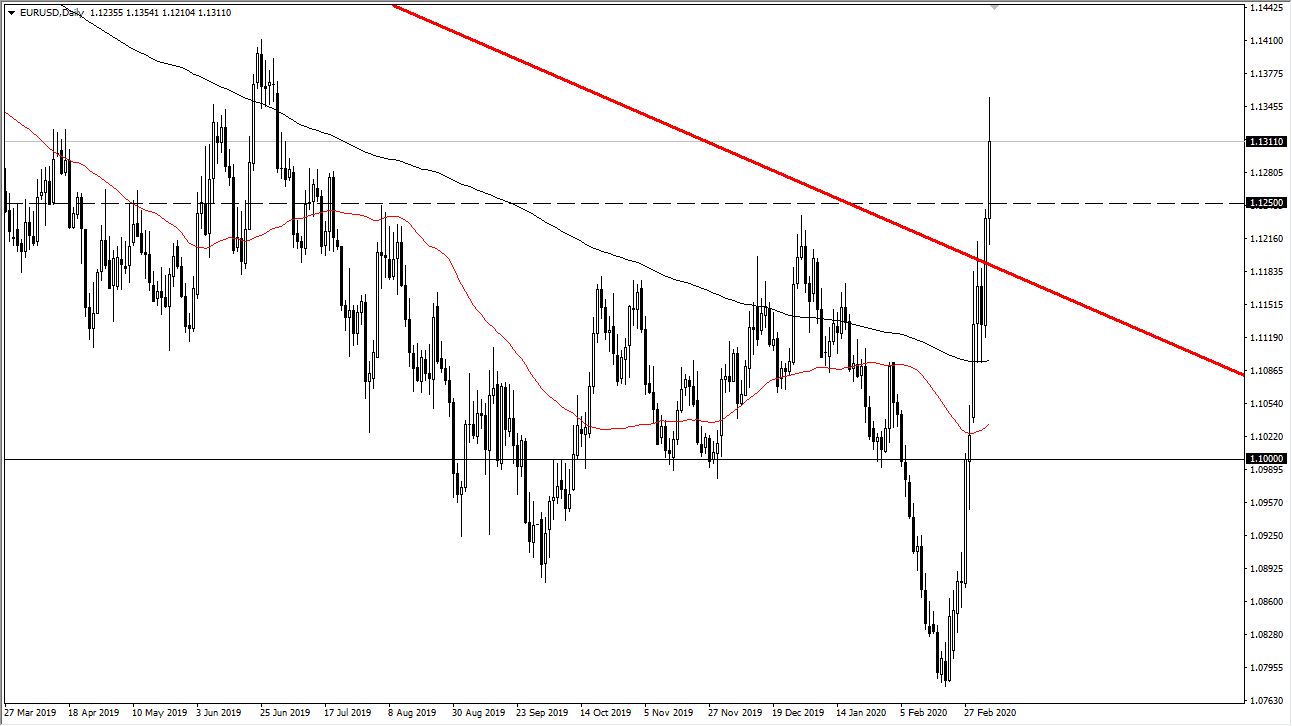

The Euro has rallied again during the trading session on Friday, as we continue to see the juggernaut of this market in full effect. We have cleared the 1.1250 level, an area that I suggested would be crucial to break above in order to go long for a bigger move. This doesn’t mean that we will pull back and quite frankly I think we will in the short term. Having said that, we have almost certainly seen a major breach of a lot of resistance and therefore I think we are looking at what it can only be described as a trend change.

With the Federal Reserve cutting 50 basis points, it sent a surge of orders into the market to close the US dollar positive positions. At this point, the Euro was a beneficiary by default. That being said though, I think there are plenty of areas underneath that should offer plenty of support. At this point, I anticipate that the 1.1250 level could be support as it was previous resistance. Furthermore, there is a significant amount of support at the 200 day EMA underneath, which would be the trend defining technical indicator. The 1.11 level underneath is important and therefore if we were to somehow slice through there it’s likely that we would see a crash right back down to the lows. I don’t think that happens though, and therefore it’s only a matter of time before buyers come in and pick up these dips.

All things being equal, I think that the market is probably going to go looking towards 1.14 level above, perhaps even towards the 1.15 level after that. This market has been down trending first quite some time, so this unwind of the short positioning will take some time. Forex trends tend to last for years on end, so I think we may be at the very beginning of seen a complete change. That’s a bit interesting considering how poor the European Union economic conditions are, but it looks as if we are trying to reassess the value of the US dollar more than anything else right now. Overall, I’d be a buyer of dips and have no interest whatsoever in shorting this market anytime soon, at least not until we break down below the 200 day EMA. If that happens, it will probably be a huge change in the overall attitude of the market yet again.