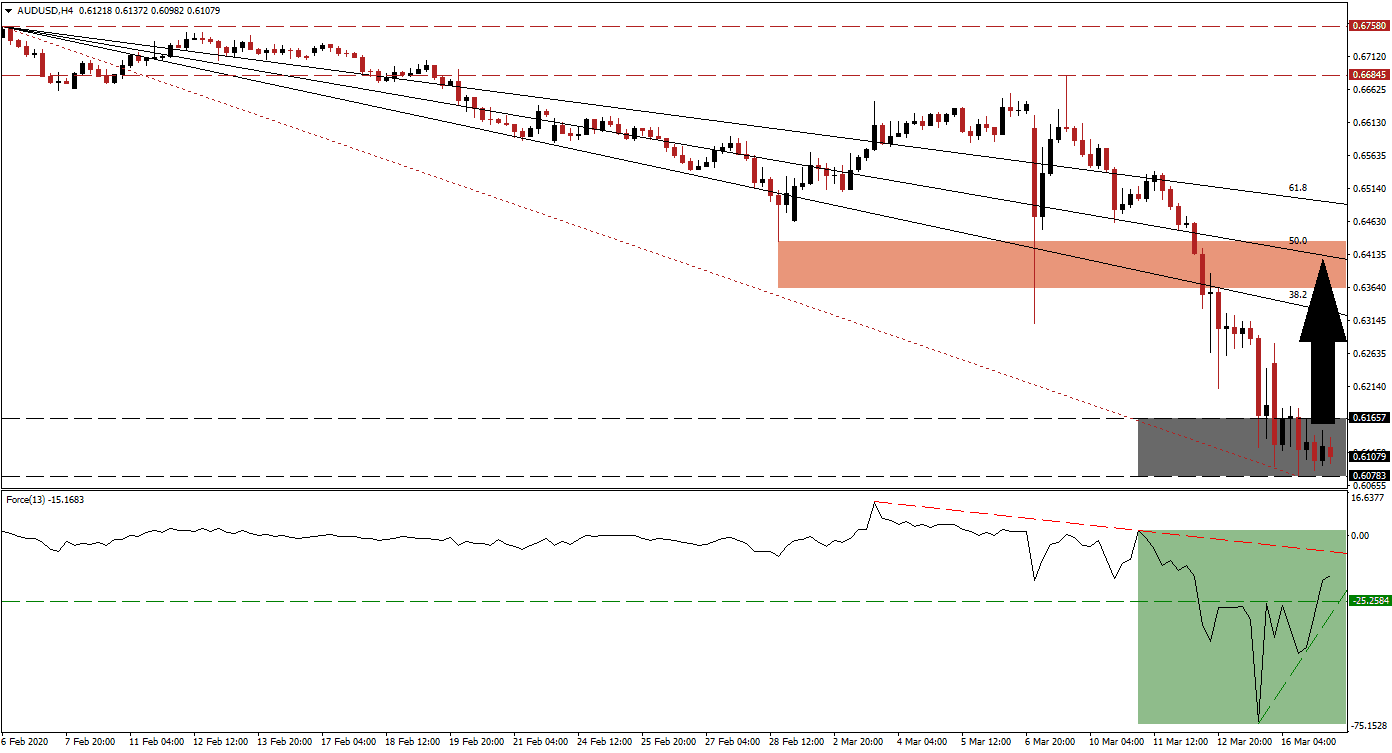

Australian consumer confidence stabilized according to one metric but remains depressed. One of the most significant damages from Covid-19 is related to the loss in business and consumer confidence, which may result in a global recession. The Australian government announced its A$17.6 billion stimuli. It is roughly the amount of the most optimistic economic loss estimate for 2020, currently at A$17 billion. Bullish momentum in the AUD/USD is recovering after price action settled into its support zone.

The Force Index, a next-generation technical indicator, offered an early signal that a partial reversal of the sell-off is imminent with the emergence of a positive divergence. While this currency pair contracted to a new 2020 low, the Force Index spiked higher. A steep ascending support level pressured it above its horizontal resistance level, converting it into support. This technical indicator is now approaching its descending resistance level, as marked by the green rectangle. A push above it will result in a crossover above the 0 center-line, placing bulls in charge of the AUD/USD.

With bullish momentum building up, a breakout in price action above its support zone located between 0.60783 and 0.61657, as marked by the grey rectangle, is anticipated to result in a short-covering rally. It will allow the AUD/USD to close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. Granting a fundamental catalyst is the US Federal Reserve's new round of quantitative easing, expected to be long-term bearish for the US Dollar. You can learn more about a short-covering rally here.

Forex traders are recommended to monitor the intra-day high of 0.62799, the peak of a reversed breakout that led to a marginally lower low. A sustained push higher is favored to result in the addition of new net long positions in this currency pair, providing additional upside pressure. The AUD/USD is likely to extend its pending advance into its short-term resistance zone located between 0.63618 and 0.64339, as marked by the red rectangle. It is enforced by its 50.0 Fibonacci Retracement Fan Resistance Level.

AUD/USD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 0.61100

Take Profit @ 0.64100

Stop Loss @ 0.60250

Upside Potential: 300 pips

Downside Risk: 85 pips

Risk/Reward Ratio: 3.53

In case of a contraction in the Force Index, driven lower by its descending resistance level, the AUD/USD may attempt a breakdown. Given developing fundamental conditions, the downside potential appears limited. The next support zone awaits this currency pair between 0.58790 and 0.59260, dating back to March 2003. Forex traders are advised to consider this an excellent long-term buying opportunity.

AUD/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.59900

Take Profit @ 0.58900

Stop Loss @ 0.60250

Downside Potential: 100 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 2.86