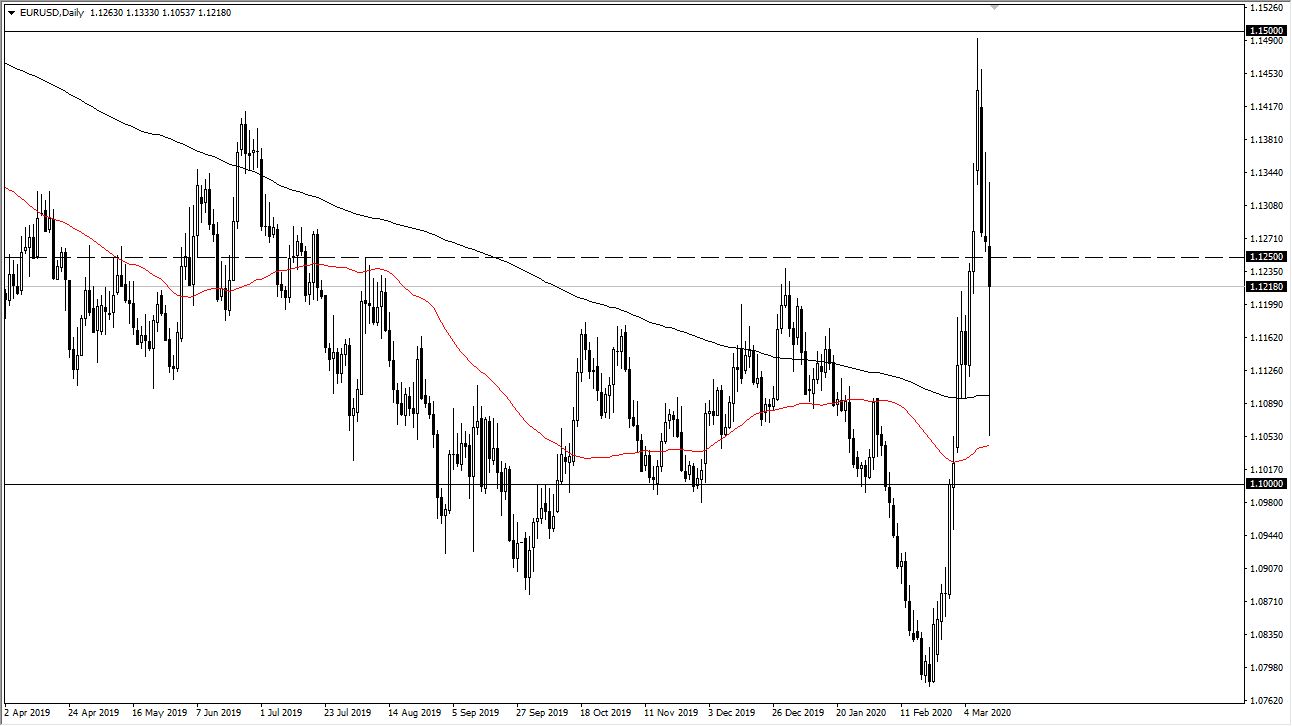

The Euro has been all over the place during trading on Thursday as we continue to see massive amounts of swings and volatility. Christine Largarde did not cut interest rates, and as a result the Euro initially tried to rally after the ECB meeting. However, we then solve the Euro collapse a bit and reach towards the 50 day EMA underneath before bouncing massively to reach towards a somewhat neutral candlestick. That being said, the market simply has no idea what to do at this point and it should be noted that it is with good reason.

The European Union probably enters a recession but it’s difficult to imagine how the US does in either at this point. With most things being shut down, economic activity is simply going to stop. The Federal Reserve is likely to cut another 50 basis point so this does in fact mean that the Euro will probably try to reach the highs again but the path to get there is going to be messy to say the least. To the downside, we could see a retest that 50 day EMA, and perhaps even the 1.10 level after that. All things being equal, this is a market that will see extreme amounts of volatility, which is something that it has not seen in a very long time. The Euro is typically a very quiet currency to trade, but at this point there are a lot of concerns when it comes to this market as there seems to be no real way to handle this type of noise.

The markets are trading on fear more than anything else. Because of this, the position size that you use should be smaller as the markets will certainly take your money if you aren’t cautious. The latest headline will throw them into disarray, as we have seen more than once. At this point in time it’s likely that the next move will be erratic, regardless of what it is. The Euro typically doesn’t have 250 PIP ranges, so these are most certainly extraordinary situations. Ultimately, we will get clarity, but it will probably show itself in the form of the weekly chart, as simple day-to-day undulations art much in the way of decisive action. I believe that the 1.10 level underneath is massive support, as the 1.15 level above is massive resistance. “Fair value” is at the 1.1250 level. Think of that as a magnet for price but don’t bet too much.